“Inflation swindles the bond investor … it swindles the person who keeps their cash under their mattress, it swindles almost everybody.”

— Warren Buffett, 2022 Berkshire Hathaway Annual Meeting

In This Week’s Digest …

- “Information Wants to be Free”

- Elon Musk on Passive Investing

- Selected Articles and Podcasts

- Warren Buffett in 1962

“Information Wants to be Free”

The ethos of the technology industry in the late 1990s was centered on the idea that the internet would change the world by making information freely available to everyone. People would be more informed than ever before. This would have salutary effects on equality and improve the political process. The world was clearly on the verge of entering a second enlightenment.

It hasn’t quite turned out that way.

The internet has revolutionized how people access information and upended countless business models. It has generated vast wealth and created new industries. And we certainly have all kinds of services and information at our fingerprints that appears to be free. However, much of the idealism of the late 1990s died with implosion of the dot com bubble. It turned out that internet-based services had to come up with sustainable business models after all.

Elon Musk’s pending deal to acquire Twitter has created all sorts of outrage, but those who are most affected financially are Twitter’s long-suffering shareholders.

Imagine being a shareholder of Twitter and reading this tweet that Jack Dorsey sent out the day after Twitter’s Board of Directors agreed to sell the company:

Jack is expressing a sentiment common during the early days of the internet but somehow glossing over the fact that he was the leader of a company that placed the advertising business model at the very center of its existence since inception!

The future of Twitter is in flux, but one thing is for certain: It will continue to be a company for the foreseeable future and will have to generate cash flow from somewhere, and that is most likely to continue to be from advertising.

But we should not focus exclusively on Jack Dorsey and Twitter. What about a service that is even more central to our day-to-day lives? Google dominates the global search market and also relies on an advertising supported business model.

As a recent article in The New Yorker article observes, ads have been front-and-center on Google for over two decades and were introduced despite Sergey Brin and Larry Page believing that an ad-supported business model was suboptimal:

From the beginning, the company’s founders, Sergey Brin and Larry Page, recognized the tension between useful search results and profitable ones. “The goals of the advertising business model do not always correspond to providing quality search to users,” they wrote as Stanford students, in a 1998 paper. Yet ads were introduced in 2000 and have proliferated ever since.

Early advertising algorithms were primitive. With some basic knowledge of a user’s activity on a website, programmers could crudely predict what kind of products or services they might be interested in. But over time, the algorithms have become much more sophisticated. The game-changer was the rise of the smartphone and other connected devices. Sophisticated algorithms can now build a composite portrait of a user that is unnervingly accurate since we live so much of our lives online.

Despite the issues that idealists like Jack Dorsey now acknowledge, there is no evidence to suggest that Twitter has a viable alternative to a business model that heavily relies on ads. Elon Musk can claim that he is not buying Twitter for economic reasons, but he will have a heavy debt load to service even if he doesn’t care about a return on his equity investment.

Ads are almost certainly here to stay on the internet whether we like it or not.

Elon Musk on Passive Investing

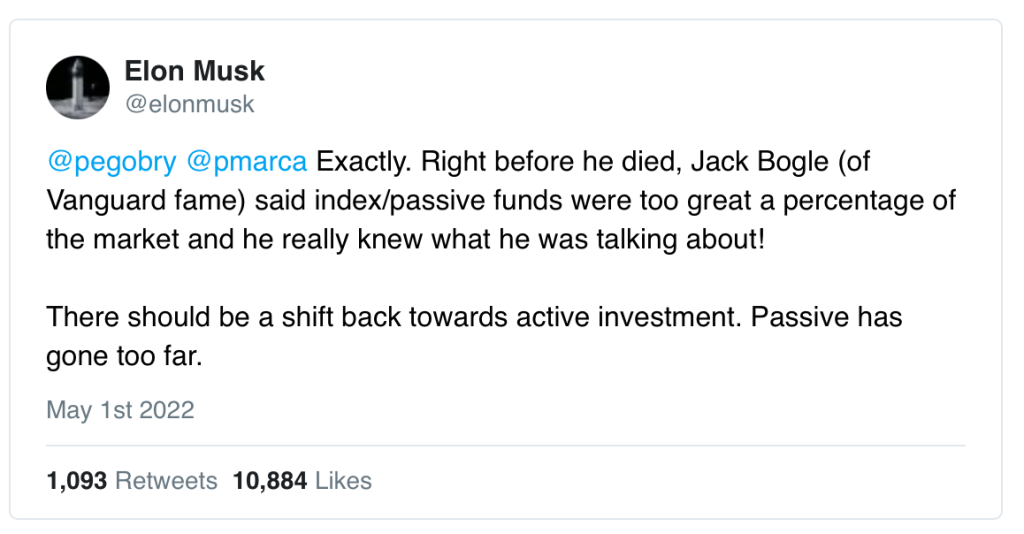

Elon Musk made the following statement about Jack Bogle in response to a thread about how large institutional investors have become increasingly vocal on corporate governance matters:

This statement didn’t seem quite right to me when I read it.

I recalled that Mr. Bogle expressed concern toward the end of his life, but never came to the conclusion that passive funds were too great a percentage of the market.

Less than two months before his death, Mr. Bogle wrote an op-ed for the Wall Street Journal warning about the possibility that passive strategies would become too dominant in the future. But he reiterated his strong support for indexing. The entire op-ed is worth reading, but here is a quote that makes Mr. Bogle’s views quite clear:

“But one thing seems crystal clear. Even if present trends continue (sometimes they don’t), the enormous value of index funds should not be ignored. First, index funds provide investors with the most effective stock-market strategy of all time: buy American business and hold it forever, and do so at rock-bottom cost. Second, index funds are among the few truly long-term owners of stocks—for all practical purposes, permanent owners of capital—an enormously valuable asset to society. The long-term focus of index funds is a much needed counterweight to the short-termism favored by so many market participants.”

Those who are interested in learning more about passive investing should consider reading Robin Wigglesworth’s new book, Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever. I reviewed the book recently in an article for paid subscribers.

For more on Jack Bogle, I suggest reading my review of his book, Enough: True Measures of Money, Business, and Life, which is available to all readers.

Articles

Top Ten Highlights From Berkshire Hathaway’s 2022 Annual Meeting The Berkshire Hathaway annual meeting took place on Saturday, April 30. I wrote an article with key highlights from the annual meeting. (Rational Reflections)

How Berkshire Hathaway Could Deploy $6 Billion, April 26, 2022. In this article, I discuss the possibility of Berkshire Hathaway acquiring the minority interests of Berkshire Hathaway Energy (BHE). Berkshire Hathaway Vice-Chairman Greg Abel holds a 1% interest in BHE while the estate of Walter Scott Jr., a former Berkshire director, owns a 7.9% stake. The subject came up at the annual meeting. Warren Buffett said he would not pursue such a transaction but appeared to leave the door open to being approached by Mr. Abel and the Scott estate. (Rational Reflections)

My Life with Context Switching by Lyle McKeany, April 23, 2022. It seems like the plague of context switching is discussed frequently these days. The Wall Street Journal’s recent article, How to Overcome Multitasking Madness, covers the same terrain. I thought that this “day in the life” account of a perennial context switcher was funny and sad at the same time. The only solution I can offer is to turn off app notifications on all devices which helps quite a bit. (Just Enough to Get Me in Trouble)

A Stock is Not an Index by Nick Maggiulli, April 26, 2022. Buying an individual stock that has declined precipitously can be a good investment or it can end in disaster. Individual companies die all the time, and many fallen angels never recover. The same is not true for broad based index funds because the components of these funds are constantly changing over time. “We get a list of which companies to own and in which percentages to own them and we don’t have to pay for any of it. Other market participants do all the work for us. They spend their time, money, and energy setting prices and figuring out what we should invest in. And we don’t have to lift a finger.” (Of Dollars and Data)

Goldman Sachs Means Nothing by Roger Lowenstein, April 27, 2022. A highly critical article regarding the changing culture at Goldman Sachs, contrasting the way the firm operated as a partnership and what it has evolved into today as a publicly traded company with significant agency problems. “Mr. Solomon’s job is to allocate Goldman’s capital. When profits accrue, they rightly belong to the shareholders that risked the capital. Surely, Goldman understands the concept of risk. Carving out a slice from one of its richest profit streams (but not, of course, cutting them into less attractive deals) makes a mockery of the blather in the proxy statement about aligning pay with performance. It is aligning pay with self-interest.” (Intrinsic Value by Roger Lowenstein)

The Rich And The Wealthy by Morgan Housel, April 27, 2022. “Rich means you have cash to buy stuff. Wealth means you have unspent savings and investments that provide some level of intangible and lasting pleasure – independence, autonomy, controlling your time, and doing what you want to do, when you want to do it, with whom you want to do it with, for as long as you want to do it for.” (Collaborative Fund)

The Mindset Gap, May 1, 2022. “It is easy to overestimate the role of money and underestimate the role of mindset. Often, we convince ourselves that if only we had the resources, we would apply the second mindset. But the second mindset isn’t a luxury of the rich, it is a necessity to build wealth in the first place. When you focus on the money you miss the leverage of mindset hiding in plain sight.” (Farnam Street)

Nostalgia and the Cessation of Time by Lawrence Yeo, April 2022. “I find nostalgia so interesting because it’s a blend of emotional states that would otherwise be found at opposite ends of a spectrum. It evokes happiness for a particular memory, while also evoking sadness at the realization that it’s in the distant past. It provides a sense of serenity for the present moment, while also introducing a sense of longing for an artifact of time.” (More to That)

Podcasts

Twitter, Berkshire Hathaway, and Corporate Governance, May 1, 2022. “In this episode, co-hosts Elliot Turner, Phil Ordway, and John Mihaljevic discuss timely issues in corporate governance, including the pending sale of Twitter to Elon Musk and proposals at the Berkshire Hathaway annual meeting.” (This Week in Intelligent Investing)

Buffett’s Biggest Blunders w/David Kass, April 28, 2022. David Kass discusses some of Warren Buffett’s investing mistakes over the decades including the much examined 2016 acquisition of Precision Castparts, a mistake of commission. In addition, mistakes of omission are discussed, such as how Berkshire Hathaway missed out on investing in Google once it went public. (The Investor’s Podcast)

William Green — Lessons for Life and Investing, April 28, 2022. William Green is the author of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life. I read this book last year and mentioned it in Rational Reflections in May 2021. This was an interesting discussion that covered many of the same themes covered in the book. (Infinite Loops)

Warren Buffett in 1962

This video of Warren Buffett’s first known television appearance in 1962 has been making the rounds over the past week. I remember first watching this many years ago.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.