Introduction

The United States has a decentralized form of government which is based on the principle of subsidiarity. Political issues are supposed to be decided with as much local input as possible. Aside from enumerated powers retained by the federal government, states and localities are empowered to handle their own affairs. Although the federal government has gained power over the years, states and localities are still more than administrative arms controlled by a central authority.

The design of our political system has led to a great deal of fragmentation in terms of how states and localities operate. Within the fifty states, counties are typically the primary administrative entities. There are over three thousand counties in the United States, each with separate administrative bodies.1 In addition to counties, there are 36,000 cities and towns and 12,900 school districts, along with 38,000 special districts and agencies.2 Localities have different ways of doing things and many are fiercely independent. Naturally, this poses major challenges when it comes to meeting increasingly complex information systems meant to effectively serve the people.

Citizens who are accustomed to using advanced technology in their personal and professional lives are unlikely to be satisfied with government agencies that operate in the technological Stone Age. Of course, governments have deployed information technology solutions for decades, but legacy systems are inflexible and fail to offer modern solutions. The need to adapt more quickly to changing requirements and the difficulty of hiring and retaining top tier technical talent are factors that have led governments to outsource software to private firms specializing in modern solutions.

Tyler Technologies is one of the leading companies that offer software and related services for public sector entities in the United States. However, the company did not start in a teenager’s garage and grow organically. Its history is more complicated.3

Tyler’s roots go back to 1966 when Joseph McKinney began to build a conglomerate consisting primarily of industrial businesses, one of which included Tyler Pipe.4 Over the years, most of the businesses were sold. By 1996, the Tyler’s main subsidiaries included Forest City, a retailer of automotive parts and supplies, and IFS, a company that provided products for fundraising programs in schools.

In 1997, Tyler decided to shift its focus to information technology. IFS was sold during that year and Forest City was sold in 1999. In a flurry of acquisitions starting in early 1998, Tyler began to transform itself into a software company with a clear focus on providing systems and services to the public sector.5

Tyler has continued its strategy of growth through acquisitions over the past quarter century. In 2021, Tyler posted revenue of $1.6 billion and net income of $161.5 million. Revenue for the first nine months of 2022 was $1.4 billion with $133.2 million of net income. As of January 6, 2023, the company has a market capitalization of $13 billion, a valuation that is obviously far from inexpensive relative to revenue and earnings.

This briefing is not a complete financial and business profile of Tyler Technologies. Instead, I focus mostly on the following two areas:

- Business Model. Tyler’s revenue has been shifting from licensing and maintenance fees for traditional on-premise software to subscription fees for software as a service (SAAS) solutions. During this transition, Tyler receives less initial revenue but anticipates greater revenue over the life of client relationships.

- Court and Justice Agencies. The scope of Tyler’s product offerings extends far beyond courts and justice agencies, but my primary interest when reading about the company was to consider its competitive position relative to Journal Technologies, a subsidiary of Daily Journal Corporation.

Last month, I wrote an article about Journal Technologies, the move toward SAAS solutions, and some observations regarding the software industry. Readers who are interested in the software industry in general, or in Tyler Technologies in particular, might want to read that article before proceeding since I will keep the background information in this article at a more basic level.

Business Model

Tyler Technologies offers information management software and related services for a broad array of public sector needs. The software is intended to provide local governments with easy access to information that results in improved performance and transparency within agencies, between agencies, and in interactions with the general public. The software solutions fall into the following broad categories:

- Public Administration. Financial management systems are designed to conform to government financial reporting and auditing requirements while providing agencies with visibility into future revenue. Enterprise resource planning (ERP) solutions are integral to day-to-day activities as well as longer range planning. In addition, appraisal software automates the process of estimating property values and collecting taxes as well as handling city and county land records.

- Courts and Public Safety. Courts and justice systems have complex needs related to managing courtroom dockets as well as the complexities of individual civil and criminal cases, including the automation of tasks related to discovery, witnesses, and other details that attorneys need access to. Tyler also provides software to manage jails and to integrate jail management with police and court systems.

- Health and Human Services. Disability benefits software automates the process of handling applications and continuing eligibility requirements for benefits. Additionally, Tyler offers solutions related to environmental health permitting, inspections, and related processes.

- K-12 Education. Tyler provides software to automate tasks such as school bus routing along with a complete ERP package designed to handle school budgeting, attendance, and human resources functions.

- Platform Tools. Tyler provides platform technologies that can be used to program new applications with minimal levels of required coding and utilizing data from multiple sources.

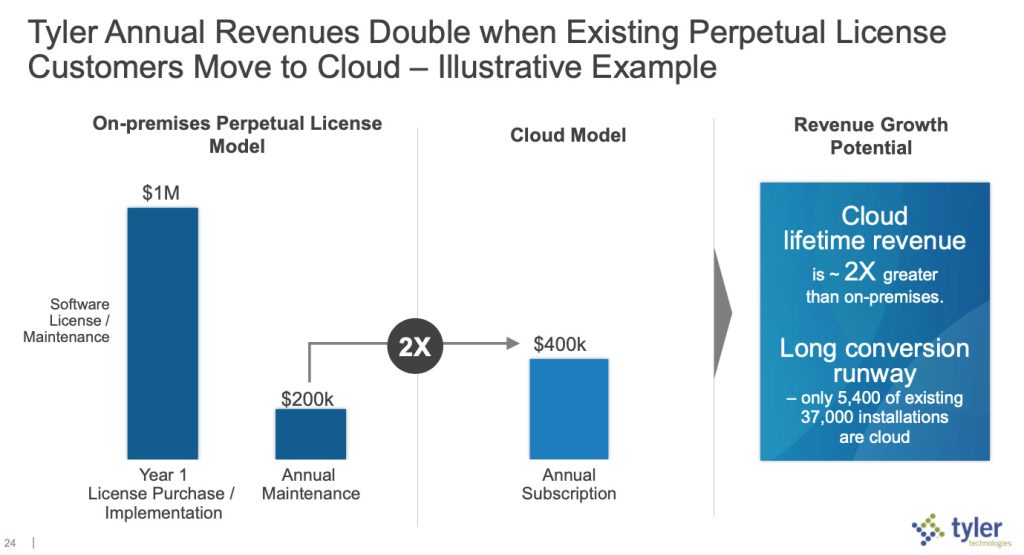

As I discussed at length in my recent article on Journal Technologies, the software industry has experienced rapid technological change in recent years. The most significant change impacting the business model has been the shift from selling perpetual software licenses with optional maintenance packages to cloud based SAAS solutions. This has changed the timing of revenue by shifting up-front licensing fees to subscription fees that are received over the course of a client relationship. Tyler illustrated this shift in a recent presentation:

Assuming that customers stick around for long periods of time, the SAAS model has the potential to realize greater revenue than the traditional perpetual licensing model. Tyler claims to have client turnover of approximately 2% annually which bodes well for the company’s efforts to grow SAAS revenue in the long run.

The exhibit below shows how Tyler’s revenue mix has changed over the past decade:

Licensing and royalty revenue has declined from 9-11% of revenue in the mid 2010s to under 4% during the first nine months of 2022. Over the past decade, subscription revenue has increased from 12.3% in 2012 to 54% during the first nine months of 2022. We can also see how software maintenance has declined as a percentage of total revenue over the past decade. The overall effect of the changing revenue mix has been to make more of Tyler’s revenue sources recurring, as the following exhibit shows:

The shift toward a greater percentage of revenue coming from recurring sources is a powerful trend if customers stick with Tyler’s solutions in the long run. Perpetual licenses are one time charges and customers could opt to not renew maintenance agreements. However, SAAS customers have no option to stop paying for subscription fees if they wish to continue using the software. Even if customers are not thrilled with the software, making a change is a long and winding road and this makes subscription revenue very sticky once customers are using software in production.

Let’s take a look at Tyler’s income statements over the past decade:

A full analysis of Tyler’s financials is beyond the scope of this briefing, but let’s at least take a look at how key statistics, including margins, have trended over time:

Software licensing offers very high margins. Due to Tyler’s history of acquisitions, software gross margins are burdened with amortization related to acquired software. Although the cost is real, it is not a cash expense. Stripping the amortization charge from software licensing results in “cash” gross margin figures well in excess of 90%.

Tyler does not provide granularity when it comes to gross margin provided by subscriptions alone. Instead, we only have reported cost of revenue for subscriptions, professional services, and maintenance. This figure has remained stable in the low to mid 40% range over the past decade. However, gross margin on subscription revenue is likely higher than gross margin on professional services due to the cost of employees required to provide the services. Cost of revenue for subscription services includes the cost of hosting software either internally or using provides such as AWS.

Overall gross margin has remained relatively stable over the past decade as the revenue mix shifted toward SAAS. I have not conducted an in depth investigation of the numerous acquisitions made by Tyler over the past decade or how the mix of acquisitions have impacted margins or opex, nor have I conducted an analysis of the price paid for these acquisitions. I would note that Tyler has significant stock compensation expenses and the share count has been climbing over time.

Courts and Justice Agencies

Tyler Technologies and Journal Technologies both provide software for courts and justice agencies. Let’s take a brief look at several of the most important categories of software that Tyler offers in this vertical market:

- Court Case Management. Tyler offers a broad array of software targeting court case management with Enterprise Justice representing their flagship product. The primary function of the software is to allow for efficient operations of courtrooms by automating tasks and providing interfaces for all parties to a lawsuit for both criminal and civil cases. The system also allows for virtual courtrooms, a feature that has been in increasing demand in recent years.

- Civil Process. Court clerks must track a large amount of information related to case papers and related data as well as handling the process of dealing with summons, subpoenas, warrants, protective orders, and interfacing with law enforcement agencies. Since court clerks have public facing roles, the software is designed to improve efficiency when dealing with the public.

- Electronic Filing. Tyler states that over 850,000 users file over 28 million documents on their platforms annually. In addition to accepting filing submissions, the software also handles the process of accepting payment for fees and fines. Tyler derives revenue from transaction fees for payment services.

- Jury Management. Software is needed to track citizens eligible for jury duty, handle the process of calling citizens for duty, and then managing the process of jury selection and payment to jurors for their service.

A high degree of integration is required between disparate software modules, as we can easily see by considering the functionality implied by these categories. The needs are specialized and will vary from one jurisdiction to another. Furthermore, individual judges are known to establish somewhat different procedures in their courtrooms. The ability to configure and adapt software for these functions is very important.

Tyler’s history in court software dates back to the company’s shift from industrial businesses to software. The company’s 1998 10-K describes a set of products that includes judicial information management and court management software. It appears that the court and justice vertical is one of the original software markets selected by Tyler very early in its transformation to a software company.

Conclusion

It is interesting to note that Daily Journal’s initial entry into the software business took place around the same time that Tyler moved into software. In January 1999, Daily Journal acquired Sustain Technologies. Sustain’s business focused on court and justice systems, a field that Daily Journal knew well due to its longstanding presence in the legal community. Daily Journal and Tyler Technologies have been direct competitors in this space for nearly a quarter century.

While this briefing is not a full profile of Tyler Technologies, it seems clear that the company is a serious competitor in public sector software solutions in general and in court and justice systems in particular. While Daily Journal’s software operations have remained small and limited to court and justice agencies, Tyler has grown much more rapidly through acquisitions of numerous software companies. Tyler has also expanded far beyond courts and justice to offer a broad array of public sector software.

Vertical market software can be a very lucrative business. Once a customer “goes live” on a software product, they typically remain with the same vendor for a very long period of time. The traditional perpetual licensing model with annual maintenance is attractive because of the initial inflow of cash from the license sale and ongoing revenue from maintenance, but the customer always has the option of not paying for maintenance while retaining the rights to use the software.

The SAAS model is potentially even more attractive for companies like Tyler Technologies and Daily Journal because customers must continue paying annual subscription fees in order to use the software since no perpetual license has been granted. We can see from Tyler’s results that the shift from traditional licensing to SAAS has resulted in more recurring revenue while not harming overall gross margin. These favorable economics have led to high market expectations (and valuations).

My motivation for looking at Tyler was to better understand one of Daily Journal’s competitors. I am in the process of continuing research on Daily Journal which will be the subject of this month’s business profile. Software is only one of Daily Journal’s businesses, but it represents the future, at least from an operational standpoint.

Copyright and Disclaimer

This newsletter is not investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in Tyler Technologies or Daily Journal Corporation.

- Wikipedia provides a current list of county and county equivalents in the United States. [↩]

- Tyler Technologies 2021 10-K, page 3 [↩]

- The article on Tyler Corporation on encyclopedia.com has quite a bit of detail about the company’s origin and evolution. [↩]

- Joseph F. McKinney, Tyler Corp. chief likes his companies diverse and ready to make the cash flow by Harihar Krishnanupi, December 2, 1984. [↩]

- The strategic shift is discussed in Tyler’s 1998 10-K. [↩]