TIPS for Retirement?

I have written about Treasury Inflation Protected Securities (TIPS) and I Bonds on several occasions over the years. In April, I wrote about how I use five year TIPS to construct a five year bond ladder which I use for personal cashflow needs. The article has links to several additional resources on TIPS. In June, I followed up with an article about using TIPS and I Bonds to hedge against inflation.

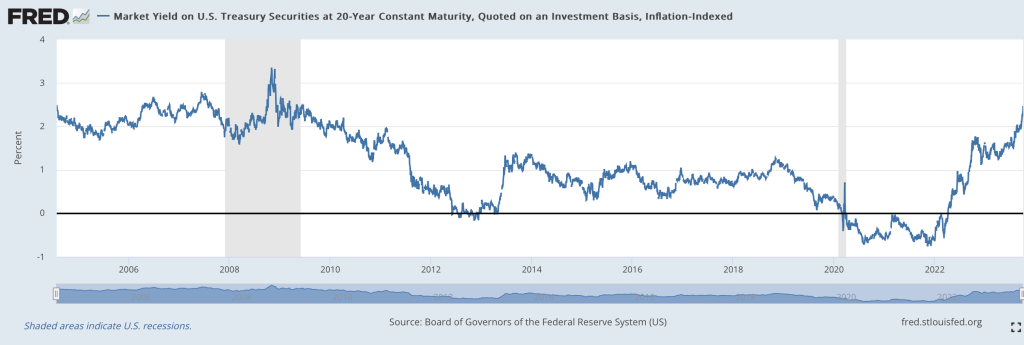

In recent months, the real yield of TIPS has increased substantially. At the time of my April article, the real yield on five year TIPS hovered around 1.25%. The real yield has since doubled to 2.5%. TIPS principal receives an inflation adjustment based on the CPI-U index with the bond’s coupon rate applied against inflation adjusted principal.

Current TIPS yields can be found on the Department of the Treasury website. As of October 4, TIPS yields were as follows:

- 5 Year: 2.54%

- 7 Year: 2.46%

- 10 Year: 2.40%

- 20 Year: 2.41%

- 30 Year: 2.44%

As we can see, the real yield curve is essentially flat, with longer maturities offering only slightly lower yields than the five year which offers the highest yield. Taking the 20 year TIPS as an example, the recent rise is best viewed as a return to market conditions that prevailed prior to the financial crisis.

In my opinion, the primary purpose of retirement savings is not to get rich but to avoid financial distress in old age. Within a tax advantaged vehicle such as an IRA, a thirty year TIPS could roughly double a retiree’s purchasing power, assuming reinvestment of coupons at the same rate. At first glance, this seems like an attractive deal for at least a portion of one’s retirement savings. While it is true that stocks should offer a higher real return, there is value in a “sure thing.”

But can we view the real yield on TIPS as a sure thing? As I wrote during the debt ceiling debate earlier this year, it is highly unlikely that the United States government will ever default on treasury securities. Regular treasuries are denominated in nominal dollars and the government will create whatever nominal dollars are needed to pay debt, even if the purchasing power for debt owners is substantially degraded.

When it comes to TIPS, the principal value is adjusted based on the CPI-U index, but the government controls the definition of the CPI-U and has repeatedly modified the calculation of the index in ways that reduce reported inflation. There’s plenty of debate over whether the modifications were warranted, but the point is that the government can “default” on TIPS in the sense that it controls CPI-U and there is very limited recourse for owners of debt who disagree with the government.

But let’s step back for a moment and consider whether the CPI-U is an accurate measure for what many retirees are trying to hedge against in old age. Medical costs represent a very significant component of potential costs in old age, particularly long-term care costs that are not covered by Medicare. The following exhibit published by Peterson-KFF is based on an analysis of components of the CPI published by the BLS. The green line represents medical costs while the blue line represents overall prices.

Many people, myself included, seek to have enough resources in old age to prevent themselves and others in their family from ending up in an institutional setting such as a nursing home or assisted living facility. Accomplishing this objective requires a significant amount of reserves given that in-home healthcare can cost over $30 per hour in many cities, amounting to over $250,000 per year for 24/7/365 care which would be in addition to the many other costs a person in such a situation would incur.

Using TIPS yielding ~2.4% plus CPI-U to self-insure for in-home nursing care in three decades seems very attractive but we have no way of knowing whether such costs will inflate at the rate of CPI-U. This raises a broader topic of one’s personal inflation rate.

Even if the government does nothing nefarious in its calculation of CPI-U in the future, the fact is that such an index will never measure an individual’s personal cost of living accurately since everyone consumes a different basket of goods and services. It is difficult for many people to anticipate their cost of living in retirement. Certain costs, such as commuting and purchasing clothing for work, will disappear while other costs, such as travel, may initially increase. Later in retirement, medical costs are unfortunately very likely to increase dramatically.

I’m personally undecided at this point regarding using longer term TIPS for retirement. At least investors have options today that were entirely lacking for many years when the real yield on TIPS was minuscule or even negative. With a real yield of between 2-3%, it seems like TIPS at least deserve consideration in a diversified retirement portfolio, especially if one believes that inflation will average more than the currently implied ~2.4% represented by the difference between the yield on the regular thirty year treasury bond and the thirty year TIPS.

This article represents the author’s opinions and is not meant to be investment advice. The author is not an investment advisor. Readers should consult their investment advisor before making any financial decisions.

Articles

How China’s BYD Became Tesla’s Biggest Threat by River Davis and Selena Cheng, October 5, 2023. An interesting overview of BYD’s development over the past two decades as well as Berkshire’s decision to invest in 2008. However, the story strangely seems to credit David Sokol with the idea rather than Charlie Munger. (WSJ)

Serendipity on the Streets of New York: How One Man Seized the Day & Sold His Company to Berkshire Hathaway by Kingswell, October 3, 2023. This article tells the crazy but true story of how a random encounter on the streets of New York City resulted in Berkshire Hathaway acquiring Helzberg Diamonds. (Kingswell)

- Warren Buffett’s 1995 letter discusses his encounter with Barnett Helzberg.

- Book Review of What I Learned Before I Sold to Warren Buffett (Rational Walk)

Market Bipolarity: Exuberance versus Exhaustion by Aswath Damodaran, October 4, 2023. This article is a comprehensive review of markets in the third quarter. “As I was writing this post, I am reminded of one of my favorite movies, Groundhog Day, where Bill Murray is a weatherman who wakes up and relives the same day over and over again. We started the year, talking about inflation and a possible recession, and we keep returning to that conversation repeatedly. You may want to move on, but it is unlikely that either uncertainty will be resolved in the near future.” (Musings on Markets)

How I Survived (Barely) as a Jazz Musician at Business School by Ted Gioia, September 30, 2023. “It didn’t help that I’d be one of the youngest students in the program. Even worse, I was competing against hotshots who had already flourished doing high level stuff for Goldman Sachs or Morgan Stanley, while I had been playing Miles Davis tunes at low-paying bar gigs. They just exuded slickness, while I was as awkward as Lenny Bruce in Sunday School.”(The Honest Broker)

Scientists behind mRNA COVID Vaccines Win 2023 Nobel Prize by Lauren J. Young, October 2, 2023. Katalin Karikó and Drew Weissman won the Nobel Prize in Medicine for their work on mRNA technology. Although their work is most closely associated with COVID vaccines, Karikó initially hoped to develop therapeutics for multiple diseases including cancer which is still a possibility. (Scientific American)

- Penn Toasts Winning Scientist After Shunning Her for Years by Gregory Zuckerman, October 5, 2023. (WSJ)

- Book Review of A Shot to Save the World by Gregory Zuckerman (Rational Walk)

Why rings of RNA could be the next blockbuster drug by Elie Dolgin, October 4, 2023. “RNA’s fleeting nature isn’t a big problem for a vaccine: it needs to encode proteins only for a short time to trigger an immune response. But for most therapeutic applications, it would be much better to have RNA that could stick around for longer. That’s where circular RNAs, or circRNAs, come in. Tie the ends of an RNA transcript together, and many RNA-munching enzymes have nothing to sink their teeth into. As a ring, RNA gains stability and longevity that, in theory, could increase its therapeutic potential, even at low dose levels.” (Nature)

Podcasts

Teledyne – 1986 Annual Report, September 28, 2023. 34 minutes. Jacob McDonough continues his series of podcasts covering Henry Singleton and Teledyne. Previous episodes covered the 1967 and 1968 annual reports. (The 10-K Podcast)

Marc Andreessen: It’s Time to Write, October 4, 2023. “Marc Andreessen co-founded Netscape, where he created the first popular web browser. He invented the tweetstorm, and has helped form the internet. He coined the idea ‘software is eating the world’, which has defined humanity’s evolution over the last decade.” (How I Write)

- Why Software is Eating the World by Marc Andreessen, August 20, 2011. (WSJ)

Tim Ferriss Interviews Shane Parrish, September 28, 2023. 1 hour, 59 minutes. Shane Parrish is the founder of Farnam Street. In this interview, Shane discusses his background, the genesis of Farnam Street, and his new book. (The Tim Ferriss Show)

- Shane Parrish: A Glimpse into Clear Thinking, October 3, 2023. 13 minutes. In this brief episode, Shane Parrish describes five insights that can promote clear thinking and describes his new book, Clear Thinking. (The Knowledge Project)

Jimmy Buffett, October 3, 2023. 1 hour, 10 minutes. Jimmy Buffett had trouble gaining traction in country music so he invented his own distinct musical genre and built a powerful franchise anchored on extensive touring. David Senra discusses what he learned from Jimmy Buffett’s autobiography. (Founders Podcast)

Joe McCarthy, the Hydrogen Bomb, and Ten Fateful Months That Kicked Off the Cold War, September 29, 2023. 40 minutes. One of the gaps in my knowledge of history is the period between the end of World War II and the Korean War. This podcast covers many events during Truman’s second term. (History Unplugged)

A Rainy Day in Paris

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.