“Trust is the foundation of society. Without a basic level of trust regarding the intentions and expected behavior of other human beings, our modern civilization would very quickly disintegrate into total chaos.”

— The Paradox of Trust, October 31, 2019

Charlie Munger often talks about the benefits of living within a seamless web of deserved trust. In such a system, it is unnecessary to take protective steps when dealing with others. You can let your guard down and focus on positive interactions and relationships. For most people, the best that we can hope for is to have a close circle of family and friends who can be trusted unconditionally.

It is rare to live within a system of unquestionable trust, but social conventions develop over long periods of time that make it possible to have a baseline level of trust that facilitates business and personal relationships. This is the type of trust that I was thinking about a few years ago when I wrote about trust being the foundation of society. At the time, I had no idea that our world would soon be upended by the pandemic. Our society lost much of its baseline level of trust over the past three years.

It is difficult enough to build trust personally and within a society at a moment in time. Building trust within society over multiple generations and even over multiple centuries is an extraordinarily rare accomplishment.

In recent weeks, there have been countless articles about the possibility of the United States defaulting on the national debt. The focus is typically on the dire consequences of missing interest and principal payments on treasury securities. Failing to make payments as called for would represent a violation of the contractual terms of debt and would be a serious development. However, even if there is some delay, there is virtually no chance that debt holders will suffer any permanent loss of capital.

The real casualty of missing payments on the national debt is trust. Any government that has the privilege of being able to issue debt in its own fiat currency has the capacity to make payments on the debt. The choice of not doing so is a political act, one that is more of a repudiation of trust than a repudiation of a financial obligation.

Missing payments on contractual obligations like treasury securities is an obvious breach of trust. However, failing to make payments authorized by law is also a serious violation of trust. Legislation passed by Congress and signed by the President received a seal of approval that should only be rescinded with new legislation. If Congress passes budgets that are not fully funded with tax revenue, the obvious implication is that the executive branch must issue debt to satisfy the legislation.

There is much talk about whether the Department of the Treasury should prioritize payments on the national debt over other spending. From a contractual perspective, this can be justified. However, many observers consider prioritization to represent a “technical default” due to failure to make other payments authorized by law. This could result in a credit rating downgrade but, more importantly, an erosion of trust.

In a well-functioning system, Congress would debate tax and spending policy as part of a carefully designed annual budget process. In reality, much of the spending of the federal government is on autopilot. This is particularly true for entitlement programs such as Social Security and Medicare. Many Social Security beneficiaries are under the false impression that the system is funded by taxes they paid during their working years. I am sure that most beneficiaries consider their payments to be “contractual” even though benefit levels are subject to change at any time by Congress.

You cannot maintain trust if you do not have a predictable system. Contractual obligations should never be questioned, nor should quasi-contractual obligations be questioned without extensive debate, transparency, and time to adjust to changes.

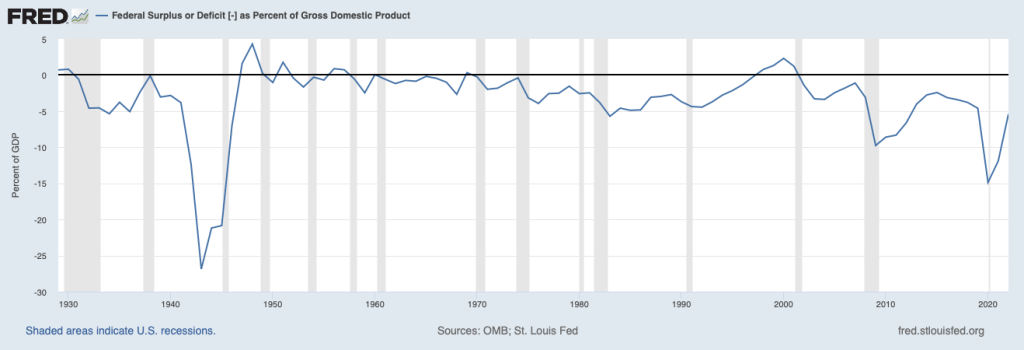

With very few exceptions, the federal government has failed to operate with a balanced budget. The pandemic spending exploded the deficit to levels not seen since the Second World War when measured as a percentage of Gross Domestic Product:

Whether you agree with the pandemic era spending or not, the reality is that the United States had massive capacity to borrow only due to an equally massive level of trust that treasury obligations are sacrosanct and contractual terms will be satisfied.

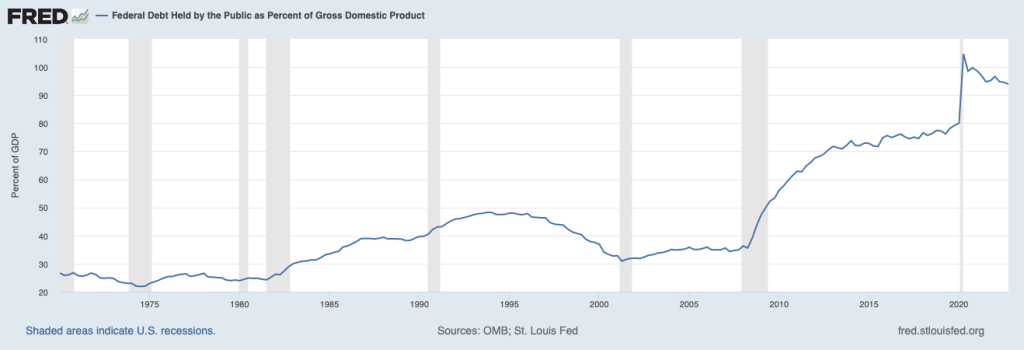

Does the United States have a spending problem? There is no question that debt as a percentage of Gross Domestic Product has skyrocketed in recent years:

It is remarkable that debt has reached such heights with interest rates at still at relatively low levels. Again, a major reason that the federal government can borrow at very low rates is due to trust that contractual obligations will be satisfied and that the government will not choose to inflate its way out of debt. Our recent bout of inflation has been tolerated by investors but we are already pushing our luck.

We find ourselves in a bizarre two-track system. Congress routinely passes legislation that is not fully funded with tax revenue, with the obvious implication that debt must be issued to make up the shortfall. However, the implied debt is not authorized along with spending legislation. Instead, we face the periodic drama of whether Congress will raise the debt ceiling. The main beneficiaries of this exercise are politicians who can vote for deficit spending while also voting against raising the debt ceiling.

Everyone has their own personal opinion regarding government spending and the overall size of the federal government. My opinion is that the federal spending is out of control and that each and every category of spending, both “discretionary” and “non-discretionary”, must be on the table during the annual budget cycle.

Congress has the power of the purse and can refuse to authorize spending during the annual budget cycle. If the President and Congress cannot agree on annual spending, parts of the government will not be funded until agreement can be reached. This is a proper part of the give and take of government. What is improper is to authorize spending as part of a budget cycle and then fail to authorize the implied debt required to satisfy the budget. All this does is erode trust in society.

I am not naive and understand that the debt ceiling has been a potent tool for fiscal conservatives to compel concessions from politicians who are more inclined to favor a larger federal government. As a negotiating tool, this strategy has worked to contain spending in the past and perhaps it will work again this time. However, political wins using this method are not free. The price that will be paid is erosion of trust in the system, especially if obligations authorized by law are not satisfied, even briefly.

Trust takes a long time to build up and can be destroyed quickly. The United States has built a deep reservoir of trust over the past 236 years which has permitted much abuse by politicians of both parties. This reservoir is not an unlimited resource. We should not assume that loss of trust in the system will be linear. Trust in society was already seriously impaired prior to the pandemic and suffered massive blows over the past three years. No one knows how many additional blows the system can take or where the line is between erosion and total collapse.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.