Dear Readers,

Thanks to the subscribers who submitted questions for The Rational Walk’s first-ever “Ask Me Anything” article. The AMA topic was about Berkshire Hathaway and there were a total of seven questions. I originally intended to write one article to answer all of the questions but I am now planning to respond in a series of articles. Today’s installment is about whether Berkshire Hathaway should disclose the performance of investment managers, specifically Todd Combs and Ted Weschler.

I will write additional articles covering the remaining questions, although I am not sure about the timing since a few questions/topics require an extended discussion. Topics include worst-case scenarios for Berkshire, how the company’s culture will change with new management, the current inflationary environment, the outlook for reinsurance, and whether management has added value via reinvestment of earnings.

To gain full access to all questions and responses, as well as to other exclusive content, please consider a paid subscription. The Rational Walk is a reader supported publication and I appreciate those who choose to support my work.

Thanks for reading!

“Buffett once published Lou Simpson’s investment track record in the annual report. When do shareholders get the same treatment for Ted and Todd?”

I wrote a brief tribute to Lou Simpson in early 2022 soon after his death:

Mr. Simpson’s track record as an investor at GEICO spanned from 1979 through the end of 2010 when he retired to found SQ Advisors. His positions were closely followed by investors in the years that followed. When Berkshire Hathaway acquired GEICO in 1995, Lou Simpson became the only investment manager at Berkshire to whom Warren Buffett granted complete autonomy to make investment decisions.

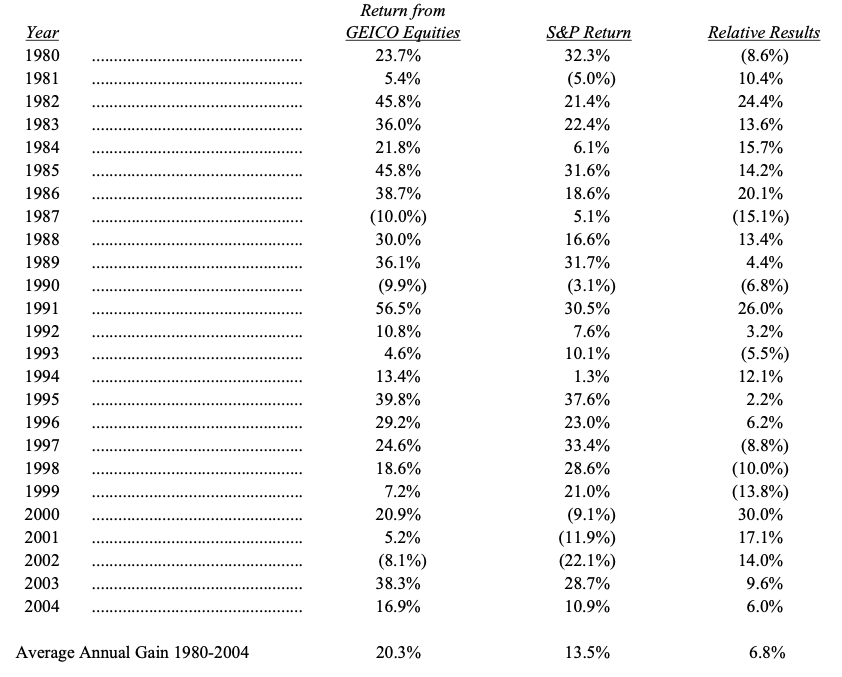

In his 2004 letter to shareholders, Warren Buffett provided Lou Simpson’s track record with GEICO’s portfolio under the title of “Portrait of a Disciplined Investor”:

This quarter-century record is extraordinary. Why did Warren Buffett refer to Lou Simpson as “disciplined”? Take a look at the underperformance of Mr. Simpson’s portfolio from 1997 to 1999. This was the height of a massive bull market and even strong performance in absolute terms was insufficient to beat the S&P 500. However, this difficult period was followed by years of outperformance. Lou Simpson never strayed from his core investing style. When Mr. Simpson retired in 2010, Mr. Buffett joked that he was not disclosing Mr. Simpson’s record from 2005 to 2010 because it would make Mr. Buffett’s performance look bad in comparison. “Who needs that?”

This brings us to the question of whether Berkshire Hathaway should disclose the performance records of Todd Combs and Ted Weschler. Mr. Combs was hired in 2010 and Mr. Weschler joined the company in early 2012. However, Berkshire emphasized that Warren Buffett would continue to manage most of Berkshire’s funds. This state of affairs has continued for over a decade.

Berkshire’s 13-F disclosures do not specify the investment manager responsible for each position. However, Warren Buffett is known to focus on larger positions while Todd Combs and Ted Weschler often own smaller stakes. For example, we know that Berkshire’s large stake in Occidental Petroleum is Mr. Buffett’s position and we can infer that small positions such as Floor & Decor, Louisiana-Pacific, and Diageo were purchased by either Mr. Combs or Mr. Weschler.

But there is always some ambiguity.

For example, the Markel position, worth around $600 million at the end of the first quarter, would normally be a size that we would not associate with Warren Buffett. However, when the purchase was first revealed last year, I suspected that it was Mr. Buffett’s decision.

At the end of 2021, Todd Combs and Ted Weschler had complete authority to manage $34 billion of investments based on Warren Buffett’s 2021 annual letter. This sum is divided equally, so each man is responsible for ~$17 billion. Mr. Buffett noted that some of the funds are contained within pension plans of Berkshire-owned businesses rather than assets owned by Berkshire itself. It is likely that their portfolios are approaching $20 billion each in mid-2023. Warren Buffett continues to personally manage the bulk of Berkshire’s mammoth-sized $328 billion portfolio of equities.

Warren Buffett does not micromanage the decisions of Berkshire’s investment managers. In his 2017 letter to shareholders, when each manager was responsible for $12 billion, Mr. Buffett indicated that he usually learns about decisions they make by looking at monthly portfolio summaries. This doesn’t mean that Mr. Buffett never talks to his managers about stock ideas. In a recent interview, Todd Combs revealed that he spends many Saturday afternoons at Mr. Buffett’s home talking about investment opportunities. Mr. Combs moved his family to Omaha many years ago and Mr. Weschler spends significant time at Berkshire’s Omaha headquarters.

This brings us to the question of how Berkshire’s investment managers have performed. Berkshire does not disclose this information and Warren Buffett has been reluctant to provide specifics. However, in early 2019, he indicated that the managers have trailed the S&P 500 by “a tiny bit” since they joined Berkshire. Apparently, they both got “well ahead” of the index over the first few years before falling somewhat behind when measured over the entire period of their tenures. Mr. Buffett noted that his own performance during the period trailed the S&P 500 by even more, although in fairness I would note that he was managing far more money and had less flexibility.

Obviously, trailing the S&P 500 over nearly a decade is not a great outcome, especially when compared to the bar Lou Simpson has set. However, in the same 2019 interview, Mr. Buffett noted that both Todd Combs and Ted Weschler have added significant value at Berkshire outside of their investment activities, particularly in the area of acquisitions. For example, Mr. Weschler handled Berkshire’s deal with Lee Enterprises to manage Berkshire’s newspapers. Presumably, Mr. Weschler was also involved in the 2020 transaction to sell the newspapers to Lee Enterprises which I discussed briefly at the end of a related book review about the Buffalo News.

In addition to his responsibilities as an investment manager, Todd Combs has been CEO of GEICO since January 1, 2020. Mr. Combs has presided over GEICO during a difficult period in the insurer’s history, a topic that I have written about several times over the past two years, most directly in the following articles:

According to an account of a recent interview, Mr. Combs has what can only be characterized as an extreme work schedule:

“With respect to his time management, Combs said that he has a couple of jobs. From an allocation perspective, 100-110% at GEICO, 16-hour days there, and he does his investing at nights and weekends, which makes up approximately 25%, and finally bank board meetings and other is 25% (Combs sits on JP Morgan’s board which unlike a traditional company has 8 board meetings a year as opposed to 4).”

Suffice it to say that both Todd Combs and Ted Weschler have Warren Buffett’s confidence and have been given progressively more money to manage over the years, not to mention additional responsibilities that go far beyond money management.

Mr. Buffett has spoken in the past about compensation agreements that are tied to performance relative to the S&P 500, with clawbacks possible on a three year rolling basis. In addition to personal performance, Mr. Combs and Mr. Weschler’s pay also depends to some extent on the performance of the other man, according to Adam Mead’s account of a response to a question at the 2018 annual meeting:

“The two investment managers are paid 10% of their outperformance over the S&P 500 on a rolling three-year basis, with 80% tied to their specific performance and 20% tied to the other man (to incentivize cooperation).”

One other factor to bring up is that Berkshire’s massive investment in Apple was actually initiated by Todd Combs and Ted Weschler in early 2016. At the time, Mr. Buffett confirmed that he played no role in the decision. In fact both Warren Buffett and Charlie Munger previously stated that they would not own Apple! The following excerpt is from the 2012 annual meeting:

CHARLIE MUNGER: Well, I think we can fairly say that other people will always understand those two companies [Apple and Google] better than we do. We have the reverse of an edge. And we’re not looking for that. (Laughter)

WARREN BUFFETT: Now he’s going to say isn’t the same thing true in IBM?

CHARLIE MUNGER: Well, I don’t think it is. I think IBM is easier to understand.

WARREN BUFFETT: Yeah. The chances of being way wrong in IBM are probably less, at least for us, than being way wrong with Google or Apple. But that doesn’t mean that those — the latter two companies —aren’t going to do, say, far better than IBM.

But we wouldn’t have predicted what would happen with Apple 10 years ago. And it’s very hard for me to predict, you know, what will happen in the next 10 years.

They’re certainly — you know, they’ve come up with these brilliant products. There’s other people trying to come up with brilliant products.

I just don’t know how to evaluate the people that are out there working, either in big companies or in garages, that are trying to think of something that will change the world the way they have changed it in recent years.

CHARLIE MUNGER: And what do we know about computer science?

Fast forward a decade and Berkshire’s largest equity investment is Apple and Charlie Munger’s Daily Journal has transformed into a software company!

I think it is safe to assume that Mr. Buffett’s interest in Apple was sparked by the decision of his managers to take that original position in 2016. Apparently, he was particularly impressed with Mr. Weschler’s account of how Sandy Gottesman, a Berkshire Director and longtime friend of Mr. Buffett, felt like he had lost a “piece of my soul” when he lost his iPhone!

Apple is an interesting case of “reverse coat tailing” in the sense that Warren Buffett took an investment thesis first developed by others and was able to gain enough conviction to take a much more massive position with the funds he manages. In the years since 2016, Berkshire has profited handsomely from the Apple investment that is part of Warren Buffett’s portfolio, but this performance is not part of the direct investment record of Todd Combs or Ted Weschler.

I think that we have a general sense that Todd Combs and Ted Weschler’s record is not quite as strong as Lou Simpson’s record, but there are many mitigating factors at play that make it necessary to look beyond their direct investment record when it comes to measuring how much value they add for Berkshire. This may be one reason for Warren Buffett’s reluctance to provide a table with their year-to-year performance relative to the S&P 500. I would find it interesting to see the record, but I am not particularly bothered by its absence given what I know of the overall situation.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.