Remote work appears to be here to stay. Many affluent Americans are migrating from crowded metropolitan areas to exurbs and rural areas boosting the prospects of companies catering to their needs.

Introduction

Tractor Supply Company was founded in 1938 by Charles E. Schmidt as a mail order business distributing machinery and parts to farmers. Late in his life, Mr. Schmidt told a reporter that, as a “city boy” from Chicago, he knew nothing about tractors and had never even set foot on a farm.1 But this did not stop him from identifying a promising business opportunity at the age of 26 in the midst of the Great Depression.

In the 1930s, farmers were hard pressed for cash and were rarely in a position to purchase expensive new equipment. However, they had no choice but to buy replacement parts for their aging tractors if they wanted to stay in business. Mr. Schmidt’s strategy was to run a low-overhead operation supplying non-discretionary parts and to pass the savings to customers.2 In the company’s first year of operations, it sold $50,000 of merchandise through a 24-page catalog listing 2,000 products.3

In 1939, Tractor Supply opened its first retail location in Minot, North Dakota, a rural town fifty miles south of the Canadian border. This store performed well and led Mr. Schmidt to successfully replicate the same model in additional locations. At this point, over ninety percent of sales were to farmers. However, after World War II, farm consolidations caused the company to move its locations closer to cities, change its retail brand name to TSC, and distance itself from its farm and ranch roots.4

Tractor Supply posted $10 million of sales in 1959 and went public with Mr. Schmidt retaining a controlling interest. By 1964, the company had 100 locations.5 Five years later, in the midst of the 1960s era of conglomeration, Mr. Schmidt sold the company to National Industries. This proved to be a negative event for Tractor Supply which lost its focus, and the company’s profitability was entirely extinguished by 1980.3

In 1980, Tom Hennesy became CEO and succeeded in returning the company to its roots. Management’s renewed focus on serving the farm and ranch niche market led to break-even results in 1982 and Mr. Hennesy led a management buyout in 1983. After a decade of progress returning the company to its profitable growth trajectory, Mr. Hennesy took Tractor Supply public for the second time in 1994.2

Although Tractor Supply might sound boring, the business has performed remarkably well since its public offering, and this has been reflected in its stock price. A dollar invested in Tractor Supply at the time of its public offering in 1994 is now worth ~$143, making it a rare “100+ bagger”. In addition, the company has paid a total of $12.53 in dividends since initiating a quarterly payout in 2010. There is nothing boring about a company that has compounded at over 19% for nearly three decades!6

In 2021, Tractor Supply recorded $12.7 billion of sales through its network of 2,181 locations in 49 states. In addition to 2,003 Tractor Supply stores, the company operates 178 Petsense locations. A Tractor Supply store is relatively small at between 15,000 to 20,000 square feet and is typically located in an exurban or rural setting rather than in major metropolitan areas. The square footage of a Tractor Supply store is well under twenty percent of an average Home Depot or Lowes.7

Tractor Supply defines its customer base as those who enjoy the “Out Here” lifestyle. The company’s marketing message emphasizes a pioneering spirit catering to the lifestyle needs of recreational farmers and ranchers. This is a demographic group that typically has above average incomes and does not usually rely on farming or ranching for their primary income. Instead, most customers simply enjoy living in less crowded, rural settings and value the convenience, targeted assortment of products, and superior customer service that Tractor Supply offers.8

This article evaluates Tractor Supply’s business model, recent operating history, capital allocation, future prospects, and potential risks. However, since Tractor Supply has been positively impacted by the COVID-19 pandemic, it is useful to first spend some time examining measures that were initially taken due to government-mandated lockdowns but now have become deeply entrenched in society.

Pandemic Tailwinds

The United States nearly shut down in mid-March 2020 due to the pandemic. A lockdown persisted for several weeks nearly everywhere and was followed by a more fragmented situation where state and local governments imposed various restrictions on offices, schools, retail stores, restaurants, entertainment venues, medical facilities, and public transportation systems. In general, large metropolitan areas continued to mandate significant restrictions for much longer than exurban and rural locations.9 Over time, this was accompanied by increasing levels of frustration, social discord, and political fragmentation during a contentious election year.10

The pandemic brought about a bifurcation in the economy in which a significant percentage of workers discovered that they could work remotely. This was possible because of the proliferation of high-speed internet service. The ability to access information quickly and reliably is essential for office jobs. However, the ability to interact will colleagues over videoconferencing might have been the killer app that allowed for extended periods of remote work. Even Charlie Munger, a nonagenarian not known as an early adopter of technology, declared that he was in love with Zoom.

Despite the signs that remote work was becoming entrenched, I remained skeptical a year after the start of the lockdowns, bemoaning the abandonment of offices and the decline of cities. I anticipated that vaccines would lead to a return to offices and a revitalization of deserted downtown business districts. In retrospect, this belief was driven by a bias toward my preferred outcome rather than the emerging reality.

Once knowledge is obtained, it is impossible to mentally erase what has been learned. Office workers who previously faced an unattractive tradeoff between living in cramped and expensive urban settings or enduring long commutes from distant suburbs resisted the notion that they should return to offices even as health rationale for remote work began to recede.11 Many workers who had lived in expensive cities or close-in suburbs prior to the pandemic had already moved to more spacious homes far from work. As months turned into years, social norms and work-life patterns changed and what had been a temporary stop-gap measure became the new normal.

There are many valid questions regarding the long-term viability of remote work, especially in fields where close interaction of individuals is essential. The creative serendipity of unplanned interactions with co-workers, especially in areas that might be adjacent to your discipline, is hard to replicate over Zoom. However, it is plausible that hybrid work arrangements could adequately balance the need for periodic in-person interaction with accommodating the desire for remote work.

There is growing evidence that higher income households are choosing to migrate from dense metropolitan areas to small cities and areas with a lower cost of living, low tax burdens, and fewer pandemic-related restrictions.12 While the main driver of compensation is the skill-set that an employee brings to the table, the location of a job has historically influenced pay packages. However, highly skilled employees are increasingly insisting that pay should reflect their skill set regardless of where they perform the job. Employers competing for workers in a tight labor market have limited negotiating power when dealing with highly skilled workers.

If the migration of higher income households to exurban and rural America continues over the course of a full business cycle, the trend initiated by the pandemic will clearly be here to stay. If that ends up being the case, Tractor Supply is particularly well positioned because the company’s strategic focus has long been to serve recreational farmers and ranchers with above-average incomes. No major shift in operational strategy is required to capitalize on this rapidly growing market opportunity.

Business Model

The retail landscape has become increasingly competitive in recent years. Home Depot and Lowes are the dominant players in the mass-market for general home improvement products and Amazon, sometimes known as the “everything store”, continues to expand its footprint online. In this environment, Tractor Supply has successfully focused on what initially appears to be quite a narrow market segment:

“We have identified a specialized market niche: supplying the lifestyle needs of recreational farmers, ranchers, and all those who enjoy living the rural lifestyle. By focusing our product assortment on these core customers, we believe we are differentiated from general merchandise, home center, and other specialty retailers. We cater to the rural lifestyle and often serve a market by being a trip consolidator for many basic maintenance needs for farm, ranch, and rural customers through convenient shopping options both in-store and online.”

Tractor Supply Company – 2021 10-K

Anyone who has taken long road trips in the United States knows that vast expanses of the country remain sparsely populated. Even at thirty thousand feet, it is obvious that agriculture remains a major part of the economy in “flyover country”. However, haven’t most family farms been consolidated by corporations in recent decades? Is there a significant opportunity in the niche market that Tractor Supply has identified?

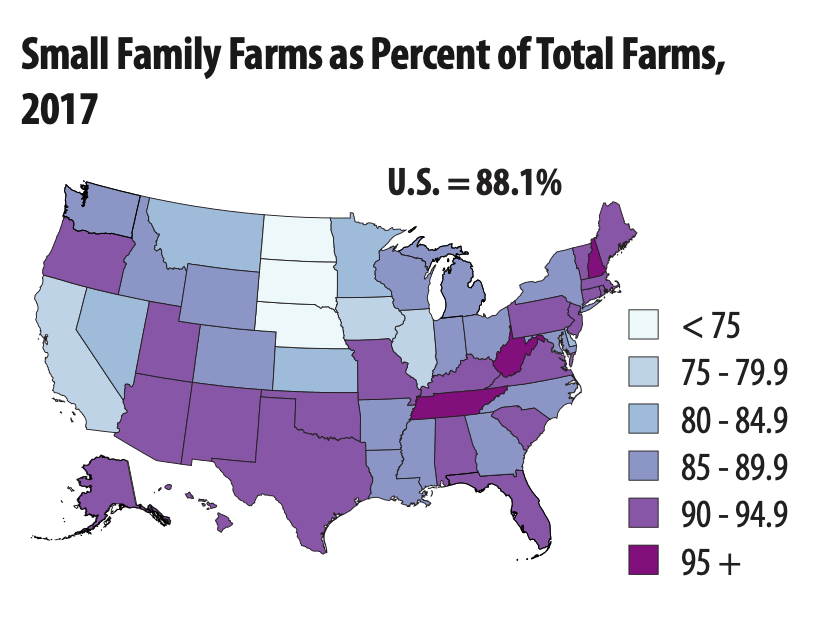

The United States Department of Agriculture conducts a census of agriculture every five years that provides a wealth of information regarding farm and ranch activity. A two-page summary report on family farms provides a great deal of insight regarding the size of Tractor Supply’s target market, and is summarized as follows:

“In 2017, 96% of U.S. farms were family-owned. Small family farms account for 88% of all U.S. farms, 46% of land in farms, and 19% of the value of all agricultural products sold. Large-scale family farms made up less than 3% of all U.S. farms, but produced 43% of the value of all agricultural products. Mid- size family farms accounted for 5% of U.S. farms, and produced 20% of the value of all agricultural products.”

The number of family farms has declined since the previous census taken in 2012, but there are still nearly 1.8 million small family farms, defined as operations with gross cash income of between $1,000 and $350,000. 92% of small family farms have two or fewer producers and 63% of these individuals report that their primary occupation is not farming related. 42% of individuals reported working over 200 days off the farm.

In addition to these small family farmers who generate some income from agriculture, there are individuals and families who live on acreage but do not earn any income from the land at all. These individuals are not captured in USDA farm census data. Most of the households who have relocated to acreage properties in rural America are likely to fall into the category of recreational farmers or ranchers who do not derive income from agriculture and they would not be captured in the USDA statistics.13

There are differences in the prevalence of small family farms based on geography. The following map from the census report illustrates this dispersion, but its notable that small family farms account for over 75% of total farms in nearly every state.

The map shown below shows Tractor Supply’s recent store count by state. The number of locations in each state is clearly correlated to overall population as well as the prevalence of small farming communities.

As we can see from the Google map below, Tractor Supply is not located anywhere near major population centers or even in dense suburbs near major cities. I ran this search for locations near New York City and Philadelphia, but the same type of pattern exists if you search for locations near any major city:

By locating stores in small towns and avoiding large metropolitan areas, Tractor Supply is not competing directly with big box retailers such as Home Depot and Lowes, but instead aims to serve as a one-stop trip consolidator in rural areas that have fewer retail options.

Tractor Supply hires employees who live a rural lifestyle themselves and can relate to the needs of the customer and provide knowledgeable service. The stores tend to be located far enough from each other to avoid cannibalization. 95% of stores are leased, typically on initial terms of ten to fifteen years, at terms more favorable than available to retailers operating within large metropolitan regions.

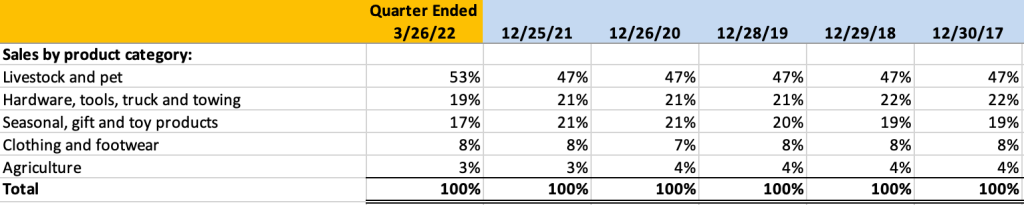

The following exhibit shows the composition of sales by product category over the past five years. Although product mix varies by quarter based on seasonal factors, the year-to-year mix of sales is quite stable over time:

While the majority of products are national brands, Tractor Supply offers a number of private-label products that have accounted for ~30% of sales in recent years. Private-label brands include consumable product lines such as 4health, Dumor, Pets & Claws, Producer’s Pride, Retriever, Royal Wing, Strive, and Untamed. Tractor Supply contracts with manufacturers to produce these private label products. Particularly for animal feed, private label brands can generate repeat business since customers tend to avoid switching from feed that their pets and livestock are already accustomed to.

A major part of the company’s strategy is to focus on products that drive recurring revenue streams, also known as consumable, usable, and edible (C.U.E.) product lines. Such products include items such as livestock feed, pet food, bird seed, lubricants, propane, fertilizer, weed control, mulch and pest control products.

Although both private label and branded consumable products have lower gross margin than other lines, management has emphasized sales in this area as a way to drive traffic into stores on a recurring basis. During the first quarter of 2022, sales growth for C.U.E. products was three times Tractor Supply’s overall growth rate.14

Tractor Supply offers between 16,000 to 22,000 products per store plus over 170,000 products that can be ordered online and shipped directly to customers or picked up at a local store. Prior to the pandemic, ~3.5% of sales were placed online with ~75% of orders picked up at Tractor Supply stores. As of June 2022, the online channel has increased to ~7.5% of sales with ~75% of orders picked up at stores.15 By making it easy for customers to shop via a phone app and having items waiting for them at the store, convenience is greater than dealing with small rural mom-and-pop retailers.

The company operates a network of distribution facilities consisting of 6.1 million square feet located in Arizona, Georgia, Indiana, Kentucky, Maryland, Nebraska, New York, Texas, and Washington. Nearly all distribution centers are owned. New facilities in Ohio and Arkansas are currently under construction and will add an additional 900,000 square feet of capacity in each location. Approximately 76% of merchandise in 2021 was shipped to stores via the distribution network. Most products are sourced domestically with imports accounting for ~12% of sales in recent years.

Big box home improvement retailers lack the focus to fully replicate Tractor Supply’s model and would not be able to operate at scale in areas with low population density. Online-only retailers might be able to undercut Tractor Supply on price but cannot offer knowledgeable in-person advice and service from employees who might very well also be neighbors. Small mom-and-pop rural stores can offer advice and service, but are unlikely to be competitive on price or serve as a one-stop trip consolidator.

Conventional wisdom can be deceiving. There are more small family farms in the United States than many people assume. Many farms are operated by individuals who derive most of their income outside agriculture, are pressed for time, and value convenience. Tractor Supply’s business model and value proposition is to offer customers a way to consolidate trips efficiently at locations within their communities.

Recent Operating History

The following exhibit shows Tractor Supply’s results from operations over the past decade through the first quarter of 2022 along with some basic statistics:

We can most clearly see the positive impact from pandemic-related demographic trends by taking a two-year view and comparing operating results from 2021 to 2019. Net sales rose from $8.4 billion in 2019 to $12.7 billion in 2021, a cumulative increase of 52.4% while net income rose from $562.4 million to $997.1 million representing an increase of 77.3%. Net income growth outpaced sales growth as operating efficiencies expanded margins. A declining share count brought about by repurchases boosted net income per share by 84.8% over the two year period. First quarter 2022 results show that revenue and net income growth has started to slow down from this torrid pace.

It is important to look at Tractor Supply’s results on a per-store basis to understand the company’s growth trajectory prior to and during the pandemic. The following exhibit shows Tractor Supply’s store growth over the past decade. Note that Petsense was acquired in 2016 for $143.6 million. Petsense is a small-box pet store chain operating in small and mid-sized communities with stores averaging 5,500 square feet. Although Petsense stores operate independently from Tractor Supply branded stores and have different economic characteristics, management does not consider Petsense material enough to warrant separate segment reporting.

Although Tractor Supply continued expanding during the pandemic, the number of new stores opened in 2020 and 2021 did not increase from the pace of new store openings in 2018 and 2019. Most of the increase in sales was due to comparable store sales increases rather than store expansion. The increase in comparable store sales was driven by increases in average transaction value and transaction counts. Existing stores were busier than prior to the pandemic and customers spent more money on each trip. The relatively sedate low single digit growth of comparable-store sales prior to the pandemic was replaced with explosive growth.

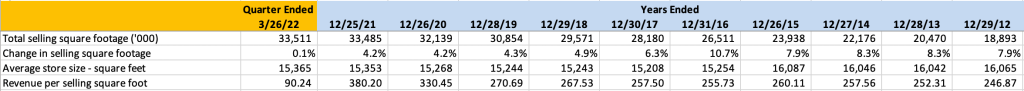

Another way of looking at the growth of the past two years is to consider total selling square footage and sales per square foot, as shown in the exhibit below:

Revenue per selling square foot is a key productivity measure that was growing slowly in the years prior to the pandemic. This measure rose from $270.69/square foot in 2019 to $380.20/square foot in 2021, a 40.5% increase.

Growth decelerated in the first quarter of 2022, which is not surprising given the slowdown in the overall economy. Although I do not place much importance on short-term management projections, it is worth mentioning that the company has provided guidance for ~8% overall sales growth in the second quarter and ~5% comparable-store sales growth with earnings per share of $3.48 or greater. This is positive growth in nominal terms, but relatively flat in real terms due to high single digit inflation.16

Balance Sheet and Capital Allocation

In this section, we will take a look at Tractor Supply’s balance sheet and capital allocation record, with a focus on the capital structure and the allocation of free cash flow between capital expenditures to expand the business, acquisitions, and share repurchases. The following exhibit shows condensed balance sheet information over the past decade along with related statistics:

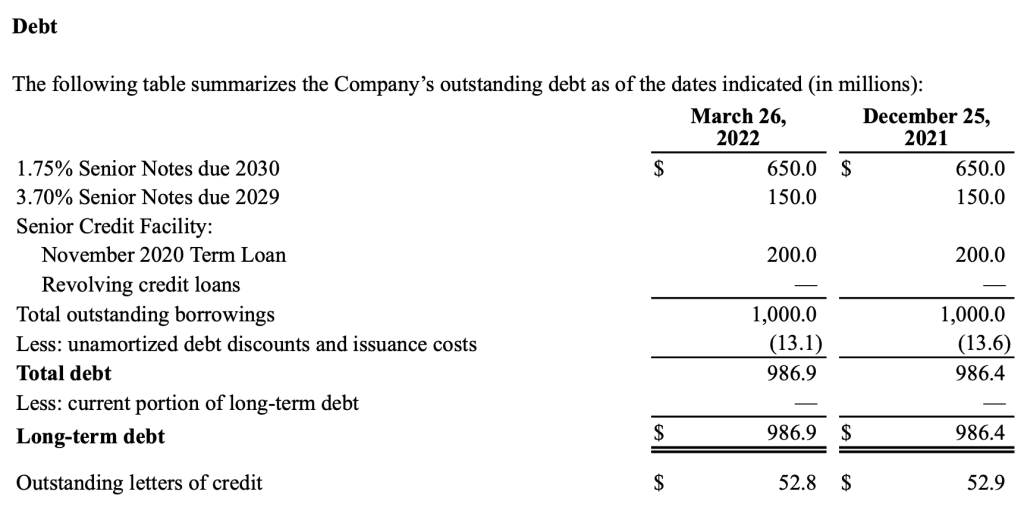

Tractor Supply historically operated with minimal indebtedness. Although the company was a beneficiary of pandemic-related trends, management decided to preemptively bolster the cash position in October 2020 by issuing $650 million in 1.75% Senior Notes due in 2030. The following exhibit from the latest 10-Q shows the composition of Tractor Supply’s long-term debt. Debt is currently 36% of total capital.

Although management did not need to issue debt in late 2020, securing ten year debt at 1.75% will likely prove advantageous over the long run given opportunities for expansion and the possibility of reducing the share count via repurchases.

Tractor Supply has been a consistent generator of free cash flow over the years. The exhibit below shows a condensed cash flow statement over the past decade:

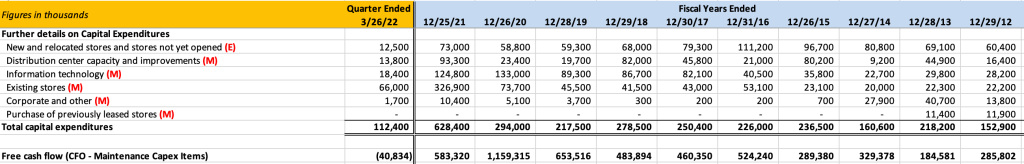

Management provides a breakdown of capex that allows us to estimate maintenance and expansionary spending. In the exhibit below, I chose to be conservative and allocate all of the capital expenditure categories to maintenance (M) with the exception of the line item specifically related to expanding via new locations (E):

It should be noted that a portion of the distribution center investments and information technology spending must be driven by a rising store count, but we do not have a breakdown of those line items. The free cash flow estimate in the exhibit takes cash flow from operations and subtracts the maintenance (M) line items.

Based on these estimates, Tractor Supply had approximately $4.9 billion of cumulative free cash flow from 2012 through the first quarter of 2022. How has management allocated free cash flow over time?

- Expansion capex to support an increasing store count has consumed $769 million. During this period, Tractor Supply increased the store count from 1,085 on 12/31/2011 to 2,003 on 3/26/2022.

- The Petsense acquisition in 2016 consumed $142 million.

- Share repurchases, net of proceeds from share issuance related to equity-based employee compensation, consumed $3.4 billion.

- Dividends consumed $1.4 billion.

The total of the four bullet points above is $5.7 billion. Free cash flow of $4.9 billion funded the majority of these items supplemented by $981 million of long-term debt.

The acquisition of Petsense in 2016 resulted in a goodwill write-down of $69 million in 2020 due to a reassessment of the chain’s long-term growth prospects. This is a significant impairment relative to the $142 million cost of the acquisition.

In February 2021, Tractor Supply agreed to acquire Orscheln, a farm and ranch retailer with 167 stores located in Arkansas, Illinois, Indiana, Iowa, Kansas, Kentucky, Missouri, Nebraska, Ohio, Oklahoma, and Texas. The transaction is for $320 million in cash. However, the acquisition has been held up in an FTC review. The parties have agreed to divest half of the stores as a condition of the merger but it is unclear whether the transaction will ultimately be approved.17

Management is confident that opening 70-80 new stores per year is an achievable target.14 Another potential growth strategy involves renovations to the interior of existing stores, referred to as the Fusion program, as well as “side lot” garden-center expansions. Tractor Supply currently has 200 garden centers, 30% of stores have been remodeled via the Fusion program, and management anticipates a significant boost to comparable-store sales from these initiatives.15

Given the company’s track record opening new Tractor Supply stores, it is worth asking whether the increased market opportunities seen over the past two years might warrant a more aggressive expansion strategy. Clearly there is ample free cash flow to reinvest in the business more aggressively, although doing so could result in a slower pace of share repurchases and dividend growth.

Conclusion

Tractor Supply has successfully served a niche market that is larger than it might appear to observers who are unfamiliar with rural America. Although the farm economy has consolidated over the long run, the prevalence of small family farms remains significant. The unique needs of small family farms and recreational farmers and ranchers are not well served by large big box home improvement centers or exclusively through online stores such as Amazon. By providing knowledgeable service and a product assortment that can make Tractor Supply a one-stop shopping experience, the company has identified a successful business model.

The key question in mid-2022 is to what extend the demographic and migratory trends driven by the pandemic will persist over the long run.

The growing awareness of the ability of office workers to do their jobs remotely has resulted in migration patterns favorable to Tractor Supply. Remote work is not necessarily an “all or nothing” proposition. Employees who work in hybrid environments where they go into the office periodically can still choose to live in locations that are quite far from major metropolitan areas. It would be unacceptable to live 100 miles from the office if commuting on a daily basis, but perhaps tolerable if going into the office only a few times per month.

We should be careful to not extrapolate pandemic trends too far. The tight labor market that has persisted over the past year has tilted the balance of power to employees and enabled many to resist moves by companies to have their workforces return to the office. The power of employees in an era of 3-4% unemployment might be at its peak. It seems premature to assume that employees would retain such power if unemployment rises considerably in a recession and employers decide that their workforces would be more productive in the office.

As of the morning of July 13, Tractor Supply shares were trading at ~$194 giving the company a market capitalization of $21.7 billion.

Based on the estimates presented earlier, free cash flow in 2020 was ~$1.16 billion and fell to $583 million in 2021. However, in 2021, $545 million was spent on existing store remodeling, information technology, and distribution centers that could arguably be considered expansionary rather than maintenance. It seems plausible that the company could generate free cash flow in excess of $1 billion if the conditions that prevailed in 2020 and 2021 continue. Then the question becomes how quickly free cash flow can grow over time.

With $12.7 billion of sales in 2021, has Tractor Supply saturated its market opportunity? Management believes that the total addressable market size is $180 billion.4 If that is the case, there is a significant opportunity to increase the store count significantly. If management boosts comparable-store sales via remodeling and side-lot garden center expansions, this would further enhance growth.

Shares have declined ~19% since hitting a record high at the end of 2021 but the stock still trades at nearly twice the price it traded at prior to the onset of the pandemic. Clearly, the market believes that a significant portion of the company’s pandemic gains will persist. Negative macroeconomic headlines that call this narrative into question could send shares down and potentially create an interesting opportunity.

Downloads

A PDF file containing this profile can be downloaded by using the link below:

Excel data used in this report is available using the link below:

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in Tractor Supply Company.

- Financier Charles Smith Dies at 83 by Neil Santaniello and Lori Crouch, May 3, 1996 (South Florida Sun-Sentinel) [↩]

- Tractor Supply: A Portrait of a Compounder as a Young Company by Matt Franz, August 7, 2020 (Eagle Point Capital) [↩] [↩]

- A 360-Degree View of Tractor Supply Company by Sara Logel, May 27, 2015. (Hardware Retailing) [↩] [↩]

- Ibid. [↩] [↩]

- Company History, Retrieved on July 8, 2022 (Tractor Supply Company) [↩]

- According to Yahoo! Finance, Tractor Supply stock closed at a split-adjusted $1.42 on February 18, 1994. The closing price of the stock on July 7, 2022 was $203.44. In addition, the company has paid $12.53 of dividends since initiating a dividend payout in 2010. Stock price annualized return (excluding dividends): (203.44/1.42)^(1/28.4) – 1 = 19.1%. Also see Tractor Supply’s Investment Calculator and Dividend History pages. [↩]

- The average Home Depot location has 104,000 square feet of indoor space and 24,000 square feet of outdoor selling space, while the average Lowes store has 112,000 square feet of indoor space and 32,000 square feet of outdoor selling space. Sources: Home Depot 10-K for the fiscal year ended January 30, 2022. Lowes 10-K for the fiscal year ended January 28, 2022. [↩]

- In the early 2000s, I lived in a rural community thirty miles east of Sacramento that precisely matches Tractor Supply’s target market. I would have welcomed a “one-stop shop”, but I was not familiar with the Tractor Supply chain. I purchased supplies from a variety of businesses, from mom-and-pop stores to Home Depot. I first became aware of Tractor Supply in 2010 when I researched the company as a potential investment. This was many years after I relocated to a large city for work-related reasons. [↩]

- For example, this recent article discusses how rural areas have seen a boom over the past two years: Rural Counties Are Booming, but Can It Last? by Sarah Chaney Cambon and Andrew Mollica, June 28, 2022. (WSJ) [↩]

- One of the benefits of writing a journal, as well as posting content online, is that I can go back and review my thinking at the time. On March 15, 2020, I wrote The Surreal Weekend just as the lockdowns began. A few weeks later, I wrote The World Has No Pause Button with some observations after finally venturing out. [↩]

- There have been numerous articles written about workers resisting a return to the office. For example: Big Cities Can’t Get Workers Back to the Office by Lauren Weber, Peter Grant, and Liz Hoffman, July 7, 2022. (WSJ) [↩]

- The most convincing study I have read is From L.A. to Boise: How Migration Has Changed During the COVID-19 Pandemic by Peter H. Haslag and Daniel Weagley published on March 18, 2022. This paper is particularly useful for understanding the migration trends of higher income households. Tractor Supply’s strategy is to target households with above-average incomes living in rural areas for lifestyle reasons. [↩]

- The 2022 Agricultural Census will capture data from farms with revenue over $1,000. It is unlikely to capture much data on new arrivals who have purchased rural land primarily for lifestyle reasons rather than for income. 2022 census data will be published in 2024. [↩]

- Tractor Supply Q1 2022 Conference Call Transcript, April 21, 2022. [↩] [↩]

- Baird 2022 Global Consumer, Technology & Services Conference, June 7, 2022. [↩] [↩]

- CPI Inflation is running at 9.1%. (BLS) [↩]

- The transaction has received support from several state attorney generals who sent FTC Chair Lina Khan a letter dated May 22, 2022 urging a timely approval of the acquisition. [↩]