Corporate Tax Headwinds

The Tax Cuts and Jobs Act of 2017 was the result of a political process constrained by anticipated effects on the long-run fiscal condition of the federal government. In order to bring the projected cost of the overall package down to politically acceptable levels, many of the tax cuts have an expiration date at the end of 2025. If Congress does not act, an array of taxes will automatically increase in 2026.

Perhaps it is a sign of the relative power of various constituencies, but the steep cut in the corporate tax rate is one of the few that do not expire in 2025. The corporate tax rate was cut from 35% to 21% and this was advertised as a “permanent” change. If Congress is gridlocked in 2025, the corporate tax will remain at 21%.

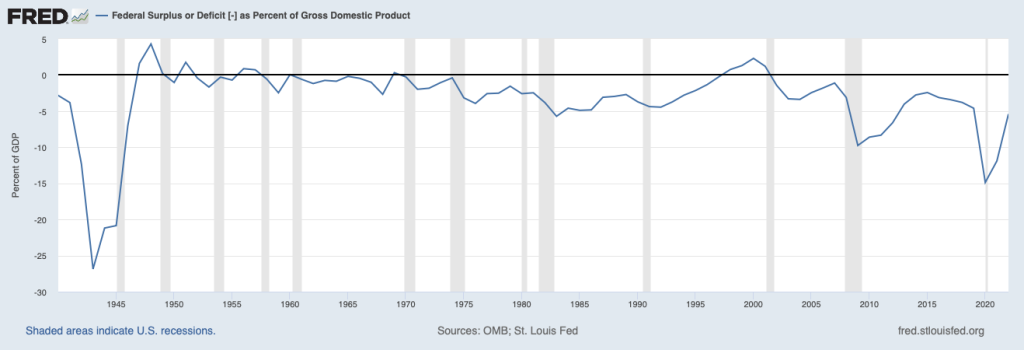

When it comes to tax policy, it is dangerous to consider anything to be “permanent” when the fiscal condition of the United States is in disarray. The pandemic brought about massive deficit spending and debt as a percentage of GDP has skyrocketed, as we can see from the charts below. The first chart shows the federal budget deficit as a percentage of GDP since 1940. The second chart shows total public debt as a percentage of GDP since 1966, the first year in the data series.

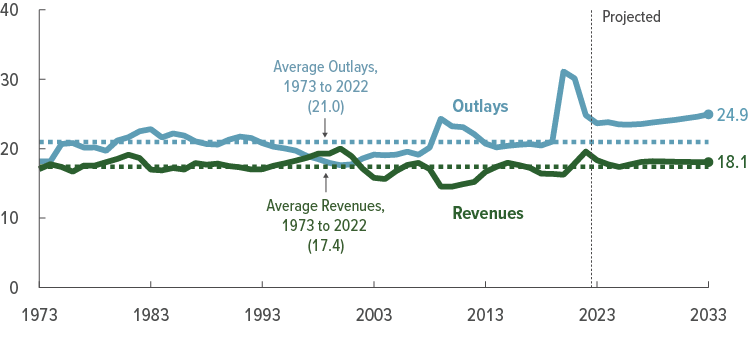

The Congressional Budget Office (CBO) projections for deficits and debt in the years to come are extremely disturbing, even with optimistic assumptions regarding the interest rates paid on the national debt. There is a massive gap between projected revenues and spending as far as the eye can see. The pandemic spending spree does not appear to be transitory; instead, it established a new and much higher baseline.

I should emphasize that the CBO is assuming that the “temporary” tax cuts will expire on schedule in 2025. If Congress wishes to extend any of those cuts, the outlook will be even worse than the chart indicates. One can observe that we have a spending problem, not a revenue problem, given that revenues are on trend while outlays have risen far above trend, but few politicians seem willing to even propose serious cuts.

I do not regard the “permanent” status of the corporate tax rate to be of much comfort because it will be politically difficult to maintain a 21% rate if the other provisions of the 2017 legislation are allowed to expire in 2025. Most investors seem oblivious to this potential headwind that could start blowing with a vengeance in the near future. Markets are forward looking and if it looks like the corporate tax rate might rise in 2026, markets will reflect this well ahead of time, perhaps starting next year.

Many companies experienced a strong tailwind when the corporate tax cut went into effect in 2018. For example, look at the effective tax rate of Dollar General, the subject of an article I wrote earlier this week:

It is obvious that Dollar General benefited from the 14% cut in the federal tax rate and would be harmed by a tax increase. It is unlikely that the corporate tax rate will return to 35% but we should note that President Biden’s fiscal 2024 budget called for the rate to rise to 28%. Obviously, this will not happen with the current composition of Congress, but it indicates that there could be upward pressure in the future.

The political landscape is constantly evolving. One unmistakable shift in recent years is that the Republican Party has moved in a “populist” direction, a major change from the party’s traditional “pro business” philosophy. From a political perspective, the GOP could very well be amenable to an increase in the corporate tax rate in exchange for retaining tax cuts that have more populist appeal. Therefore, I think that the corporate tax rate is not just a function of which party is in power.

Investors have mostly shrugged off the strong headwinds of rising interest rates over the past year which seems odd given that it is now possible to purchase a ten year treasury note yielding 4.3% or a ten year TIPS yielding 2% + CPI. As Warren Buffett has said on more than one occasion, interest rates act like “financial gravity” when it comes to the valuation of all assets. If Uncle Sam, our “silent partner” as investors, decides that he will claim an additional 7% of corporate profits in a few years, that will represent yet another headwind that investors must account for.

The stereotype of value investors is that we are not supposed to consider the macroeconomy. It’s one thing to avoid making investments based on projections of the CPI in September or GDP in the third quarter. But we should be aware of longer term trends related to taxes and interest rates, particularly when it comes to our central expectation for the returns of stocks over the next decade.

Articles

Warren Buffett’s Green Cash Washes Over Coal Country by Scott Patterson, September 5, 2023. The “Inflation Reduction Act” included major incentives for clean energy projects. Berkshire Hathaway Energy has a long history of responding to tax incentives. This article reports on a project in West Virginia involving BHE as well as Precision Castparts, another Berkshire subsidiary. These projects apparently came together without Warren Buffett’s direct involvement. “I’m glad it worked out,” Buffett told The Wall Street Journal. “I can claim no personal credit.” (WSJ)

The Real Story of Elon Musk’s Twitter Takeover by Walter Isaacson, September 2, 2023. In an excerpt from his biography of Elon Musk to be released next week, Walter Isaacson provides some behind-the-scenes reporting on the Twitter acquisition. “The way that Musk blustered into buying Twitter and renaming it X was a harbinger of the way he now runs it: impulsively and irreverently. It is an addictive playground for him. It has many of the attributes of a school yard, including taunting and bullying. But in the case of Twitter, the clever kids win followers; they don’t get pushed down the steps and beaten, like Musk was as a kid. Owning it would allow him to become king of the school yard.” (WSJ)

The Rise and Fall of ESPN’s Leverage by Ben Thompson, September 5, 2023. Disney’s stock has been beaten down severely in recent months. One of the difficulties in analyzing the company has to do with the long term future of ESPN, a crown jewel that has seen its moat slowly erode in recent years. I found this article’s discussion of ESPN’s history and current competitive position very useful. (Stratechery)

Initial estimates point to Hurricane Idalia insured loss of below $10 billion by Saumya Jain, August 31, 2023. “The Big Bend area of the Florida coast where Idalia made landfall is far less densely populated than the region devastated by Hurricane Ian last year. In contrast to Hurricane Idalia, there were approximately 1 million people within 30 miles of landfall for Ian, while there were about 38,000 people within that distance for Idalia, according to an AccuWeather report.” (Reinsurance News)

Warren Buffett: “I am a better investor because I am a businessman and a better businessman because I am an investor.” by Kingswell, September 5, 2023. This article contains excerpts from the 1993 Forbes 400 issue when Warren Buffett edged out Bill Gates for the #1 spot on the list. It’s easy to picture him making many of the same statements today. One of the hallmarks of Warren Buffett’s approach to business and life is his consistency over very long periods of time. (Kingswell)

These 38 Reading Rules Changed My Life by Ryan Holiday, September 6, 2023. I agree with almost everything in this article, especially the benefits of reading older books, taking notes, and turning to books rather than the mainstream media to better understand current events. I continue to have trouble abandoning “bad” books before I finish them. Hope springs eternal, I suppose. (RyanHoliday.net)

Never Look Down the Road Not Taken by Nick Maggiulli, September 5, 2023. Attempting to replay history is an exercise fraught with peril. This article reminds me of the article I wrote about selling Apple stock in 2001. (Of Dollars and Data)

Respect and Admiration by Morgan Housel, September 6, 2023. This is a good reminder that buying expensive things to impress people is pointless vanity. Respect is not driven by showy displays but by innate qualities. (Collaborative Fund)

Podcasts

Nvidia: The Dawn of the AI Era, September 5, 2023. 2 hours, 54 minutes. This is an interesting overview of the development of AI over the past decade. “Over the past 18 months Nvidia has weathered one of the steepest stock crashes in history ($500B+ market cap wiped away peak-to-trough!). And, it has of course also experienced an even more fantastical rise — becoming the platform that’s powering the emergence of perhaps a new form of intelligence itself… and in the process becoming a trillion-dollar company.” (Acquired)

Where Does Your Return Come From: Yield, Growth, and Multiple Expansion, September 4, 2023, 32 minutes. This discussion breaks down the sources of returns on an investment. It’s important to understand where you expect your returns to come from when considering a new investment as well as where your returns have actually come from when evaluating current and past investments. (Focused Compounding)

Good vs. bad science: how to read and understand scientific studies, September 4, 2023. 1 hour, 50 minutes. Mainstream media articles covering scientific studies cannot possibly discuss all of the complexities that one needs to understand in order to separate signal from noise. In this long and detailed podcast, Peter Attia explains his process for reading scientific papers, focusing on how studies and clinical trials work. He delves into topics including differentiating relative risk from absolute risk and how to determine the statistical significance of study results. (The Drive)

Berkshire’s Beginnings w/Jacob McDonough, August 31, 2023. 1 hour, 25 minutes. “In 1962, Warren Buffett began purchasing shares in Berkshire Hathaway, a struggling textile maker in the midst of a decline. Ironically, in hindsight, Buffett has said that purchasing Berkshire Hathaway in the first place was one of his worst decisions ever. In this episode, you’ll learn how Buffett was able to turn the business around and make its way to eventually becoming worth nearly $800 billion in 2023.” (We Study Billionaires)

Why Doomberg left Twitter (okay, X) to go all in on Substack, September 4, 2023. “If the new owner of Twitter had not specifically and proactively throttled all Substack authors, we would almost certainly still be on the platform. It’s his private property. He can run his property in any way that he sees fit… but the primary driver and the motivation to leave the platform was because of the impact on all of our friends.” (On Substack)

The Lifecycle of Greed and Fear, August 31, 2012. 12 minutes. “All greed starts with an innocent idea: that you are right, deserve to be right, and are owed something for the efforts you put into establishing your beliefs and opinions. It’s a reasonable feeling. But it sets off a chain reaction that leads to an inevitable boom-and-bust cycle. This episode explores one of the most important topics in investing: the lifecycle of greed and fear, and why it cannot, and will not, ever go away.” (The Morgan Housel Podcast)

Jimmy Buffett

No matter the weather outside, you can always get a virtual ticket to the tropics. Jimmy Buffett, who died on September 1, invented his own tropical sound that transcended country and rock and earned the loyalty of generations of fans.

Jimmy Buffett and Warren Buffett were not related but they were friends who referred to each other as “Cousin Warren” and “Cousin Jimmy”. Jimmy Buffett was a Berkshire Hathaway shareholder for many decades and was known to appear at annual meetings and hold impromptu performances for shareholders.

I don’t think that Fruitcakes is one of Jimmy Buffett’s best known hits but I’ve always liked it because it says something about our flawed human condition. RIP.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.