This article was originally published in December 2017.

“I know that there are millions of Americans who are happy, who are content with their health care coverage — they like their plan, they value their relationship with their doctor. And no matter how we reform health care, I intend to keep this promise: If you like your doctor, you’ll be able to keep your doctor; if you like your health care plan, you’ll be able to keep your health care plan.”

— President Obama, June 11, 2009

Health care is a big business in the United States. This sector of the economy consumes over 17 percent of Gross Domestic Product, a figure that has crept up steadily over the past few decades. The health insurance system in the United States is a mishmash dominated by private insurance provided by companies to their employees as fringe benefits and government programs designed to insure the poor, the elderly, veterans and other groups. Individuals who are not covered by their employers and do not qualify for government programs have often had difficulty obtaining health insurance in private markets. Those who obtained coverage before encountering major medical issues could generally find affordable coverage but those who attempted to buy coverage only after getting sick typically could not buy coverage at all or only at high cost. This caused a great deal of social dislocation for individuals facing steep medical bills and for hospitals required to provide care to all who requested treatment, even those with no ability to pay for services.

The Affordable Care Act, popularly known as “Obamacare”, became law in 2010 and has taken effect over the past several years. Obamacare attempts to provide access to health insurance to individuals regardless of pre-existing conditions by eliminating medical underwriting. In other words, insurance companies are required by law to accept all applicants. Premiums are regulated and cannot vary based on health risks, with the exception of surcharges for smokers. All insurance plans are required to cover a set of “essential benefits” and are further divided into various “metal categories” such as bronze, silver, gold, and platinum based on the level of coverage provided, deductibles, and other key variables. A very complex system of subsidies was put in place to help individuals and families with incomes up to 400 percent of the federal poverty level pay for premiums and new taxes were imposed through payroll taxes and investment taxes on higher income taxpayers. Obamacare has survived numerous legal challenges and attempts to “repeal and replace” the law have failed.

It appears that Obamacare is here to stay and whether one supported or opposed it, coming to terms with it is no longer optional. The law includes an individual mandate requiring one to purchase insurance or to pay a penalty. Although the Republican tax proposal that passed the Senate recently eliminates the mandate, it is doubtful that a mandate repeal will make it into the final tax law. With open enrollment for 2018 ending on December 15, those who wish to purchase health insurance on the Obamacare exchange have only a few more days to do so.

Note that this article covers the process one would go through to purchase private insurance on the Federal Obamacare exchange and ignores the process of applying for Medicaid. Obamacare offered partial funding to states that wished to expand Medicaid but not all states have opted in. In general, most readers of this site will want to obtain private coverage rather than rely on Medicaid. Also, this article only provides links to healthcare.gov which is the federal exchange that is used for residents of states that do not have their own exchange. Certain states have opted to set up their own exchanges. In most cases, these exchanges should work similarly to the federal exchange but the process will vary.

Obamacare Subsidies Demystified

Obamacare includes a complex system of subsidies that are intended to help individuals and families with incomes below 400 percent of the federal poverty level afford health insurance premiums and out-of-pocket costs. The following excerpt from healthcare.gov explains the types of subsidies available depending on where one’s income falls relative to the federal poverty level:

The 2017 federal poverty level for an individual is $12,060 and is higher for households with multiple people (for example, a four person household has a federal poverty level of $24,600). These levels are documented on the HHS website. Poverty levels are uniform for all states except for Alaska and Hawaii which have slightly higher levels (long suffering residents of high costs states like California and New York might wonder why their poverty level is the same as low cost states like Arkansas and Mississippi but that’s a digression for another day … )

What is “income” for purposes of Obamacare? One must calculate expected modified adjusted gross income (MAGI) for 2018 to determine subsidy eligibility. This is essentially the adjusted gross income (AGI) line on tax returns plus certain additional income sources such as tax-exempt income, untaxed foreign income, and untaxed social security income.

A key point to remember is that Obamacare subsidies are triggered based on income only and have nothing to do with your net worth.

This is particularly important for individuals in the “early retirement” community who have achieved financial independence and no longer obtain their income from traditional employment. Your expected 2018 income is all that matters when it comes to determining subsidies during open enrollment. This means that you have an opportunity to plan your 2018 income in order to achieve a desired level of subsidy. The best way to view this is to consider Obamacare subsidies in the context of your overall tax and income situation for 2018. If you have flexibility regarding legal ways to alter recognition of taxable income, this can be used to your advantage when it comes to purchasing health insurance.

There are two distinct types of subsidies provided by Obamacare: premium tax credits and cost sharing subsidies. Each type of subsidy has complex rules and will be discussed separately. Before proceeding, one should visit healthcare.govand enter the number of people in your household and your home state. You will then be presented with state specific guidelines pertaining to your situation.

For example, the following is presented to someone applying for coverage who lives in a household of four people in Kentucky:

Premium Tax Credits

Premium tax credits are refundable tax credits provided to help pay for health insurance premiums for those who have income below 400 percent of the federal poverty level. These credits are “refundable” because they are paid out regardless of whether the taxpayer has any income tax liability. One can choose whether to apply the premium tax credit directly to the monthly premium paid for health insurance or to receive it in a lump sum when filing federal tax returns. Most individuals will opt to have the subsidy applied to reduce monthly health insurance payments.

Unfortunately, there appears to be no way to obtain a table showing the subsidy levels one would qualify for based on various income level ranges. Instead, it is necessary to go to healthcare.gov and enter your income repeatedly to manually generate a listing of subsidy levels for various income levels. One can browse plans without creating an account. You will be asked for your ZIP code and basic information such as your household size, age, sex, and whether you use tobacco. You will also need to estimate your 2018 income. This will be followed by results such as what appears below (for a 25 year old with $25,000 income – this will also potentially vary by state):

This indicates that you qualify for a $184/month premium tax credit as well as “extra savings” that pertains to cost sharing subsidies (discussed in the next section). Subsequent screens will display all plans that exist within the region you live in along with subsidized premiums that you would pay after applying the $184 per month credit.

In order to determine how the credit varies based on income, you can change your income (and other details) by clicking on the “Edit” button at the top of the page where plans are displayed:

For example, how much would the premium credit be if income drops from $25,000 to $24,000 per year? After editing income, it turns out that the premium credit increases from $183.60 to $195.15 per month. You can repeat this process as many times as you would like to obtain a table of subsidy levels based on income.

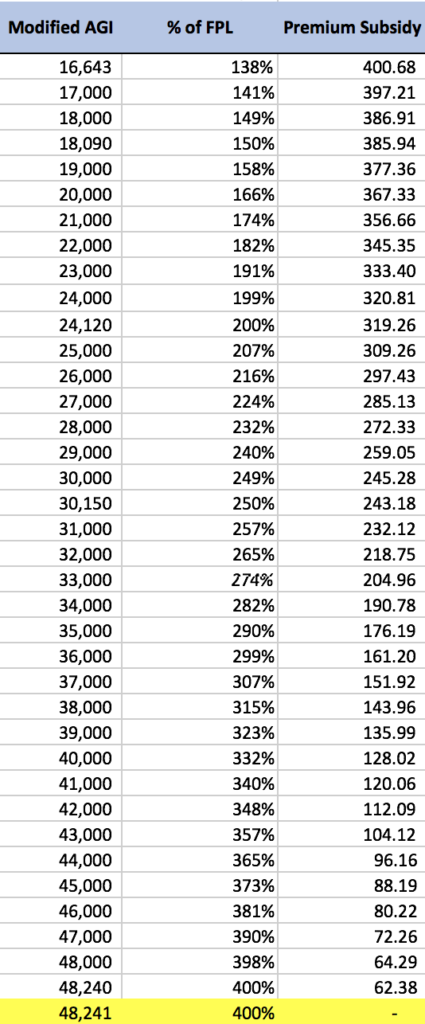

What you really want to do is generate a table showing the level of premium subsidy for income at various levels. It might be useful to create a table such as the one below which shows how subsidy levels vary. In this new example, we examine the level of premium subsidy available to a middle aged non-smoker living in a southern state:

Note that in this example, $16,643 is the minimum income required for premium subsidies on the exchange. Incomes below this level would push the applicant into Medicaid which we are not considering in this article. Note that $48,240 is the upper limit for subsidies at 400 percent of the federal poverty level. Also note how the subsidy suddenly drops from $62.38 to zero if income exceeds 400 percent of the poverty level by even one dollar!

What if you estimate your 2018 income incorrectly? When you file your return for 2018, there is a reconciliation process that will ensure that any premium subsidies paid on your behalf during the year is correct based on your actual income. If your income is higher than expected, you will have to repay the excess credits. If your income is lower than expected, you will receive additional tax credits even if you do not have any income tax liability. For those who are totally unsure about their income, it is possible to not have any credits applied to insurance premiums during the year and settle up with the IRS when your 2018 tax return is filed. The choice of whether to obtain credits during the year is up to the individual.

Cost Sharing Reductions

Cost sharing reductions are provided to those who have income between 138 – 250 percent of the federal poverty level and apply only to silver level plans. These cost sharing reductions are designed to reduce out-of-pocket expenses during the course of the year by lowering the deductible and out-of-pocket maximum for silver plans. In many cases, the lower deductible and out-of-pocket maximum makes silver plans resemble much more expensive gold and platinum plans.

These cost sharing subsidies are controversial and President Trump recently took steps to halt cost sharing subsidies paid to insurance companies. However, for 2018 at least, insurers must still provide these subsidies whether they are reimbursed by the government or not. As a result, individuals can take full advantage of these subsidies when making decisions for open enrollment. Note that unlike premium credits, there is no settlement process required for excess cost sharing subsidies received in a given year if income estimates prove to be incorrect. This means that even if your income turns out to be higher than what you specify when enrolling for a plan, you still will benefit from the lower out of pocket costs and will not be liable to pay back these benefits. Obviously, as a matter of integrity, one should not purposely underestimate income to get these subsidies but it is good to know that an inadvertent increase in income will not result in a large bill to repay these subsidies when it comes time to file taxes.

Reviewing Subsidy and Premium Levels

There is no way to see a table listing premium subsidies, premiums for offered plans, and cost sharing subsidies based on various incomes so it is necessary to procure this information manually. The table below is an example for a single middle aged male living in a southern state. The table lists the level of premium subsidy based on income along with two sample plans: one at the bronze level and the other at the silver level. Only the silver level qualifies for cost sharing subsidies which appear as lower deductibles and out-of-pocket maximums (Max OOP). Note that your situation is bound to be different so this table should be used as an example only. You will have to compile similar information from healthcare.gov for your own unique situation and then apply a similar analysis.

The following points are important:

- Premium subsidies are only available from 138 – 400 percent of the poverty level (FPL) which is a range from $16,643 to $48,240. Those who have incomes below $16,643 are referred to Medicaid in states that have expanded Medicaid and those who have incomes above $48,240 will have to pay full freight for health insurance with no subsidies whatsoever.

- For those at very low incomes, such as $18,000 per year, a bronze plan is available at almost no cost but has a substantial $6,500 deductible and a $7,350 out-of-pocket maximum. At that income level, however, a silver plan is available for $59.78 per month and has a very small $100 deductible and $1,900 maximum out-of-pocket thanks to the cost sharing subsidies.

- For those with incomes of around $30,000, the bronze plan is $151.44 per month with the same high deductible and out-of-pocket maximum. At this income level, which is just slightly below 250 percent of the federal poverty level, one still qualifies for cost sharing subsidies as well, although at a reduced level. In this case, the silver plan has a premium of $201.41 per month with a deductible of $2,000 and an annual out-of-pocket maximum of $4,700. Note what happens when income goes from $30,000 to $31,000: the cost sharing subsidies are lost and the silver plan’s deductible rises to its “normal” unsubsidized level of $3,200 with a maximum out-of-pocket of $6,600.

- If income is right at 400 percent of the federal poverty level of $48,240, you still qualify for a small premium subsidy but if you earn just one dollar more, you lose all subsidies! Earning that additional dollar could cost you nearly $750/year in lost subsidies! Clearly, caution is called for when one is approaching the income limits for Obamacare subsidies.

Selecting The Right Plan

In the example above, obviously the bronze plan will be cheaper for someone who ends up not using any health care services, or only going for an annual physical which is covered by all Obamacare compliant plans without payment of a deductible. However, those who anticipate using more health care services would benefit from the silver plan, especially if income can be targeted to a level that results in lower deductible and out-of-pocket maximum levels thanks to the cost sharing subsidies.

Controlling Income – The Two Year Cycle

The people who Obamacare was intended to help generally cannot control their income level from year to year other than working more or less hours and, of course, seeking promotions and raises. However, people who are financially independent and derive income from their investments generally have far more control over their taxable income in any given year. These were not the people Obamacare intended to help since the rationale for the subsidies was to help people with limited financial means. Nevertheless, Obamacare has no wealth test, only an income test, and anyone with the incomes specified in the law can take advantage of subsidies. Whether you choose to do so or not is entirely up to you.

One suggestion for financially independent people with control over their income is to adopt a two year cycle. In the first year, income is tightly controlled in an attempt to minimize taxable income as much as possible. The goal would be to obtain a significant premium subsidy and also fall within an income range that qualifies for cost sharing subsidies. A silver plan with a low deductible and out-of-pocket maximum should be selected. During the year, seek as many medical services as needed including preventative services that might have been deferred. The goal should be to end the year having consumed all plausible medical services – not wasting medical services but consuming all that is conceivably appropriate. The following year, make no attempt to limit your reported income and reconcile yourself to not qualifying for any subsidies at all (or perhaps only a minimal subsidy). For the second year, purchase the cheapest bronze plan that is offered on the exchange. Go for your annual physical, available without paying a deductible, but otherwise avoid any discretionary medical services. For the third year, again limit income and purchase a subsidized silver plan and seek out all conceivably necessary medical services. And so on …

This process can be repeated on a two year cycle as long as one is healthy. For those who are in poor health, it will almost always make sense to opt for a better policy (silver or above), so this strategy is only viable for those in relatively good health.

A Note on Grandfathered Plans

President Obama’s quote at the beginning of this article stated that those who liked their health care plan prior to Obamacare would be able to keep their health plan. Politicians aren’t known for presenting a list of caveats in small print along with political statements and this case is no exception. It is technically true that individuals who had health insurance plans prior to the passage of Obamacare could keep those plans once the new law took effect. However, those plans were prohibited by law from changing in any material way and remained “frozen in time” in terms of benefits and deductibles, but most certainly not in terms of premiums (which could continue to increase). Also, because pre-Obamacare plans were not eligible for subsidies, many individuals abandoned those plans in favor of plans on the Obamacare exchanges which reduced enrollment and caused many plans to be cancelled. Finally, health insurance in the United States is highly fragmented. If one moves away from the service area of a health plan, it is necessary to obtain different insurance coverage. At that point, one cannot purchase an equivalent pre-Obamacare plan. One is required to go to the exchange to purchase an Obamacare complaint policy.

In my case, I had health insurance prior to Obamacare and was able to keep that insurance through the end of 2017. However, after moving to a different state, I was forced to change my insurance policy. All of the Obamacare options available to me are substantially more expensive than the cost of the grandfathered policy, although adopting the two year income cycle strategy will help to mitigate the cost differential.

It should be noted that although my pre-Obamacare plan remained in force until this year, the premium dramatically increased from 2009, the last year prior to passage of Obamacare. From 2009 to 2017, my premium increased by 175 percent, a compound annual increase of 13.5 percent. Despite that enormous increase, the grandfathered plan continued to be cheaper than the unsubsidized cost of the cheapest bronze level plan on the Obamacare exchange. Furthermore, the grandfathered plan had a deductible and maximum out-of-pocket limit comparable to subsidized silver plans. In addition, the grandfathered plan allowed me to contribute $3,400 per year to a health savings account (HSA) along with a direct reduction to adjusted gross income which resulted in significant tax savings. The only HSA compliant plans on the Obamacare exchange carry much higher premiums so I will not have a HSA compliant plan for 2018.

In all respects, I would have been far better off had I been able to keep my grandfathered plan. Although I am not one of people of limited resources Obamacare was designed to help with subsidies, I feel perfectly justified in maximizing my use of subsidies (via the two year cycle strategy) which will only partially mitigate the negative impact of being forced out of the grandfathered plan in 2018.

Hopefully readers have gained some insight into the complicated world of Obamacare after reading this article. Good luck and remember that open enrollment for 2018 ends on December 15 – just six days from today!