A strong regional competitor with a fifty-year history

Introduction

Investors Title Company was founded in 1972 by J. Allen Fine. In the early 1970s, the market for title insurance in North Carolina was small with total premiums of just $1.7 million. Mr. Fine anticipated increasing demand for title insurance when lenders began to sell mortgages on the secondary market and he played an instrumental role in educating lenders, attorneys, and home buyers regarding the risk of title defects.1 By 1984, Investors Title was the leading title insurer in North Carolina.2

At the age of 87, Mr. Fine still serves as Chairman and Chief Executive Officer and two of his sons have held executive positions in the company for over three decades. Mr. Fine and his sons own 24.2% of the company.3 Markel Corporation is a long-term shareholder of Investors Title and owns 11.2% of the company.4

Investors Title posted $273.9 million of net written premiums in 2021 which gives it just over 1% of the title insurance market in the United States.5 However, the company has a strong second place position in its home state of North Carolina with market share of 23%.6 North Carolina, South Carolina, Georgia and Texas accounted for 81% of net written premiums in 2021.

During 2020 and 2021, Investors Title posted cumulative net income of $106.4 million and returned $69.3 million to shareholders, primarily via special dividends. The company has benefited from a housing market boom and strong investment returns.

With the company’s stock trading at $152, Investors Title has a market capitalization of $289 million with total stockholders’ equity of $232.5 million as of March 31, 2022, indicating that the shares trade at ~1.24x book value. The company has an investment portfolio of $216.4 million, $37.3 million of cash equivalents, and no debt.

Investors Title, as well as all companies operating in the title insurance industry, are directly exposed to the cyclicality of the housing market. Housing market conditions are still strong in mid-2022, but higher mortgage interest rates, record high home prices, and low consumer confidence represent strong headwinds going forward.

Long-term investors should not be overly concerned with trends over the next few years, but it is important to examine how companies have performed during previous market cycles. This is particularly true for title insurers. This article provides an overview of Investors Title’s performance in recent years and also looks back at how the company and the stock performed during the housing bubble of the mid-2000s, the subsequent housing market crash, and the financial crisis of 2008-09.

Business Model

Investors Title is headquartered in Chapel Hill, North Carolina. All of the company’s home office and most branch operations take place in North Carolina. With home and branch operations, the company directly underwrites and issues title insurance policies and retains the entire premium since there are no commissions paid to agents. Over the past decade, home and branch operations have ranged from 20-30% of premiums. In 2021, 25% of premiums originated in home and branch operations.

The company works with a large number of independent title agencies that are responsible for underwriting and issuing policies. Agencies retain the majority of the premium and remit the remainder to Investors Title. Outside of North Carolina, nearly all premiums originate from agencies. In 2021, 75% of premiums originated in agency operations.

Title insurance is the company’s principal business and only reportable operating segment. In addition to title insurance, the company provides ancillary services to clients including tax-deferred real property exchange services (1031 exchanges), investment management and trust services to individuals and organizations, as well as management services to title insurance agencies. For purposes of this article, I focus on title insurance since ancillary services are not drivers of the overall business.

Like all insurance companies, Investors Title is in the business of accepting premiums in exchange for protection against risks. Their goal is to make an underwriting profit and to earn investment returns on policyholder liabilities. These liabilities, often referred to as “float”, represent funds that are estimated to be needed to pay out claims in the future. Title insurance claims are relatively rare and can occur many years after a policy is issued. This means that Investors Title’s float is long-tail, and the company can benefit from investment income from these funds for many years.

Although the company is licensed to write insurance in 44 states and the District of Columbia, it currently writes in only 23 states and the District of Columbia. However, as noted in the introduction, 81% of premiums in 2021 were attributable to just four states: North Carolina, Texas, Georgia, and South Carolina. The exhibit below shows net written premiums by state over the past five years:

We can see that premium volume increased dramatically in 2020 and 2021 as a result of the booming housing market. The company has benefited from operating in sunbelt states that have been growing in recent decades. All of the company’s largest states experienced significant positive net migration during the pandemic.7 While these states have seen home price appreciation, it is notable that Investors Title does not have operations in states, such as California, where housing is extremely unaffordable and possibly subject to larger future price declines.

Recent Operating History

The following exhibit shows Investors Title’s results from operations for the past five years as well as the first quarter of 2022. One point to note is that accounting rule changes starting in 2018 require that unrealized gains and losses on equity investments must be included in net income. A cumulative total of $20.1 million of unrealized gains on equity investments have been posted since 2018, which includes a $5.9 million decline in the first quarter of 2022.

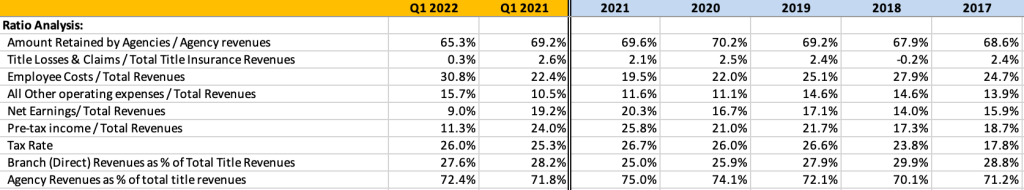

The following ratio analysis is helpful when looking at the company’s results. In the title insurance industry, claims are relatively rare and are expected to represent a small percentage of revenue. We can see that this has been the case recently with title losses representing just 2.1% of revenue in 2021. The major costs are commissions paid to agencies and employee costs. ~70% of revenue is retained by agencies.

We can see that the company has benefited from operating leverage as premium volume increased in 2020 and 2021. Employee costs dropped from 25.1% of revenue in 2019 to 19.5% in 2021. All other operating expenses, which includes overhead spread over a larger revenue base, declined from 14.6% of revenue in 2019 to 11.6% in 2021.

The first quarter has less real estate activity than the peak spring and summer months, but it is still notable to see expenses trending upward as year-over-year title insurance revenue growth has slowed down. The company’s first quarter press release attributes the higher expenses to geographic expansion and higher staffing costs:

“Personnel expenses were 31.6% higher primarily due to expansion of our presence in key markets, overall staff growth to support higher transaction volumes, and increased employee benefit and contract labor costs. Other categories of operating expenses were 7.4% higher than the prior period primarily to support expansion of our geographic footprint as well as ongoing strategic technology initiatives.”

One way to evaluate how the company might perform in a housing market slowdown is to look at what happened during the housing bubble and crash which we will examine in some detail after first reviewing the company’s balance sheet.

Balance Sheet

In this section, we will take a look at the company’s balance sheet with a focus on how management invests shareholders’ equity and float. In addition, we will look at how reserves have developed over time. The following exhibit shows the company’s balance sheet over the past decade (please click on the image for a larger view):

As we will see in the capital allocation section below, the company has been a regular buyer of its shares over the years. Over the past decade, the share count has declined from 2,107,681 on 12/31/11 to 1,897,000 on 3/31/22 as a result of $21.3 million of repurchases. Over the same period, the company paid $121.6 million of dividends.

Book value per share increased from $50.54 on 12/31/11 to $122.56 on 3/31/22, a compound growth rate of 9%. If we add back the $64.64 per share of dividends paid during this period, the compound growth rate rises to 13.6%.

The exhibit below shows how the investment portfolio has been allocated. In recent years, management has reduced the fixed income allocation considerably while building up cash and short-term investments (which consist primarily of money-market funds). The allocation to equity investments has increased as well primarily due to market appreciation. As of 3/31/22, the $69.9 million equity portfolio had a cost basis of $28.5 million.

The fixed income portfolio has a relatively short duration with very few maturities past five years. This is a good situation in a rising interest rate environment:

The company has a debt-free balance sheet with shareholders’ equity accounting for 71% of total assets. Reserves for claims of $36.4 million represent just 11% of assets. By any measure, this is a conservative balance sheet, but let’s take a closer look at loss reserves and how they have developed over time.

The exhibit shows a number of important data points starting with the breakdown of reserves between known title claims and incurred-but-not-reported claims (IBNR). Over 90% of reserves are attributed to claims that management believes could occur in the future. This is the nature of title insurance: claims are rare and unpredictable.

The obvious question is how good management’s track record is when it comes to reserve adequacy. We can get a sense of this by examining the middle section of the exhibit which shows how the reserve balance has changed over time. In general, management has tended to over-reserve, as we can see with the negative numbers in the provision for prior year claims.

Part of this result is likely due to the management’s conservatism, but we also should be cognizant of the fact that housing market conditions have been very favorable in recent years. While it is good to strive for accurate reserving, it is far better to err on the side of redundancy than inadequacy. Management’s track record provides some comfort that reserves are adequate for the claims likely to arise in the future.

The Housing Bubble and Crash

As we can see from the prior exhibits, particularly the reserve development spreadsheet, the provision for losses as a percentage of premiums has been quite low in recent years. The natural question to ask is what will happen if the housing market declines for many years or even crashes, as it did in the mid to late 2000s.

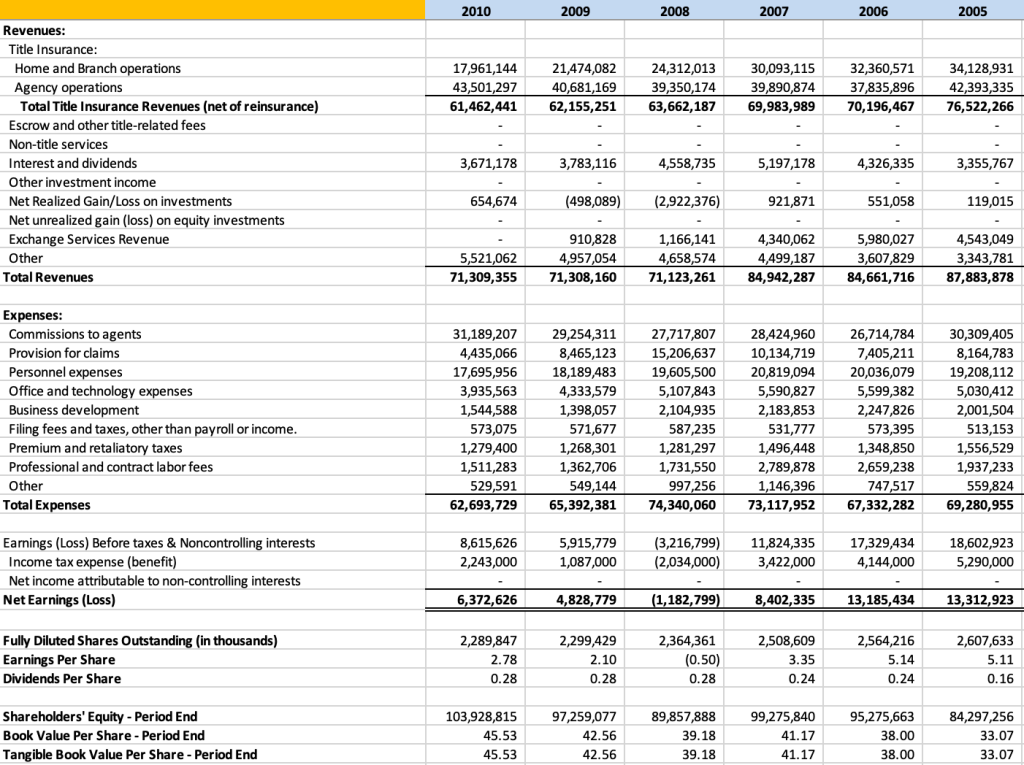

The following exhibit shows relevant data from 2005 to 2010:

We can see that the company posted a net loss in 2008, but otherwise escaped the housing crash relatively unscathed. Notably, the provision for claims in 2007 and 2008 increased significantly as a declining market often provides an incentive for individuals to find title defects. The combination of the decline in title insurance revenue and increased provision for losses led to net income declining from over $13 million in 2005 and 2006 to a loss in 2008 before partially recovering in 2009 and 2010.

If I had to highlight one feature of the housing boom and crash that sharply contrasts with the recent environment, it would be the much higher reserve for claims that prevailed throughout the 2000s, as we can see from the exhibit below:

Even in the boom times, the provision for losses was over 10%. It spiked to nearly 24% in 2008. This loss experience is troubling because it is far in excess of recent trends as we saw earlier. In recent years, the provision for title losses has run between 2-3% per year. Are we in a permanent era of much lower loss experience compared to the decade of the 2000s, or could we expect a spike in claims if the housing market declines or crashes in the years to come?

The difference between a 2% and a 10% provision for losses on $274 million of premiums is $22 million. If the loss experience that prevailed in the 2000s appears again in a new housing market crash, it is possible that the loss reserves on the balance sheet could be inadequate.

From an outside perspective, it is difficult to know what the probability of such an adverse development might be, but the risk should not be ignored given what took place during the last housing crash. Investors Title’s strong balance sheet means that the company’s solvency isn’t likely to be in question even under very adverse conditions, but it is possible that shareholders’ equity could take an unpleasant hit.

Capital Allocation

Investors Title is a relatively small player in the title insurance industry and has taken a conservative course when it comes to capital allocation. Although the company has generated significant free cash flow over the years, management has opted to return most of the cash to shareholders rather than to attempt an aggressive expansion within title insurance or pursue opportunities in adjacent industries.

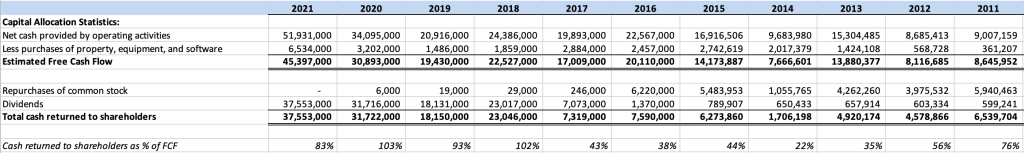

The exhibit below shows the company’s track record over the past decade:

The company pays a relatively modest regular quarterly dividend currently set at $0.46 per share which is equivalent to a yield of 1.2%. However, starting in 2017, several special dividends have returned significant cash to shareholders. From 2017 to 2021, a total of $117.5 billion of dividends were paid while share repurchases were a modest $300,000. Prior to 2017, management preferred to return cash to shareholders via share repurchases. From 2012 to 2016, the company used $21 million to repurchase shares while paying $4.1 million in dividends.

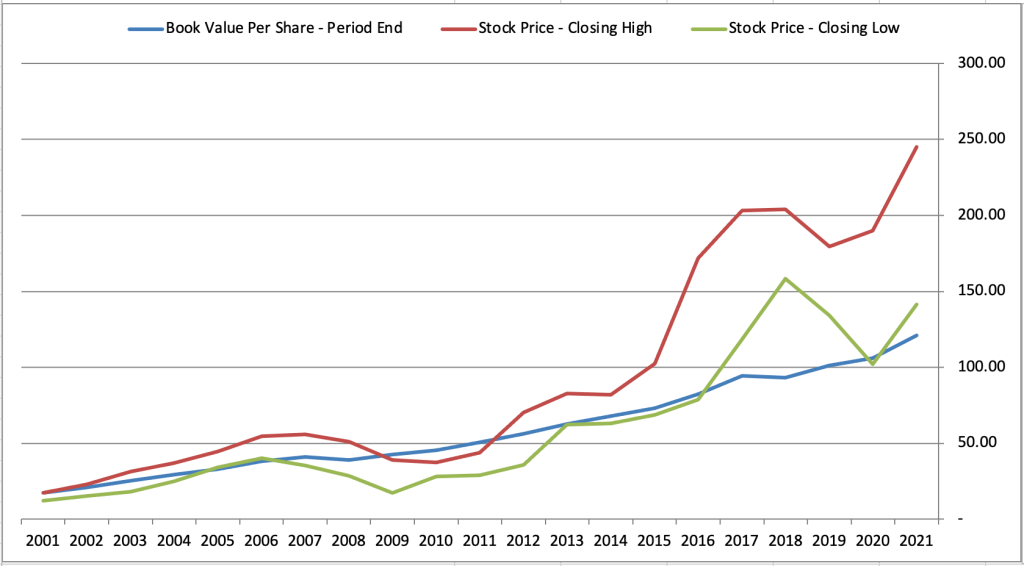

The exhibit below shows the company’s book value over the past two decades along with the low and high closing stock price for each year. Management is obviously opportunistic when it comes to share repurchases and prefers to return cash to shareholders via special cash dividends during times when the shares are trading well above book value. Obviously, this says something about management’s view of the attractiveness of the shares. With significant inside ownership, we do not see share repurchases at any price, but only at prices relatively close to book value.

A similar pattern held during the 2007-2011 period when the stock often traded well below book value. During those years, management used $17.4 million to repurchase stock and paid out $3.1 million in regular dividends.

Corporate Governance and Ownership

J. Allen Fine and his sons control 24.2% of shares outstanding and other insiders on the Board of Directors control an additional 2.7%. Markel Corporation holds 11.2% of the company’s shares as has been an owner since 2006.8 Groveland Capital LLC owns 5.9% of the company and appears to be a long-term shareholder as well.9

With 44% of the company owned by insiders and large long-term shareholders, there appears to be significant skin in the game at Investors Title. Due to the Fine family’s history with the company and large ownership interest, coupled with the presence of a shareholders’ rights (“poison pill”) plan that’s been in effect since 2002, Investors Title is effectively controlled by the Fine family.

Board compensation is reasonable based on current standards. In 2021, cash fees ranged from $20,000 to $25,000 for the company’s six outside directors and each received stock option awards of just under $40,000. Mr. Fine and his sons serve on the board but do not receive additional compensation for board service.

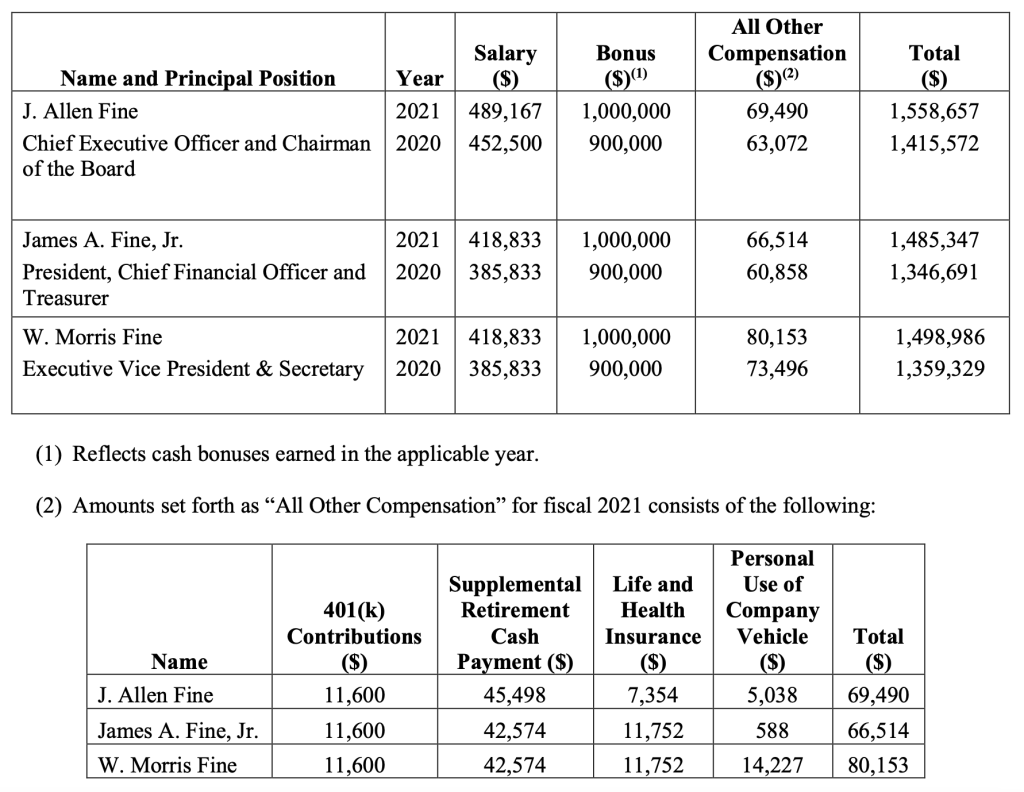

Considering the size of the company and the Fine family’s ownership interest, I regard executive compensation to perhaps be on the generous side but not at all egregious given strong operating results over the past two years:

Whenever I study a company that is effectively family-controlled, I try to look at the situation from the perspective of the individuals involved. With a total ownership interest valued at close to $70 million, the Fine family is obviously very financially secure with no need to work in the business.

Through their involvement in running the company, the family collectively earns around $4.5 million per year which is probably a necessary incentive for them to continue to be interested in operating the business. Presumably, James A. Fine, Jr. and W. Morris Fine will continue to be involved in running the company once J. Allen Fine, who is 87 years old, steps down as CEO.

Does the ownership interest of the Fine family, the presence of a “poison-pill”, and their current compensation make the prospect of a merger or acquisition with a larger title insurer less likely? I suspect that this is the case.10 Therefore, outside shareholders should evaluate Investors Title as a company that is likely to remain independent for the foreseeable future, even if the stock may sometimes trade at a valuation that could be attractive to larger companies in the industry.11

Conclusion

Title insurance is a non-discretionary component of nearly all real estate transactions and seems unlikely to be “disrupted” in the future.12 Since title insurance is meant to protect policyholders against past events, skilled operators in this industry should be able to minimize losses. Since there is a great deal of fragmentation in the real estate industry, local knowledge is invaluable when it comes to conducting comprehensive title searches and detecting problems before a sale takes place.

Investors Title might be a small player when it comes to market share in the United States as a whole, but it has higher market share in the states representing the majority of its business and has a proven history of sound and profitable operations. This has been particularly true in recent years with the strong tailwind of a strong housing market showing up in financial results.

When I first wrote about the company in late 2010, the market capitalization was $66.5 million while book value was $102.5 million.13 This seemed like an attractive entry point for the stock and I built a position in the company.

In June 2012, with the stock trading at slightly above book value, I decided to sell out of my position.14 In retrospect, this was not such a great decision given that the stock price has increased from $54.50 to $152 over the past decade while paying out over $64 in dividends, a compound return of ~15%, slightly more than the S&P 500.15

Investors Title currently trades at a significant premium to book value and the Fine family has been returning capital to shareholders via dividends rather than share repurchases. At times when the stock traded closer to book value, capital was returned primarily through share repurchases.

Given the Fine family’s ownership interest, we should take their preference for dividends vs. repurchases seriously. The stock would clearly be a more attractive value closer to book value, and it would have a large margin of safety if it can be purchased significantly below book value. If negative headlines about the housing market begin to appear, it is possible that title insurers will sell off along with other stocks that have real or perceived exposure.

Downloads

A PDF file containing this profile can be downloaded by using the link below:

Excel data used in this report is available using the link below:

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in Investors Title.

- Profile of J. Allen Fine, Triangle Business Journal, December 16, 2005. [↩]

- Investors Title has published a brief history of the company on its website. [↩]

- According to the 2022 proxy, J. Allen Fine owns 196,475 shares. W. Morris Fine individually owns 83,804 shares and James A. Fine, Jr. individually owns 83,491 shares. W. Morris Fine and James A. Fine, Jr. jointly own an additional 95,000 shares. In total, the Fine family controls 458,770 shares, or ~24.2% of the 1,897,255 shares outstanding as of April 1, 2022. [↩]

- According to the 2022 proxy, Markel Corporation owned 213,300 shares as of April 1, 2022. [↩]

- Source: National Association of Insurance Commissioners (NAIC) Report: U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results, p. 17. [↩]

- Market share by state can be found at Demotech market share report by Jurisdiction and NAIC Group – Q1 2022. [↩]

- There is an interactive map that shows net migration within the United States since the start of the pandemic which I found useful for visualizing these patters. [↩]

- These figures are taken from the company’s 2022 proxy statement. [↩]

- See Groveland Capital’s 13D filing dated October 7, 2015. [↩]

- On the other hand, there are many family-run companies that eventually seek a buyer and many care about selling to a long-term minded new owner. With Markel’s significant ownership interest, it would not be shocking if Markel acquires Investors Title, but I have no reason to suspect that this might occur soon, if ever. [↩]

- It should be noted that the shares are quite illiquid which could present an additional impediment for any unfriendly acquirer. [↩]

- Of course, there are “fintech” startups that will try to disrupt the industry. It is possible that they will succeed, but the real estate industry as a whole has proven very resilient in the past. [↩]

- Investors Title Company Represents Value in Midst of Housing Turmoil, November 29, 2010. [↩]

- Investors Title Company Approaches Intrinsic Value, June 21, 2012. [↩]

- The S&P 500 has a total return of 13.05% annualized over the past ten years according to S&P Global. [↩]