In this gift guide for investors, originally published for the 2009 holiday season, ten books have been selected which are certain to capture the attention of anyone interested in the field of investing. Some choices will be familiar while others may be unexpected. For eleven additional book recommendations, see our list of suggestions for the 2010 holiday season or ten books covering non-financial topics which we suggested for summer reading lists.

#1: The Intelligent Investor

The Intelligent Investor by Benjamin Graham is perhaps the most widely cited but least followed book on investing. Few investors on Wall Street have failed to read this classic and countless individual investors have done so as well. Why is this book ranked #1? For those who have the appropriate temperament and capabilities, it serves as an outstanding introduction to the field of value investing in a format that will not intimidate those without formal training in finance. Chapter 8 entitled “The Investor and Market Fluctuations” is more than worth the price of the book alone.

#2: A Random Walk Down Wall Street

Readers of The Rational Walk may wonder why Burton Malkiel’s A Random Walk Down Wall Street appears on this list. After all, Mr. Malkiel is skeptical regarding the ability of investors to “beat the market” consistently over time and recommends a passive indexing strategy. However, the book is worthwhile for many reasons. Mr. Malkiel presents the argument for market efficiency in a very clear manner that is easily accessible to those who are new to investing. It is critical for value investors to understand the prevailing views driving the decision making process of the vast majority of investors. While most value investors reject the notion of market efficiency, there are worse outcomes than adopting an indexing strategy.

#3: Common Stocks and Uncommon Profits

“I am an eager reader of whatever Phil has to say, and I recommend him to you. — Warren Buffett”

What is fascinating about Mr. Buffett’s quote is that, on the surface, the investing approach described by Mr. Fisher is very different from the Graham style of value investing. In fact, Mr. Fisher’s views are regarded as key foundations for the field of “growth investing”. If that’s the case, why does Warren Buffett find the book valuable? For a full review of this book on The Rational Walk, click on this link.

#4: Security Analysis

Some readers will surely protest that Security Analysis by Benjamin Graham and David Dodd should rank #1 on this list. After all, it is the undisputed Bible of value investing. For many investors, Security Analysis is not nearly as accessible as The Intelligent Investor and many individuals grow frustrated with the book, particularly some of the older editions. While the 6th edition, reviewed in more detail on The Rational Walk, is greatly improved with introductions and examples from contemporary investors, we still consider The Intelligent Investor to be a superior choice for those new to the concepts of value investing. For those with more experience or who have already read The Intelligent Investor, Security Analysis is an outstanding choice.

#5: Poor Charlie’s Almanack

Poor Charlie’s Almanack, edited by Peter Kaufman, might appear as a book that can be read casually. While it is true that the book is richly illustrated and produced, it would be an error to regard the content less seriously than Security Analysis or The Intelligent Investor. The great virtue of this book is the multi-disciplinary emphasis expressed in Mr. Munger’s speeches and other writings. Those who are most likely to appreciate the message should have a grasp of basic concepts of investing. However, anyone can benefit from the life lessons expressed in these pages. Although Warren Buffett gets most of the credit for Berkshire Hathaway’s phenomenal track record, Charlie Munger’s influence has been enormously important over the years.

#6: Essays of Warren Buffett: Lessons for Corporate America

Lawrence Cunningham has done a great service for investors everywhere by compiling information from Warren Buffett’s shareholder letters into a very accessible compilation in Essays of Warren Buffett: Lessons For Corporate America. Readers are no doubt asking the question: Why would anyone pay to read letters that can be downloaded for free on Berkshire Hathaway’s web site? Mr. Cunningham adds a great deal of value by arranging the letters into a convenient and topical format rather than a purely chronological format. We find the compilation to be extremely useful and a must-read for anyone who would like to become familiar with Berkshire Hathaway’s history in a short period of time. Read this article on The Rational Walk for a full review of the book.

#7: Snowball: Warren Buffett and the Business of Life

Alice Schroeder was granted unprecedented access to Warren Buffett himself, his files, and his family and colleagues over a number of years and the end result was Snowball: Warren Buffett and the Business of Life. This is not a book that outlines Mr. Buffett’s investing techniques in detail, but it is of interest to those who wish to know more about his history from a personal perspective. To be sure, business topics are discussed, but the new insights tend to be more on the personal side. Certain elements of the book proved to be controversial with Mr. Buffett and his family reportedly not agreeing with coverage of certain events. For a full review of this book along with Roger Lowenstein’s 1995 Buffett biography The Making of an American Capitalist, please click on this link.

#8: The Great Crash: 1929

In The Great Crash: 1929, John Kenneth Galbraith describes in excruciating detail the human follies that led to the 1929 stock market crash along with some of the well intentioned, yet futile steps taken by market participants and government officials to remedy the situation. With the economy currently in a prolonged slump following the most severe recession since the Great Depression of the 1930s, the book should be of interest to many investors. This book was recommended by Warren Buffett at the 2009 Berkshire Hathaway annual meeting for a very important reason.

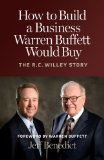

#9: How to Build a Business Warren Buffett Would Buy: The R.C. Willey Story

The R.C. Willey Story, skillfully told by author Jeff Benedict, is easily one of the most inspiring business books published in recent years. Anyone who is cynical about “up from the bootstraps” American success stories should read this book about Bill Child’s life story. It is also an excellent choice for college students and other young people who are starting a career in business. While value investing can take many forms, one of the most consistently successful approaches involves buying great businesses at cheap to average prices. From an investment perspective, it is hard to come away from reading the book without thinking of at least a few attributes to look for when searching for great businesses. For a full review, please click on this link.

#10: Influence: The Psychology of Persuasion

Robert B. Cialdini’s Influence: The Psychology of Persuasion may be #10 on this list, but the book is critically important for anyone interested in communicating more effectively. Mr. Cialdini provides the reader with the tools required to determine whether an investment advisor may be using common psychological tricks. For example, it is hard to imagine that anyone who internalizes the techniques in this book would have fallen victim to Bernard Madoff’s scam. More generally, readers come away with a much better sense of how influence is used in many business and personal contexts.