Note to readers: This article is the second in a two-part series on the dialysis industry. For background information that will be helpful while reading this article, please read Kidney Failure and the Dialysis Industry which was published last week. In order to keep this article focused on DaVita, the discussion will assume that the reader is aware of the nature of end-stage renal disease and the options that are available to treat it.

Introduction

DaVita is one of the leading kidney care providers in the United States. The company serves approximately 203,100 patients with chronic kidney failure and end-stage renal disease (ESRD) through a network of 2,809 outpatient dialysis centers located in 46 states and the District of Columbia. DaVita also delivers inpatient dialysis services in approximately 850 hospitals and the company provides training, equipment, and logistical support to patients who prefer to perform dialysis treatments at home.1

At the end of 2019, 809,103 individuals in the United States had ESRD. Of this population, 492,096 patients were receiving hemodialysis in an outpatient clinical setting, 12,243 patients were performing in-home hemodialysis, and 62,275 patients were receiving peritoneal dialysis. At the end of 2019, there were 239,419 patients who had a functioning kidney transplant. Without dialysis or a kidney transplant, the outcome for patients with ESRD is certain death within a short period of time.2

The dialysis industry in the United States is highly concentrated. DaVita’s market share is ~36% while Fresenius has market share of ~38%.3 The industry has been consolidating for over two decades and is effectively a duopoly in many regions. ESRD patients tend to be very sick and rely heavily on outpatient clinics that provide dialysis three times per week for four hours per session. It is important for patients to have safe access to these complex treatments in outpatient clinics that are located a reasonable distance from home. Missed treatments can result in traumatic and expensive hospital admissions, often via the emergency room.

The health care industry, broadly defined, has a number of peculiar characteristics due to heavy government involvement from a regulatory and payment perspective. In the case of kidney care, government policy plays a particularly important role that must be explored in order to clearly understand the dialysis industry.

After presenting a brief company overview, I focus primarily on DaVita’s dialysis business in the United States which accounts for the vast majority of the company’s revenue and all of its profitability. Understanding the intricacies of the U.S. dialysis business is the key to understanding DaVita’s overall business model.

While DaVita has posted strong free cash flow over many years and has been a major repurchaser of shares, there are a number of risks associated with DaVita’s business in particular and the dialysis industry in general. DaVita has a highly leveraged balance sheet. While debt servicing is not a problem given the current stability of the business, political risks could change the situation for the entire industry.

Finally, I briefly consider the fact that Berkshire Hathaway is a major investor in DaVita and currently owns ~38% of the company. Is there a chance that Berkshire could acquire DaVita in a friendly transaction?

Company Overview

DaVita operates in two segments. The U.S. Dialysis segment accounts for ~91% of revenue and the Ancillary Services segment accounts for ~9% of revenue. DaVita sold DaVita Medical Group (DMG) in August 2019 after a long divestment process. DMG was classified as a discontinued operation in 2017 and isn’t discussed in this article. The exhibit below shows DaVita’s operating results for the past five years as well as the first quarter of 2021 and 2022:

The U.S. dialysis business produces the vast majority of revenue and is responsible for all of the company’s profits while the ancillary services segment operates at a loss. As we will explore in more detail in the next section, the U.S. dialysis business produces stable and predictable revenue and operating profits.

Net income was $978 million in 2021 while management’s calculation of free cash flow was $1,133 million. Free cash flow has exceeded net income at DaVita in recent years. Management has used free cash flow as well as proceeds from the DMG sale to retire more than half of its shares since the beginning of 2017 for a total of $7.6 billion.

As of mid-day on May 20, 2022, DaVita common stock was trading at ~$93.50 per share. There were 94.6 million shares outstanding as of April 29, 2022 giving the company a market capitalization of approximately $8.85 billion. The company had $844 million of shareholders equity and $8.87 billion of long-term debt on the balance sheet as of March 31. With $421 million of cash on the balance sheet, we can estimate DaVita’s enterprise value at ~$17.3 billion.

United States Dialysis Segment

In order to understand DaVita, we need to direct most of our attention to the U.S. dialysis business, with particular focus on peculiarities of the economics when it comes to who is paying for dialysis. Let’s begin by looking at the last several years of results for the U.S. Dialysis segment presented in the exhibit below:4

The number of U.S. dialysis centers has been increasing steadily in recent years before expansion slowed during the pandemic. The exhibit below accounts for changes in the number of dialysis centers in the United States over the past five years:

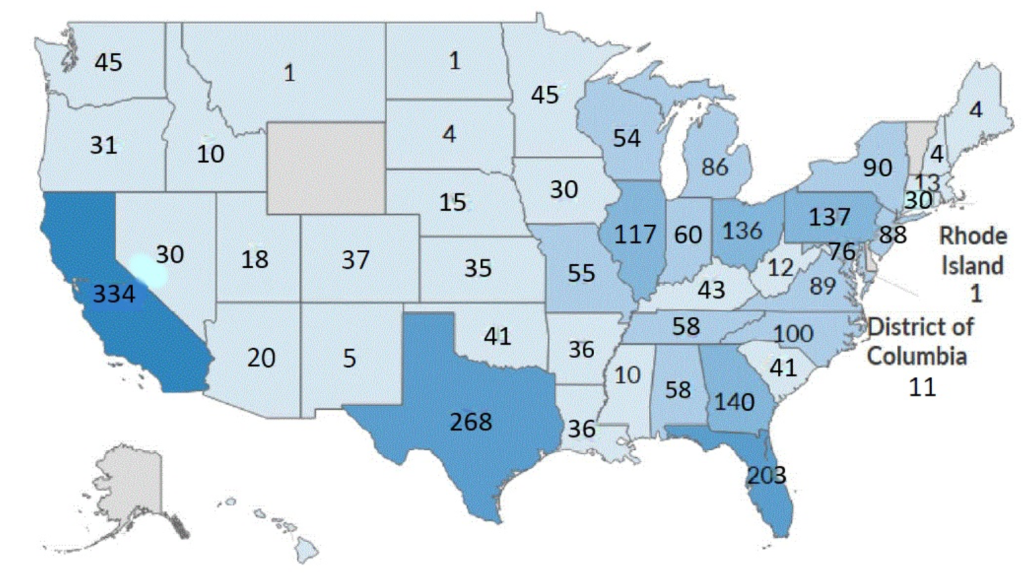

The following map, provided in the company’s latest 10-K, shows the geographical distribution of dialysis clinics within the United States at the end of 2021:

Medicare and Medicare Advantage have historically accounted for 56-58% of DaVita’s U.S. dialysis segment revenue. ESRD is the only condition that entitles Americans under the age of 65 to qualify for Medicare benefits. For most patients, there is a three month waiting period before Medicare coverage begins. Additionally, for patients who are covered by commercial health insurance at the time of their diagnosis, there is a thirty month “coordination period” in which the commercial insurer must pay for ESRD treatments before Medicare will take over.5

Medicare provides a “bundled” reimbursement rate covering dialysis as well as related drugs and supplies needed in the course of providing dialysis.6 There are a number of factors involved in setting Medicare’s bundled rate as well as adjustments to the rate that have been made due to the pandemic.7 Medicare Advantage plans are offered by private health insurers who contract with Medicare to provide services to patients. Medicare Advantage became an option for ESRD patients under the age of 65 in 2021.

In addition to Medicare, Medicaid, and other government entities, including the Veterans Administration, account for ~10% of DaVita’s U.S. dialysis segment revenue. In total, government entities have accounted for ~68% of revenue in recent years.

The key to understanding the economics of dialysis services in the United States is the fact that government programs pay a far lower rate than commercial insurers.

While ~68% of DaVita’s revenue comes from government programs, this represents ~90% of DaVita’s patient population. Commercial insurers provide ~32% of revenue and cover just ~10% of the patient population.

DaVita provides statistics regarding the number of dialysis treatments provided during a given period along with the average revenue and costs per patient. While this aggregate information is somewhat useful, we need to take the analysis further in order to understand how the patient-level economics differs between government and private insurers.

The following exhibit displays the total number of dialysis treatments provided during the past several years as well as the first quarters of 2021 and 2022. We can also see the average number of treatments per day during each period which is a useful productivity measure. The company typically discloses per-treatment revenue and costs in news releases and filings. However, the figures below are directly calculated based on the treatment counts and data provided in the first exhibit.

We can see that the average operating margin per treatment is typically in the neighborhood of $60-65, although high labor costs pushed this figure down toward $55 in the first quarter of 2022. Since the rates for dialysis services are set for the coming year in advance, DaVita and other providers have been in a position where they have to absorb higher labor costs which shows up in lower margins.

Now, let’s dig beneath the surface of these aggregate numbers to consider how the economics change based on whether the government or a commercial insurer is paying for treatment. We will begin by taking a look at patients covered by the government in the exhibit below:

What I have done in this exhibit is straight forward: DaVita discloses the percentage of patients receiving government-paid care. For each of the periods presented, I have taken that percentage and multiplied it by the total number of treatments provided.8 This results in the implied number of treatments paid for by government sources. I have added the Medicare, Medicaid, and other government revenue lines to arrive at total government revenue. I then calculate the average patient service revenue per treatment by dividing total government revenue by the implied number of treatments paid for by government sources.

As we can see, the average patient service revenue paid for by government sources results in challenging economics. Clearly, if all patients were covered by government sources and the negotiated rates remained unchanged, DaVita would not have a viable business model. However, we can do the same analysis for commercial insurers and see where DaVita’s bread and butter comes from:

I used the same methodology described for the government-paid care exhibit. We can see that the average revenue per treatment is over four times as high for commercial insurers! Thankfully, the presence of commercial insurers covering ~10% of patients generates all of DaVita’s dialysis service profitability in the United States. The revenue per treatment for commercial insurers appears to be over four times as much as for government payment sources.

One of the most difficult aspects of understanding the U.S. dialysis industry is to come to terms with this highly peculiar aspect of the economics. ESRD is the only condition for which the government provides a universal entitlement to Medicare, but this comes with a twist. Commercial insurers must retain patients diagnosed with ESRD for the first thirty months of treatment. During that period, DaVita and other dialysis providers generate high profits for this small cohort of patients.

Why would commercial insurers agree to this sort of arrangement? Clearly, insurance companies are subsidizing patients who are covered by government programs. How is this a fair practice? Why don’t commercial insurers attempt to push back?

We should bear in mind the fact that commercial insurers benefit from the presence of the Medicare ESRD entitlement. While it is true that commercial insurers pay a high cost for ESRD patients for the first thirty months, beyond that point the patient is transferred to Medicare, not only for ESRD but for all conditions.

ESRD patients usually have other serious health conditions, such as heart disease or diabetes, so the ability to move these patients from the commercial plans to Medicare helps commercial insurers remove very expensive patients from their rolls. Without this feature of Medicare, commercial insurers would be required to retain these very sick patients who are expensive to treat for ESRD as well as other conditions.

Commercial insurers also benefit from a strong network of outpatient dialysis centers. Without a sufficient network of outpatient centers, patients would be more likely to end up in emergency rooms leading to very expensive hospital stays. So, commercial insurers are fully aware of the fact that they are paying far more than the government for dialysis services, but they have multiple incentives to agree to rates that ensure a viable network of outpatient dialysis centers.

When we consider the government’s perspective, we must consider politics. ESRD patients on Medicare and other government programs are also voters, and their families are voters as well. If too much pressure is brought to bear on the dialysis industry, it is likely that the response of the industry will be cost cutting that could reduce the number of dialysis centers or the quality of care.

There are clearly risks that will be addressed later in this article, but hopefully this section has clarified how the dialysis industry works in the United States.

Ancillary Services Segment

DaVita provides dialysis services outside the United States to approximately 39,900 patients in ten countries through a network of 346 outpatient centers. DaVita also offers ancillary services in the United States that complement the dialysis business.

Integrated kidney care services aim to provide patients with a team approach to coordinating care between dialysis centers, pharmacies, hospitals, nutritionists, as well as other disciplines. The company also offers physician services, clinical research programs, and recently acquired a transplant software business.

The international dialysis and U.S. ancillary services businesses are combined into one reporting segment referred to as Ancillary Services. The exhibit below shows high level information for this segment which accounts for ~9% of DaVita’s revenue (note that this segment’s data is displayed in millions rather than thousands).

The International dialysis business has been running at a modest operating profit over the past two years while the number of centers has been expanding. The following exhibit accounts for the changes in the number of international dialysis locations over the past five years:

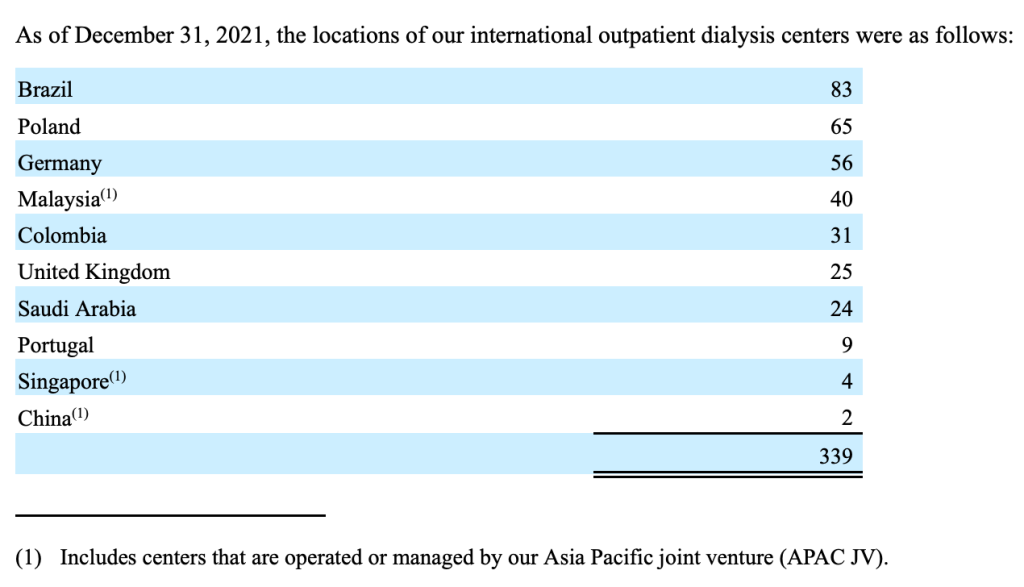

The following table from the company’s latest annual report shows the geographic distribution of international dialysis centers as of December 31, 2021:

While the international dialysis business has been modestly profitable, the integrated kidney care business is unprofitable. In an investor presentation from November 2021, management made a number of projections regarding the integrated care model which indicates a goal of breaking even on the business by 2025 and moving toward profitability in the “long-term”.

It is difficult to gain much insight into the likelihood of profitability for the integrated kidney care business. CEO Javier Rodriguez made the following comments on this business during the first quarter conference call on May 5:

“I will wrap up my prepared remarks with some thoughts on our Integrated Kidney Care or IKC business. As we shared in our Capital Markets Day, we continue to see significant potential for our IKC business. First, delegated patient volumes are strong and consistent with our initial modeling with some potential upside over the next 12 months. We are on track with our expected ESKD member growth via new payer partnerships, and we are trending ahead of plan on new CKD payer partnerships as payers recognize our ability to effectively collaborate with physicians on managing this patient population.”

Ancillary services are not a major economic driver for the business as a whole and I will not spend more time discussing it in this article. However, the segment did seem to receive quite a bit of attention in the company’s recent presentation and on the integrated kidney care section of the company’s website, so readers interested in taking a deeper dive in this area might want to take a look at those resources.

Free Cash Flow and Capital Allocation

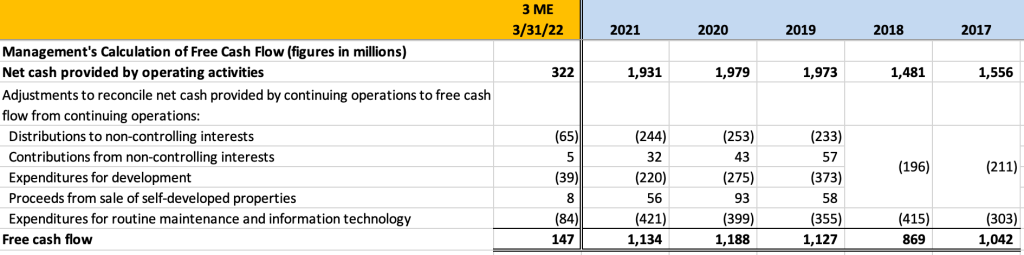

We now turn our attention to DaVita’s free cash flow generation and capital allocation. The exhibit below shows management’s calculation of free cash flow for the past five years as well as the first quarter of 2022:

DaVita’s Q4 Quarter 2018 Earnings Release for 2017 and 2018.

If we sum up the free cash flow figures in the table for the past five years and the first quarter of 2022, we arrive at free cash flow generation of $5.5 billion. In the table below, we can see management’s free cash flow figures along with the net debt issued or retired, proceeds from business sales, and cash used for repurchases. In 2019, DaVita completed the sale of its DMG subsidiary for $3.8 billion, net of cash divested.

The big story here involves the massive repurchases that have brought the share count down from 194.6 million shares as of December 31, 2016 to 95.2 million shares as of March 31, 2022, a reduction of over 51%.

As we have seen, DaVita’s U.S. dialysis business is a reliable cash cow. Although the population of patients with ESRD in the United States will certainly grow in the coming years and decades, this is not a high growth industry.

Prior to the pandemic, DaVita did commit resources toward expansion of its outpatient dialysis network. Although expansion has slowed down over the past two years, it is likely that the clinic count will resume expanding in the future, but such reinvestment opportunities are unlikely to require much cash. Therefore, management prefers to return this cash to shareholders via repurchases. The company has never paid a dividend since going public in 1994.

Past efforts to expand DaVita’s operations beyond dialysis care have not been successful. In 2012, the company spent $4.7 billion to acquire Healthcare Partners which was subsequently rebranded as DMG. This foray into the managed care industry produced unsatisfactory results and, in 2017, DaVita announced that DMG would be sold, and the transaction was completed in 2019 for proceeds of $3.8 billion.9

With DaVita now refocused on dialysis care, it seems likely that management will continue running the business for free cash flow generation and will keep repurchasing shares. As of May 4, 2022, the company had a total of $2.06 billion available under its repurchase authorization which has no expiration date.

Management’s current guidance for 2022 free cash flow is between $850 million and $1.1 billion. Share repurchases have continued in the second quarter. Between March 31 and May 4, 2022, the company repurchased an additional 0.8 million shares for $88 million at an average cost of $110.28 per share.

Business Risks

In my opinion, the primary risk facing DaVita as well as all other providers of dialysis services in the United States involves the imbalance between rates paid on behalf of patients covered by government programs versus rates paid by commercial insurers. The reasons for this disparity have already been discussed at length and will not be repeated here, but I would note that management has cautioned investors that commercial insurers are aggressive about the rates they pay, and obviously they are aware of the fact that commercial payers carry the freight for the entire industry.

Both the government and commercial insurers have major incentives to ensure that the United States maintains an extensive network of outpatient dialysis centers. Although home-based dialysis has made some headway in recent years, the reality is that this is a complex procedure with serious risks of infection and other complications. ESRD patients are very sick, and many are also elderly. The need for extensive availability of dialysis clinics is obvious from a human perspective. It is also important to politicians who are accountable to voters. And it is also important for commercial insurers who do not want patients to end up in much more expensive hospital care.

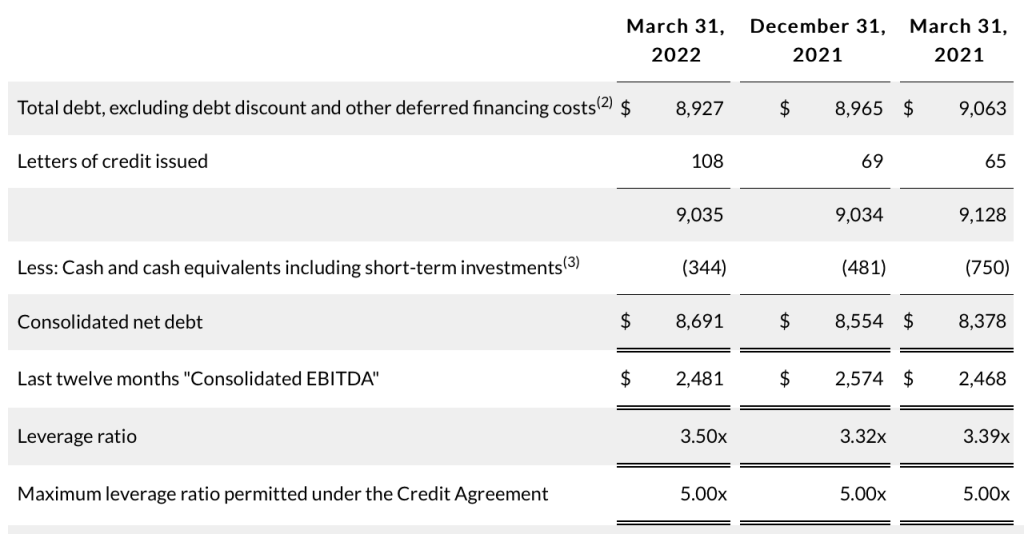

DaVita has a highly leveraged balance sheet, but the business is also extremely cash generative and it does not appear likely that the company will have problems servicing debt in the near term. The following exhibit from the company’s first quarter earnings release shows the company’s recent EBITDA.10

The following exhibit, also taken from the earnings release, shows the company’s net debt and calculates its leverage ratio, which is net debt divided by EBITDA.

The following exhibit shows the composition of DaVita’s debt as of March 31, 2022:

There is some interest rate exposure in the near term based on the company’s term loans which are tied to LIBOR, which management attempts to hedge using interest rate cap agreements. The term loans account for ~48% of total debt outstanding. The senior notes carry fixed rates and do not begin to mature until 2030.

Barring a major change to the economics of the dialysis industry in the United States, it seems unlikely that DaVita will face any sort of financial distress servicing its debt obligations. However, investors should note the high degree of leverage that exists.

In the very long run, the dialysis business faces a number of technological risks that were touched on in the first article in this series which covered the dialysis industry. Would it make sense for DaVita to invest more of its free cash flow in emerging technologies that might make home-based treatment more prevalent? Should management attempt to develop artificial organs or take equity stakes in companies that are investing in that type of R&D?

The answers to these questions are unclear. Investment in technology that could supplant traditional dialysis could save the company from decline in the distant future, but at the cost of redirecting cash flow toward projects that may never bear any fruit. Management seems content to manage the business for cash flow and retire as many shares as possible.

Berkshire Hathaway’s Ownership Interest

Let’s take a brief look at Berkshire Hathaway’s investment in DaVita. As of March 31, 2022, Berkshire owned 36,095,570 shares of DaVita. At DaVita’s price at the end of the first quarter, this stake accounted for 1.1% of Berkshire’s equity portfolio. At today’s price of $93.50, the position is worth just under $3.4 billion. The following exhibit is taken from Dataroma:

We should note that even though the listing has Warren Buffett’s name associated with the DaVita holdings, this position was actually initiated by Ted Weschler who manages approximately $17 billion of Berkshire’s portfolio.11 Assuming all of Berkshire’s DaVita holdings are in Mr. Weschler’s portfolio, DaVita accounts for 20% of his portfolio which demonstrates longstanding conviction in the company.

Berkshire has a “standstill” agreement in place with DaVita which prevents Berkshire from acquiring shares that would result in an ownership interest exceeding 25%. The reason Berkshire’s stake in DaVita has grown to ~38% of the company is because of DaVita’s aggressive stock repurchase plan, not because Berkshire took any action to increase its stake.

DaVita has many characteristics that Berkshire typically looks for in an acquisition and, even with a control premium, the company could be easily purchased for cash given Berkshire’s large cash balance. The standstill agreement does not prevent the companies from negotiating a friendly transaction. However, the political aspects of the dialysis industry might be best avoided for Berkshire. I can see how politicians could use distorted statements such as “Billionaire Warren Buffett owns DaVita” to attempt to extract concessions when it comes to Medicare reimbursements.

Conclusion

Rational Reflections is not a stock picking service and I’m not making any recommendations regarding DaVita or expressing my opinion about its intrinsic value. The purpose of business analysis articles is to look at a company as a business rather than as a stock and provide a primer for those who might want to conduct further research. Having said that, it seems clear that DaVita is not trading at an expensive valuation, with the caveat that the business is running with significant leverage. The fact that an investor as accomplished as Ted Weschler has taken a high conviction position in the company makes it worth following in the future.

Downloads

A PDF file containing this profile can be downloaded by using the link below:

Excel data used in this report is available using the link below:

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in DaVita.

Long Berkshire Hathaway.

- Unless otherwise specified, data in this article that is specific to DaVita was taken from the company’s 2021 annual report on form 10-K and the company’s Q1 2022 10-Q, and historical data was taken from the company’s past SEC filings. [↩]

- All statistics in the paragraph were taken from the Prevalent ESRD by modality section of the USRDS 2021 Annual Data Report. [↩]

- Market share for DaVita is from the company’s 2021 annual report, linked to above. For Fresenius, market share data is from the company’s annual report. [↩]

- Note that DaVita provides segment operating expenses rounded to the closest million dollars. As a result, the operating income in this exhibit slightly differs from consolidated operating income reported by the company due to rounding. The differences are not meaningful for analytical purposes. [↩]

- I am citing certain facts in this article that I documented in more detail in Kidney Failure and the Dialysis Industry. Unless otherwise noted, general industry statistics in this article are documented in the cited article, either directly in the text or via footnotes. [↩]

- Medicare pays 80% of the cost of dialysis treatments. The patient is responsible for the remaining 20% but typically either has supplemental insurance, access to Medicaid, or recourse to charitable funds to pay their share. DaVita is generally unsuccessful when it comes to collecting the patient’s co-payment except through these third-party sources. [↩]

- Although suspended during the COVID-19 pandemic, Medicare has the power to withhold up to 2% of the reimbursement rate if certain quality metrics are not achieved. The Budget Control Act of 2011 included a sequestration that reduced Medicare payments by 2%. Although the sequestration was suspended from May 1, 2020 to March 31, 2022 due to the pandemic, a 1% sequestration was imposed from April 1 to June 30, 2022 and the full 2% sequestration will resume on July 1, 2022. [↩]

- Implicit in my assumption is that patients typically receive three treatments per week whether they are on commercial insurance plans or government plans. If this assumption holds, then we can infer that ~90% of treatments are paid for by government plans and ~10% of treatments are paid for by commercial plans. [↩]

- For background on the Healthcare Partners acquisition, see my previous write-up on DaVita published in October 2016. [↩]

- EBITDA stands for Earnings before interest, taxes, depreciation, and amortization. It is an important metric when it comes to determining whether a company can service its debt. [↩]

- Warren Buffett has stated that Ted Weschler and Todd Combs manage a combined $34 billion as of the end of 2021. It is believed that they control roughly equal-sized portfolios. [↩]