“Berkshire will be the perfect permanent home for Alleghany, a company that I have closely observed for 60 years. Throughout 85 years the Kirby family has created a business that has many similarities to Berkshire Hathaway. I am particularly delighted that I will once again work together with my long-time friend, Joe Brandon.”

— Warren Buffett

Berkshire Hathaway has agreed to acquire Alleghany Corporation for $848.02 per share in a cash transaction valued at $11.6 billion. The transaction is not a done deal because Alleghany has a 25-day “go shop” period during which the company is allowed to solicit and consider a superior proposal. If the transaction proceeds, it is expected to close in the fourth quarter of 2022, subject to a vote of Alleghany shareholders.

In 2016, I wrote an article providing a brief history and analysis of Alleghany. I was attracted to the company because it seemed to have a business ethic similar to Berkshire Hathaway. Often thought of as a “mini-Berkshire”, Alleghany was in the process of expanding from insurance into a variety of non-insurance subsidiaries.

I have not followed Alleghany in almost five years, but after this morning’s announcement, I dusted off my old spreadsheets and reviewed the company’s recent results. Here are several resources that I found useful today.

- Press Release

- Alleghany 2021 Shareholder Letter

- Alleghany 2021 10-K Report

- Alleghany Q4 2021 Financial Supplement

- Alleghany March 2022 Investor Presentation

- Alleghany Capital 2022 Overview

If you have fifteen minutes to read about the company, I suggest prioritizing the March 2022 investor presentation. It has a number of graphs that will get you up to speed quickly. If you have an hour, you could add Joe Brandon’s shareholder letter and the Alleghany Capital 2022 Overview. Of course, the 10-K has much more information but takes several hours to read. Brew a pot of coffee.

Before proceeding, readers are encouraged to review my 2016 article on Alleghany for the history and financial results of the company up to that point.

Brief Overview

What follows is a brief update on the company which is by no means a comprehensive review. I will then proceed to comment on the factors that might have attracted Warren Buffett’s interest.

Prior to 2012, Alleghany primarily wrote specialty insurance through its RSUI and CapSpecialty subsidiaries. In 2012, Alleghany acquired Transatlantic Re (TransRe) which dramatically shifted the mix of business toward volatile reinsurance lines.

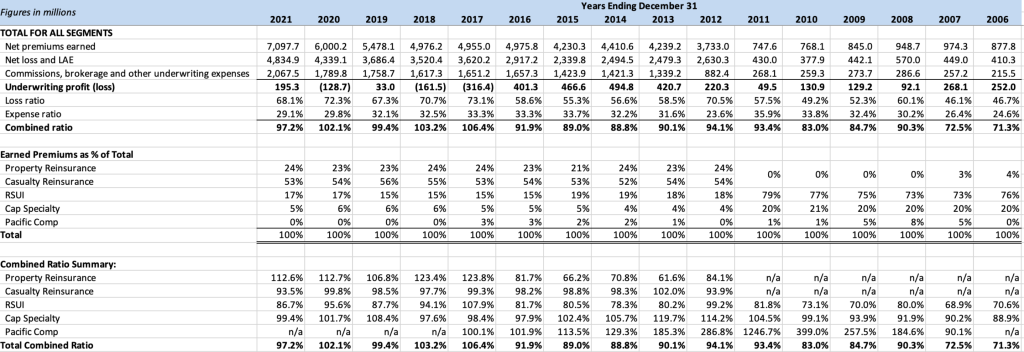

The exhibit below shows the history of Alleghany’s insurance operations since 2006:

We can see the effects of the TransRe acquisition quite clearly as earned premiums skyrocketed in 2012. Reinsurance tends to have much greater volatility compared to specialty insurance and we can see that results have been particularly poor in property reinsurance in recent years. In contrast, RSUI has posted only one year of underwriting losses in the sixteen year period shown in the exhibit.

Despite the increased volatility introduced by the reinsurance business, Alleghany has posted over $1.6 billion of cumulative underwriting profits in the decade since the TransRe acquisition:

Insurance companies that post consistent underwriting profits have access to cost-free “float” which totaled $12.9 billion at the end of 2021 according to CEO Joe Brandon’s letter to shareholders. Although this $12.9 billion is a liability representing an estimate of what Alleghany will eventually pay out to policyholders, the company is free to invest the funds until that point, and a successful insurance operation will continue to generate ongoing float in the future.1

How does Alleghany invest policyholder float as well as other resources derived from shareholders equity? The following exhibit appears in the company’s Q4 2021 financial supplement:

While the company has a $3.7 billion equity portfolio which is managed by an in-house investment team, the majority of funds are invested in fixed income securities due to regulatory reasons. The duration of the fixed income portfolio is 4.5 years, which is not terribly long but the portfolio is still subject to interest rate risk. According to the 2021 shareholder letter, Alleghany posted $320 million of pre-tax net unrealized and realized losses on the fixed income portfolio due to rising interest rates.

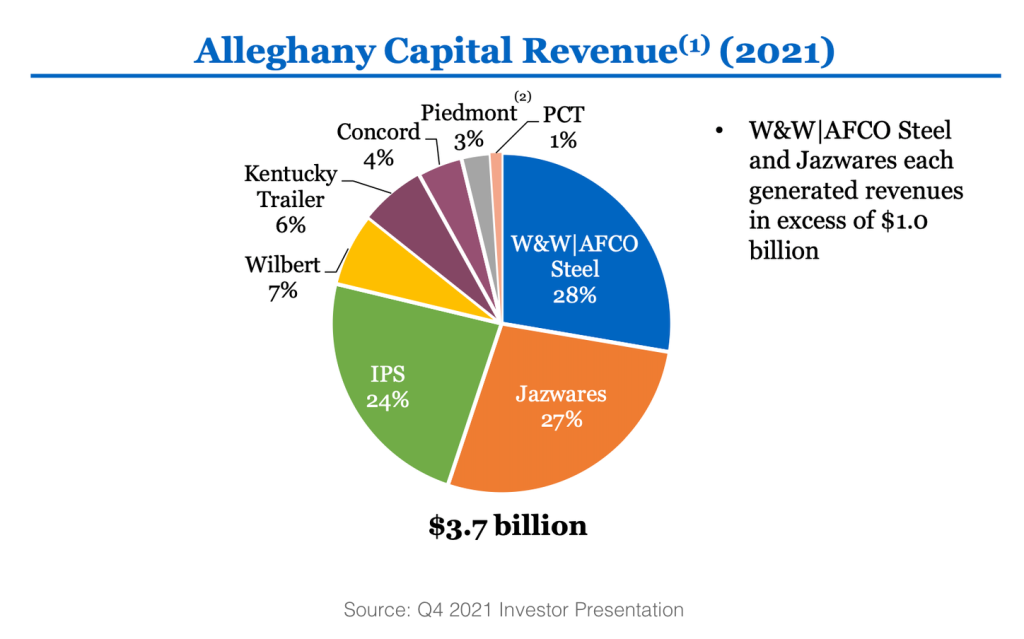

Alleghany is considered a “mini-Berkshire” because the company has acquired a number of non-insurance subsidiaries over the years, as I discussed in my 2016 article. Alleghany’s Q4 investor presentation discusses the current makeup of the non-insurance group starting on page 27. There are currently eight subsidiaries that generated $3.7 billion of revenue in 2021:

This group has seen rapid growth since 2016 and generates solid returns on equity:

What Attracted Buffett’s Interest?

There are several factors that are likely to have attracted Warren Buffett’s interest in Alleghany. The company clearly has been run in the mold of Berkshire Hathaway with former CEO Weston Hicks emulating the style of Mr. Buffett’s letters to shareholders. Joe Brandon, the current Alleghany CEO, was the CEO of General Re from 2001 to 2008. Despite a strong history, Alleghany’s valuation has never been particularly demanding, often trading near book value per share. Mr. Buffett’s offer values the company at 1.26x December 31, 2021 book value.

Let’s take a look at a few of these factors in more detail.

Insurance Operations

Alleghany is primarily an insurance company, and Mr. Buffett’s interest is likely grounded in the fact that the company has a strong record of underwriting profitability over a long period of time. While TransRe has posted volatile results, particularly in property reinsurance, the overall underwriting results of the reinsurance group is positive over the ten years of Alleghany’s ownership.2

The primary insurance operations, RSUI and CapSpecialty, have all the hallmarks of fitting in well with Berkshire’s existing primary reinsurers. RSUI, in particular, appears to be a wonderful business with underwriting profits in fifteen of the past sixteen years. Mr. Buffett has been interested in a greater presence in excess and surplus insurance for several years, launching a new venture, Berkshire Hathaway Specialty Insurance, in 2013. Although today’s press release indicates that Alleghany will continue to be managed by its existing team, perhaps Berkshire’s other specialty operations will collaborate with RSUI in the future.

It seems likely that Mr. Buffett’s main attraction to Alleghany was the prospect of buying insurance operations that can generate underwriting profits over long periods of time. History would indicate that Alleghany is such an operation. With Berkshire’s overcapitalized balance sheet, Alleghany’s underwriters could have more capacity to pursue additional opportunities in the future.

Investments

Although Alleghany’s insurance operations will continue to be managed by the existing team and will not be folded into Berkshire’s other insurance companies, Mr. Buffett will gain access to Alleghany’s $12.9 billion of float. Since Alleghany has shown the ability to post underwriting profits, that float should be cost-free over time.

As we saw in the exhibit showing Alleghany’s current investment portfolio, the company is heavily invested in fixed income securities. Indeed, Alleghany’s $16.1 billion fixed income security portfolio is nearly as large as Berkshire Hathaway’s fixed income portfolio!

Alleghany’s investment team is not likely to be thrilled with having such a high allocation to fixed income in today’s interest rate environment, but they must hold substantial fixed income for regulatory reasons. With Alleghany’s insurance operations under Berkshire’s ownership, this issue should no longer exist, and Mr. Buffett will likely be free to liquidate the fixed income investments.

It will be interesting to see if the $16.1 billion fixed income book is immediately liquidated and added to Berkshire’s cash position when the transaction closes. If so, Berkshire will actually end up with more cash after the acquisition given that the deal is for $11.9 billion.

Modest Premium to Book Value

Berkshire is paying 1.26x book value for Alleghany which is a relatively modest premium to book value. The following exhibit from Alleghany’s Q4 2021 financial supplement shows the history of book value and market value over the past two decades:

The red highlighted area at the top of the exhibit shows the price-to-book ratio for Alleghany over time. We can see that it has often traded well below book value, only rarely trading above Berkshire’s 1.26x purchase price. However, we can see in the red highlighted area at the bottom that book value has been compounding at a healthy clip.

Arguably, Alleghany has been chronically undervalued. And although “synergy” is a dirty word in the acquisition world, often used to justify the unjustifiable, Mr. Buffett’s ability to reallocate Alleghany’s float is a very real factor that could add real value.

One wonders why Mr. Buffett was not buying Alleghany common stock at a discount to book value if he liked the company’s prospects. It seems likely that he could have purchased a substantial number of shares on the open market prior to acquiring the entire company to save some money. However, perhaps he felt that doing so in this situation would signal hostile intent, a practice that Berkshire has always avoided. On the other hand, Berkshire owned a substantial interest in BNSF for several years prior to acquiring the entire railroad in 2010.

Joe Brandon

Mr. Buffett has made positive statements about Joe Brandon over the years and has given him credit for turning around General Re in the early-mid 2000s. Bringing Mr. Brandon back into Berkshire seems like a very positive move for the company.

Presumably Mr. Brandon will report to Berkshire Vice Chairman Ajit Jain who is responsible for all of the company’s insurance operations. Mr. Brandon is 62 years old, very young by Berkshire standards, and could be a potential successor for Mr. Jain who is 70.

Final Thoughts

If Alleghany does not receive a higher offer over the next 25 days, the deal is nearly certain to go through given Berkshire’s track record completing transactions. Indeed, Alleghany shares closed today at $844.60, only a small amount less than the $848.02 per share offer price.3

From the perspective of a longtime Berkshire shareholder, this news was not exactly a shock, especially since I was already familiar with Alleghany and knew of its “mini-Berkshire” strategy.

Berkshire is getting $12.9 billion of float for Mr. Buffett to deploy, a very profitable specialty insurance business, and a reinsurance business that, while volatile, could improve with Berkshire’s additional capital backing. Additionally, Berkshire adds eight non-insurance subsidiaries with good returns on invested capital.

Although this has not been a comprehensive overview of Alleghany, hopefully it has provided a sense of what Berkshire is buying and links to the resources needed to dig deeper if desired.

Disclosure: Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

- Warren Buffett explains the concept of float on page A-5 of the 2021 Berkshire Hathaway Annual report. [↩]

- An interesting aside: Mr. Buffett attempted to acquire TransRe but Alleghany submitted a higher bid. Now Berkshire will end up with TransRe a bit circuitously. [↩]

- $848.02 is an odd number. I suspect that Mr. Buffett offered $848 and was persuaded to kick in a couple of additional cents during negotiations. Mr. Buffett is famous for “take it or leave it” offers… [↩]