Kian Ghazi, founder of Hawkshaw Capital Management, is scheduled to make a presentation at the Value Investing Congress West taking place on May 3 and 4 in Pasadena, California. According to the Value Investing Congress website, Mr. Ghazi employs a “concentrated, value-driven, research-intensive approach” underscoring the firm’s emphasis on deep-dive investigative research.

Case for Core-Mark at 2009 Value Investing Congress

In October 2009, Mr. Ghazi presented the case for Core-Mark at the 5th annual Value Investing Congress in New York. According to the Value Investing Congress blog, the bullish case for Core-Mark was based on the following points:

In October 2009, Mr. Ghazi presented the case for Core-Mark at the 5th annual Value Investing Congress in New York. According to the Value Investing Congress blog, the bullish case for Core-Mark was based on the following points:

• Second largest distributor to convenience stores

• $300 million market cap

• $30 million net debt

• Trading at 12 times est 2009 earnings, 8 times TTM earnings

• Admits that this is a low margin business with low ROC, but is well capitalized, difficult to replace, underfollowed

• Highly fragmented industry

• Cigarette sales account for 70% of revenue, but just 29% of gross profit

• Company moving toward providing more fresh foods, which have much higher margins. This should more than supplant potentially declining cigarette sales.

• Believes company may ultimately be worth $45-$50

Core-Mark closed at 29.62 on October 22, 2009, the day of the presentation, and currently trades around $34.05 with a fifty-two week high of $37.19 over the past year. Based on Hawkshaw’s latest 13F, discussed below, Core-Mark is not currently part of the portfolio.

As an interesting aside, Core-Mark’s larger competitor is none other than McLane, the Berkshire Hathaway subsidiary. While we are not familiar with Core-Mark, we can underscore the fact that this type of business is very low margin. McLane typically has net margins near the 1 percent level. A Morningstar analysis of Core-Mark published last year claims that Core-Mark may have important advantages over McLane particularly in the distribution of fresh foods. We cover McLane’s activities as part of our recently released report on Berkshire Hathaway: In Search of the Buffett Premium.

As an interesting aside, Core-Mark’s larger competitor is none other than McLane, the Berkshire Hathaway subsidiary. While we are not familiar with Core-Mark, we can underscore the fact that this type of business is very low margin. McLane typically has net margins near the 1 percent level. A Morningstar analysis of Core-Mark published last year claims that Core-Mark may have important advantages over McLane particularly in the distribution of fresh foods. We cover McLane’s activities as part of our recently released report on Berkshire Hathaway: In Search of the Buffett Premium.

Hawkshaw Portfolio at December 31, 2010

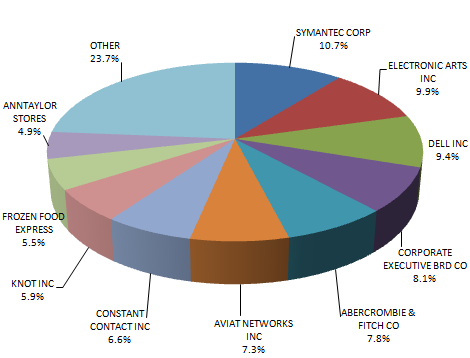

According to Hawkshaw’s latest 13F filing, listing positions owned as of December 31, 2010, Mr. Ghazi runs a concentrated portfolio with the top ten holdings accounting for 76.3 percent of the $147.9 million portfolio. Top positions include Symantec, Electronic Arts, Dell, Corporate Executive Board, and Abercrombie & Fitch. The portfolio also includes a put option on the S&P 500 index, accounting for 2.3 percent of the portfolio and probably intended to hedge the portfolio positions against a general decline in the market.

The exhibit below lists all positions Hawkshaw reported in the latest 13F:

The following chart displays the top ten holdings visually:

Readers of The Rational Walk are eligible for a $1,400 discount for the Value Investing Congress in Pasadena on May 3 and 4. To qualify for the discount, please use the following link and be sure to specify Discount Code W11RW7 upon check out. The discount expires on March 15, 2011 at which time the price to register will go up by $900. Disclosure: The Rational Walk receives a referral fee for registrations generated through the link.

Click on this link to register for the Value Investing Congress