Warren Buffett is well known for refusing to provide earnings guidance for Berkshire Hathaway, and rightly so in my opinion. If fewer companies spent the time and energy required to provide guidance to analysts, managers could focus more attention on running the business and maximizing shareholder value rather than obsessing over “meeting the number”.

Since guidance is not provided, only a few analysts publish earnings estimates for the company and such estimates are often far from accurate because of the many unpredictable elements in Berkshire’s diverse collection of businesses. There seems to be little point in trying to come up with estimates with pinpoint precision for a company with over seventy operating businesses. At best, a wide range can be estimated based on various assumptions.

In contrast, it is possible to estimate Berkshire’s book value performance from quarter to quarter with less risk of being far off the mark. This is true because the contribution of earnings for a particular quarter have a relatively muted impact on Berkshire’s many years of retained earnings. Furthermore, estimates of Berkshire’s book value are made easier by the fact that the company’s marketable securities holdings are published in SEC filings.

It is also logical to focus more attention on what a company owns rather than assigning great meaning to quarterly swings in earnings. It seems like most analysts obsess over whether a company misses earnings by a penny or two without ever glancing at the equity account on the balance sheet.

So with the caveat that this is, at best, a “back of the envelope” calculation, this article attempts to come up with a likely range for Berkshire’s book value as of September 30.

Stock Portfolio Performance

Berkshire Hathaway filed Form 13F on August 13, 2009 which lists all positions held as of June 30, 2009. Form 13-F does not include foreign stocks that are traded on foreign exchanges, so some of Berkshire’s equity investments are not included. Nevertheless, the vast majority of the value of the equity investment portfolio is accounted for on Form 13F and we will disregard changes in value of foreign holdings for this analysis.

As of June 30, 2009, Berkshire’s portfolio was valued at $48,954,993,000. During the quarter, Berkshire sold 8,780,688 shares of Moody’s which was reported on two Form 4 filings (July 20-22 and September 1-2). There were no other changes to the portfolio that we know of at this time.

Applying closing prices as of September 30, 2009 to the positions Berkshire held at June 30, 2009 and adjusting for the sale of Moody’s shares during the quarter, the portfolio should be valued at approximately $55.8 billion at the end of the third quarter. This is an increase of approximately $6.8 billion, or 14 percent, over the course of the quarter. This slightly trailed the 15 percent return of the S&P 500 for the third quarter (dividends not included).

A spreadsheet containing full details on the portfolio is provided at the end of this article.

Operating Earnings

In addition to changes to the value of the portfolio, Berkshire will have operating earnings that will be retained and added to book value. As noted previously, operating earnings can only be estimated imprecisely given the nature of Berkshire’s diverse set of operating companies. Berkshire breaks down the net income attributable to each reporting segment in the “Results of Operations” section of quarterly reports. We will estimate a wide range for each segment.

- Insurance – Underwriting. Given the lack of Atlantic storm activity in the third quarter, there is every reason to believe that Berkshire will post robust underwriting profits. However, Berkshire also reported in the second quarter 10-Q that GEICO may experience higher loss ratios in 2009 compared to 2008, and we know that premium volume for the reinsurance group was constrained earlier in the year due to Berkshire’s decline in net worth. For purposes of this rough estimate, we will estimate the underwriting profits will fall between $50 million and $150 million for the quarter compared to $81 million in the third quarter of 2008 and $83 million for the second quarter of 2009.

- Insurance – Investment Income. Berkshire will continue to benefit from the cash that was deployed into higher yielding investments during the fourth quarter of 2008 (Wrigley, Goldman Sachs, GE, and other preferred securities). We will estimate investment income to be in a range between $1.1 billion and $1.2 billion for the quarter. This compares to $1.159 billion for Q2 2009 and $809 million for Q3 2008.

- Utilities and Energy. This segment is somewhat difficult to forecast but has experienced stable results in recent years. Due to reduced demand for industrial uses of electricity during the recession, it is possible that results will be slightly lower than the third quarter of 2008, although higher than the second quarter of this year. We will use a range of $225 million to $300 million for this segment. This compares to $239 million for Q2 2009 and $324 million for Q3 2008.

- Manufacturing, Service, and Retailing. This segment, which includes dozens of diverse businesses in multiple industries, has been the hardest hit when it comes to the direct effect of the recession. Earnings should improve in the third quarter compared to the second quarter, but are still likely to be far below prior year levels. We will use a range of $275 million to $375 million, which compares to actuals of $239 million for Q2 2009 and $665 million for Q3 2008.

- Finance and Financial Products. This segment includes the manufactured housing finance business as well as furniture and transportation equipment leasing which are both sensitive to overall economic activity. We will use a range of $75 million to $100 million, which compares to actuals of $82 million for Q2 2009 and $91 million for Q3 2008.

The exhibit below provides a summary of the low and high range for estimates for the third quarter of 2009 along with actuals for Q2 2009 and Q3 2008 for comparative purposes. Total net earnings from operating businesses are forecast to come in between $1.7 billion and $2.1 billion.

Derivatives Mark-To-Market Gains

As discussed here in the past, Berkshire Hathaway has entered into a number of derivatives contracts that are marked to market each quarter even though there are limited collateral requirements and, in the case of the equity put options, cannot be exercised for many years to come. During the fourth quarter of 2008 and the first quarter of 2009, these mark to market calculations resulted in steep declines to Berkshire’s reported book value. In the second quarter of 2009 and in the third quarter, large gains will be realized to offset the prior derivatives losses.

Berkshire’s equity put options are based on different underlying indices and not all of the details are disclosed in SEC filings. We know that the S&P 500 is used as the underlying index in some cases, but there are also foreign indices on non-US contracts and exchange rate fluctuations will have an impact as well. We will not attempt to calculate Berkshire’s likely derivatives gain with any precision here. However, recognizing that the S&P 500 gained roughly the same amount during both the second and third quarter, we can guess that derivatives gains may be somewhat similar to the second quarter experience. We will use a range of $1.2 billion to $1.8 billion compared to the second quarter’s actual gain of $1.5 billion.

Book Value Projection

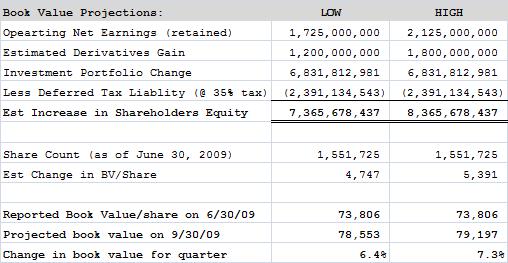

Book value for the quarter will increase due to the increase in the value of the equity portfolio less deferred tax liabilities plus retained operating earnings and the net gain on derivatives for the quarter. We can then estimate the change in book value per share during the quarter. The exhibit below consolidates the figures:

Although the ranges of estimates for operating earnings and derivative gains are very wide, we can have more confidence in the impact of the equity portfolio estimates. Most importantly, even with the wide range in estimates, the bottom line book value estimate only varies by a small amount. It seems likely that Berkshire Hathaway’s book value per share should be somewhere between $78,500 and $79,200 as of September 30, 2009.

It should be noted that this would be a record high in terms of book value per share. Does book value per share have any impact on intrinsic value calculations? This was discussed here in some detail in July. It seems safe to say that changes in book value provide directional clues regarding the movement of intrinsic value over time. Just because book value per share is likely at a record high does not necessarily mean that intrinsic value is at a record high. However, it is certainly a tribute to the resiliency of Berkshire’s business model in the midst of the most severe economic downturn since the Great Depression.

For more details on Berkshire Hathaway’s 13F filing and the projections discussed here, please click on this link for an excel workbook. The workbook contains two worksheets. The first sheet shows all of the positions on the 13F filing with updated closing prices as of September 30. The second sheet shows the earnings projections and book value projections. The accuracy of the data has been verified to the best of our ability. If any errors or omissions are noticed, please contact us using the link at the bottom of this article.

Disclosure: The author owns shares of Berkshire Hathaway.