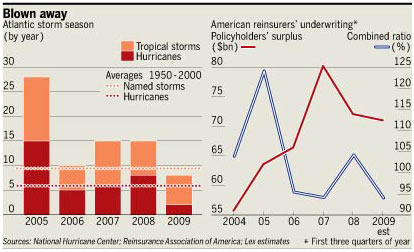

The Financial Times Lex Column reports that the combined ratio of American reinsurers through the first three quarters of 2009 averaged about 94 percent. The combined ratio is the sum of the claims ratio and the loss ratio and essentially compares the premiums received during a given year to the claims experience as well as all operating expenses. A combined ratio less than 100 indicates that a company generated underwriting profits while a ratio above 100 indicates an underwriting loss.

While a combined ratio under 100 is generally good news for the industry, Lex notes that conditions this year were about “as good as it gets”. The combined ratio of 94 is not so spectacular when one considers that it is similar to the combined ratio recorded in 2007 even though this year has had fewer catastrophes. This signals softer overall pricing in the industry.

The chart accompanying the article illustrates the trend very nicely:

Another way to look at the results is to understand that the combined ratio would likely have been well over 100 if we had a more “normal” number of mega-catastrophes in 2009. In other words, underwriting profitability in 2009 is more due to a lack of catastrophes than any sign that underwriters are demanding adequate premiums for the risks that are being taken. This does not necessarily bode well for industry results in 2010. As always, underwriting discipline is key in a soft market and insurers willing to reject inadequately priced risks will benefit in the long run.