Berkshire Hathaway has released its 2019 annual report along with Warren Buffett’s annual letter to shareholders. In the letter, Mr. Buffett spends some time discussing the power of retained earnings as well as general capital allocation strategies. Given Berkshire’s policy of retaining almost all earnings over the years, these topics are of utmost importance when it comes to understanding the company’s prospects for delivering adequate returns to shareholders in the coming years.

One important lever for Berkshire to add value for continuing shareholders is through repurchases of stock at prices below intrinsic value. In 2019, Berkshire deployed $5 billion of cash to repurchase approximately one percent of the company’s common stock. Since 2011, when Berkshire first announced a formal repurchase program, the company has allocated $8.1 billion to repurchase 33,139 Class A equivalents at an average cost of $245,177 per share.

Berkshire’s repurchase program was initially very restrictive and, as a result, few shares were repurchased. However, in July 2018, Buffett changed Berkshire’s policy which removed previous limitations that constrained repurchase activity. After July 2018, Buffett was permitted to repurchase shares at any time that he and Vice Chairman Charlie Munger considered the shares to trade at a discount to intrinsic value, provided that Berkshire’s cash balance remains at or above $20 billion.

This article presents a comprehensive overview of Berkshire’s repurchase activity since 2011. With Berkshire’s cash balance of $125 billion as of December 31, 2019 and continuing free cash flow arriving every quarter, the possibility of significant repurchases definitely exists if shares continue to trade at or below current levels.

Note: For additional commentary regarding the annual report, please read the special issue of the Rational Reflections newsletter which was sent to subscribers on Saturday afternoon.

Repurchase History: 2011-2019

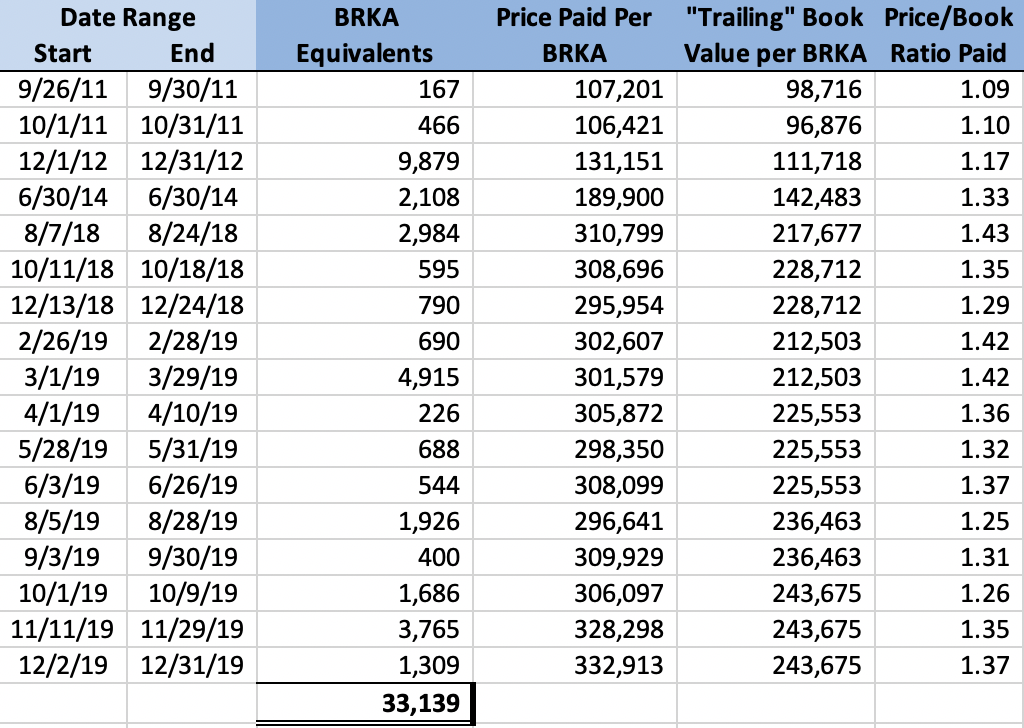

Berkshire reports the specific number of shares the company has repurchased in each 10-Q quarterly report and in the 10-K annual report each year. The reporting is done by date range rather than on a day-to-day basis but still provides granularity that can be insightful. The exhibit below shows all of Berkshire’s reported repurchase activity since the formal repurchase policy was introduced in 2011:

On September 26, 2011, Berkshire announced a formal repurchase program with the main stipulation being that management would not repurchase shares at a premium of more than 10 percent above book value. The market quickly took this as a signal that Berkshire’s shares were undervalued so only $67 million of stock was repurchased in 2011 before the stock price rose beyond a 10 percent premium. Shares never traded at a low enough valuation to trigger the repurchase policy in 2012 but when a block of shares from the estate of a longtime shareholder became available in December 2012, Berkshire changed the repurchase restriction to authorize purchases at a premium of no more than 20 percent above book value. This allowed Berkshire to allocate $1.3 billion to repurchases during 2012.

After 2012, Berkshire did not allocate any cash toward repurchases until August 2018 following an amendment to the share repurchase program that removed specific limitations regarding the premium to book value that could be paid. However, in 2014, Berkshire exchanged 1.62 million shares of Graham Holding Company for WPLG, a Miami television broadcaster, and this company came with $400 million in Berkshire stock which was effectively retired. This essentially resembles a repurchase – let’s call it the 2014 “quasi-repurchase”.

Since August 2018, Berkshire has spent $6.4 billion on repurchases which represents the bulk of activity since 2011 and most of the entries in the exhibit. Although the shares have not been repurchased constantly, some shares have been acquired in most of the months since the policy change.

Valuation of Acquired Shares

Let’s now take a look at a rough indicator of value for each of the reported repurchases since 2011. The exhibit below shows each of the date ranges along with the number of Class A equivalents that were repurchased and the average cost paid per Class A equivalent.1 The table also shows the “trailing book value” per share which is the book value per share reported at the last balance sheet date. For example, “trailing book value” for the last entry of 12/2/19 to 12/31/19 was the book value figure reported as of 9/30/19. Finally, the price/book ratio paid is presented.

As we can see, the first two entries were both done at or below 1.1x book value given the restriction imposed at the time of not paying more than a 10 percent premium to book. The 2012 purchase was executed at 1.17x book value, below the 20 percent premium to book dictated by the December 2012 amendment to the repurchase program. The 2014 “quasi-repurchase” is interesting because the effective price was 1.33x book value even though the limitation for actual deployment of cash remained at 1.2x book value.

Once the self-imposed handcuffs specifying a maximum book value were removed, we can see that Buffett had no qualms about repurchasing shares at price-to-book ratios up to 1.43. Indeed, the initial repurchase range from 8/17 to 8/24/18 was executed at 1.43x 6/30/18 book value. The range for repurchases in 2019 was from 1.25 to 1.42x book value.

Does Book Value Still Matter?

At this point, we should note that Warren Buffett’s 2018 letter to shareholders de-emphasized book value as an appropriate (albeit understated) gauge of intrinsic value.2 This appeared to change the goalposts when it comes to thinking about repurchase activity. From a mathematical perspective, any shares that Berkshire repurchases above book value will have the effect of reducing book value per share even though management believes that it is increasing intrinsic value per share by buying back shares.

Over time, the gap between book value and intrinsic value will grow due to repurchase activity and, hopefully, the ongoing generation of economic goodwill within operating subsidiaries. So, looking at the price-to-book value that Berkshire pays to repurchase shares might not be meaningful from a comparative basis over time. Nevertheless, given that the policy was only changed recently, many shareholders continue to follow book value and find it useful to think about the price-to-book ratio that Buffett feels comfortable with when it comes to repurchases.

Prospects for Future Repurchases

Four years ago, I wrote an article considering what Berkshire Hathaway might look like ten years in the future. Here is a short excerpt from that article on the topic of repurchases:

Mr. Buffett has indicated that Berkshire’s board of directors will consider repurchases as a means of returning cash to shareholders. Repurchases, if made at levels at or below intrinsic value, can be more efficient than dividends because only shareholders who are voluntarily departing will face tax consequences. If repurchases cannot be made at prices that make sense, cash dividends will have to be initiated and all shareholders would face the tax consequences.

Berkshire’s current repurchase limit of 120 percent of book value would have to be increased substantially in order to make repurchases of any significant size possible. Since 120 percent of book value is far below any reasonable assessment of Berkshire’s intrinsic value, it follows that Mr. Buffett and the board of directors would have to agree to increase the repurchase limit in order to return material amounts of cash to shareholders.

Berkshire Hathaway in 2026, published on April 26, 2016

The removal of the 120 percent limit in 2018 dramatically increases the ability of Berkshire to use repurchases to return cash to shareholders in the coming years. With $125 billion of cash on the balance sheet, Berkshire is carrying excess cash earning very modest returns. That cash is earning negative yields on an inflation adjusted basis and it is certain that Warren Buffett and Charlie Munger take no joy in having it on the balance sheet and would much prefer to deploy it to purchase great businesses at attractive prices.

Cash represents optionality and, at age 89, Warren Buffett is still going strong as CEO of Berkshire Hathaway and shows no signs of slowing down anytime soon.3 It is certainly possible that he will have another opportunity to deploy many tens of billions of dollars in a market crisis, either in marketable securities or outright acquisitions. However, Berkshire’s $125 billion cash pile will continue to grow in the near term and modest repurchases of 1-2 percent of shares outstanding annually seems more likely than not.

With Berkshire A shares trading around $335,000, which is a modest 1.28x book value as of 12/31/19, it would not be surprising to see significant repurchases this quarter. Buffett’s unusual offer in his annual letter to repurchase blocks of shares of $20 million or more is a signal that, at the right price, he is willing to loosen Berkshire’s purse strings.

Disclosure: Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway.

- Each Class A share is equivalent to 1,500 Class B shares in terms of economic interest although Class B shares have only 1/10,000 the voting rights of Class A shares. [↩]

- I have long been skeptical of the utility of book value when it comes to thinking about Berkshire. [↩]

- Buffett looked and sounded great in his appearance on CNBC this morning. In this clip, he discusses the difficulty of buying back Berkshire shares relative to the stock of other large companies. [↩]