Manufacturing time, Apple Vision Pro, Access journalism, Henry Ford’s $5/hr wage, Sharing investment ideas, Insurance brokerages, Katalin Karikó’s autobiography, John Randolph of Roanoke

The Digest #188

Manufacturing time, Apple Vision Pro, Access journalism, Henry Ford’s $5/hr wage, Sharing investment ideas, Insurance brokerages, Katalin Karikó’s autobiography, John Randolph of Roanoke

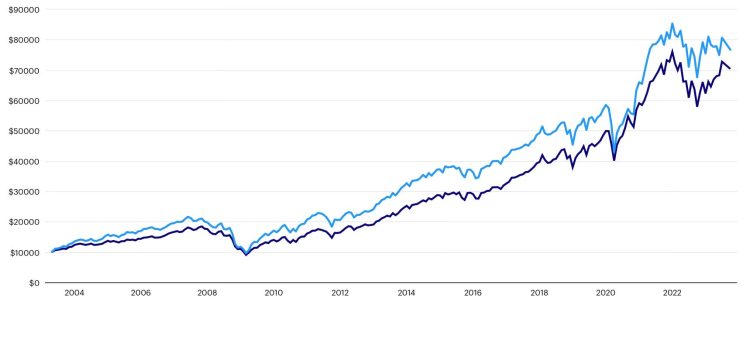

The S&P 500 is dominated by the “magnificent seven” which creates significant concentration risk. The S&P 500 equal weight index offers a possible alternative.

The life of Jesus Christ is central to the works of many authors, but can we rely on the accuracy of the accounts of his life?

Damage repair, Claude Shannon, Elon Musk’s pay, Intellectual obesity, Apple Vision Pro, Ignoring the market, Damodaran data updates, Apple packaging, Samsung, Big Pharma

We could be in the early days of a step-change in how we interact with computers. Apple’s Vision Pro is leading the industry in the field of spatial computing.

The amazing story of Shackleton’s legendary voyage to the Antarctic and how his 28 men survived shipwreck, ice floes, and constant danger.

Macintosh at 40, Coffee Can Investing, Haslams on Pilot, Vision Pro’s missing apps, Investment checklists, Shane Parrish interviews Tom Gayner, Novo Nordisk, Howard Marks on interest rates

Savings and consumption are joined at the hip. The more we consume during our working years, the longer it will take to achieve financial independence.

The trial and confinement of Socrates

Capital Allocation, Progressive’s strategy, Reading plans, Damodaran’s free courses, Looking back at Alibaba’s IPO, Chris Davis, Outsider CEOs, Shareholder activists, Oprah

This article looks back at Warren Buffett’s warning about elevated stock valuations in 1999 and considers the potential application of his ideas to valuations today.

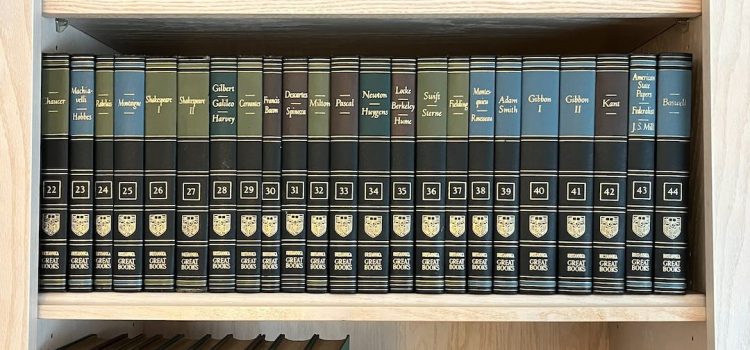

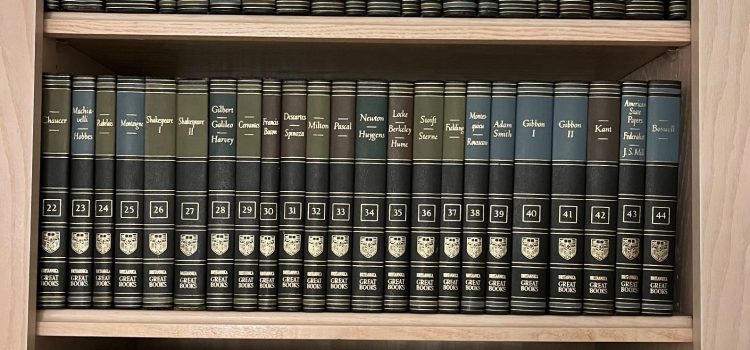

The Great Books cast a formidable shadow but most of them were meant to be read by a wide audience. Reading plans make it easier to get started.

The Rational Walk will make all paywalled articles free six months after publication. Today, paywalls have been removed from twenty-one articles.

Charlie Munger was known to have a “thirty second mind” due to his vast multi-disciplinary background. It is increasingly difficult to cultivate such a mind with modern distractions.

Ed Thorp: A Man for All Markets, Howard Marks on easy money, Active patience, Activist investing, Damodaran’s 2024 data update, Michael Ovitz, Live Oak, Red Bull, Capital allocation

Charlie Munger’s death raises many questions for Daily Journal that remain unanswered following the company’s 10-K and proxy filings.

Daily Journal, Apple, Costco, Moody’s, Munger’s wisdom, Tesla’s narratives, Tim Urban on writing, Rivian, AI’s morality, AI bubble?, How James Longstreet defied the South after the war

Warren Buffett and Charlie Munger’s business relationship was founded on a seamless web of deserved trust. Trust is earned over many years. Seamless trust requires decades.