“The compensation committee relies on its own good judgment in carrying out its duties and does not waste shareholder money on compensation consultants.”

— Daily Journal Corporation 2017 Proxy Statement

Reading primary sources of information remains the single most important activity that investors should focus on in their daily work. Although the financial news media often produces valuable content, we should always remember that the current business model of the vast majority of news outlets centers on building a broad readership base that is attractive to potential advertisers. By necessity, the mainstream financial media attempts to cover a wide range of companies. Even the most competent reporter who intends to offer an objective view of a given topic has numerous constraints, and not all reporters are informed or objective. Furthermore, as investors, we cannot expect to gain the special insights needed to outperform a passive index fund simply by reading what everyone else is reading.

The Rational Walk recently published an article on how to read a 10-K annual report effectively and, perhaps surprisingly, the number of people who read that article and commented on it via social media far exceeded recent articles on specific companies. This led to a question regarding whether readers would want to see a similar article on proxy statements:

This was surprisingly popular. Should I write “How to Read a Proxy”?

How to Read a 10-K Annual Report Efficiently https://t.co/PlYkKeC6Hm— The Rational Walk (@rationalwalk) February 1, 2017

The article on 10-K reports focused on steps that an investor can take to achieve basic understanding of a company in a short period of time in order to be exposed to as many companies as possible. The investment process can be visualized as a funnel, with very few companies that go into the top emerging from the bottom as potential candidates for further study. However, once a company passes an initial step, one must dig deeper. The 10-K needs to be reviewed again, this time with a fine toothed comb rather than taking shortcuts, and not just a single 10-K but reports going back a reasonable number of years. Additionally, recent quarterly results, conference calls, and presentations are important to review.

Taking a step back, let’s consider a case when a 10-K report is reviewed and there is some interest but the investor does not yet know whether significant additional time is justified. In such cases, one important step that can provide a great deal of clarification is a basic review of the company’s annual proxy statement. Stated simply, a proxy statement is a document that a company’s management is required to send to shareholders prior to an annual or special meeting where owners will be asked to approve corporate actions.

Reading a Proxy Statement

Proxy statements contain a wealth of information that is completely absent from annual reports. Specifically, in order to learn about the compensation provided to directors and management, as well as the governing incentive systems, one must review the proxy statement. Unfortunately, the deadline for proxy statements is usually a couple of weeks after the 10-K deadline and, except for very large companies, proxy statements are rarely covered in the mainstream financial media. Even in the case of large companies, reporters tend to ignore proxies unless the level of pay is egregious or some major change in corporate governance is taking place. For example, reporting on the departure of Gary Cohn from Goldman Sachs to join the Trump Administration necessarily drew information from the company’s proxy. But usually the proxy statement flies well under the radar. Shareholders receive proxy statements either in the mail or electronically and many individual investors do not even bother to vote. Institutional investors often take their cues from proxy advisory firms.

Just as voting in elections is the responsibility of the citizen, we would insist that reviewing a proxy statement and voting is a core duty of an informed shareholder (at least one who cares about his or her net worth). A company with a shareholder base that doesn’t care about executive and director compensation invites an exacerbation of the already ever-present agency problem. When things get bad enough, an activist may enter the picture to force changes, but not usually before shareholders are harmed. Any potential investor thinking about allocating funds to a company must put himself in the shoes of existing investors and the only way to determine whether an agency problem is likely to negatively impact results is to review the proxy.

Finding Proxy Statements

In this article, we will use the 2016 proxy statement filed by America’s Car-Mart which we discussed in an article last month. Car-Mart is a relatively simple small-cap company and the proxy statement is quite straight forward and mostly free of much of the superfluous marketing that is very common in larger companies that employ public relations firms. In general, the size of a proxy, and the amount of public relations marketing, is highly correlated with the size of a company. To keep this article to a reasonable length, we picked a simple proxy, yet not one that is as simple as the proxy filed by Charlie Munger’s Daily Journal Corporation which is a model for intelligent corporate governance.

Proxy reports can either be found on the company’s website or retrieved via the SEC’s Edgar search tool. Although Car-Mart does provide convenient access to the proxy in PDF format, not all companies do so. The SEC search screen is shown below:

Submitting this query using the ticker symbol for Car-Mart yields the following results:

We can see several of the company’s recent filings in the results screen, including the company’s latest 10-Q quarterly report as well as other types of reports. However, we do not see the proxy statement in this list. A proxy statement is known in the SEC system as a Form DEF 14A filing so we need to filter on that type of document, as shown in search field highlighted in red below:

We are now presented with a list of all of the proxy statements that the company has filed over the years. For purposes of our review, we would like to review the latest proxy statement which was filed on July 22, 2016, so we would click on the Documents button for the first entry to bring up the actual report, or alternatively, we can review the PDF file available on Car-Mart’s website. Since the PDF file is more readable and has a nicer presentation, that is where the subsequent screen shots in this article were taken from. The file is 32 pages long which compares favorably to more complex proxies (Goldman’s 2016 proxy is 104 pages).

Notice of Annual Meeting of Shareholders

The proxy typically begins with a letter from either the Chairman or CEO of the company providing information on the annual meeting, where and when it will occur, and the purpose of the meeting. The main elements of an annual meeting usually involves a short presentation by management followed by a vote to elect directors and approve the company’s auditors. The Dodd-Frank financial reform law of 2010 also mandated that shareholders have an opportunity to vote on executive compensation on an advisory basis, meaning that it is rather toothless and non-binding (this is akin to an employee setting her own pay and giving the boss an advisory vote, feeling free to disregard that vote when desired — give that a try at your next annual review!)

Car-Mart’s annual meeting was scheduled for August 31, 2016 for the purpose of electing seven directors and to vote on executive compensation and the selection of Grant Thornton as the company’s independent auditor. The letter is signed by William Henderson, the company’s CEO. At the time of the proxy, Car-Mart did not have a Chairman, although one has been appointed since that time.

Following the letter, shareholders are given information on how to vote. Shareholders not attending in person are instructed to vote by proxy, which is a form that comes with a physical proxy statement and is mailed back to the company’s transfer agent or entered online. Rules regarding the actual voting procedures, including the definition of a quorum, is provided. Most of this section is self explanatory.

Security Ownership of 5% Owners and Directors/Officers

The section on beneficial ownership of securities is where the proxy statement goes from dull to very interesting. Any owner or potential owner of a company should be very interested in the composition of the major shareholders and whether directors and officers have meaningful financial states, or “skin in the game”. The Car-Mart table of security ownership appears below:

The first three entries representing the company’s largest shareholders are financial institutions. Invesco and BlackRock are very large institutions that should be immediately recognizable to most readers. For most companies, it is normal to see a list of large institutions in the shareholder list, and this is often even more true for small companies. With a $337 million market capitalization, it doesn’t take a huge investment for a large institution to wind up with a large percentage of shares outstanding.

The company’s second largest shareholder is Bares Capital Management which is run by Brian Bares. This institution is not a household name but we recognized it immediately because Mr. Bares is someone who has been interviewed in The Manual of Ideas in the past and has also appeared in videos explaining aspects of his investment philosophy incorporating the ideas of Warren Buffett and Charlie Munger. As of September 30, Bares Capital Management owned 1,133,217 shares of Car-Mart which indicates that part of the position held at the time of the proxy filing was sold at some point between July 12 and September 30, 2016. Knowing that a 18.9 percent shareholder reduced his stake in the company is valuable information and can be easily discovered by searching for 13-F filings.

Turning our attention to management and directors, we must exercise more caution when looking at the numbers in the tables. “Beneficial ownership” includes options that are exercisable within 60 days of the filing date. Holding options to purchase shares is not the same thing as actually owning shares, yet the SEC allows the two types of holdings to be conflated in the table.

For example, CEO William Henderson beneficially owns 466,734 shares representing 5.7 percent of shares outstanding. However, let’s take a look at the small print in footnote 5:

Of the 466,734 shares “beneficially owned”, 389,000 represent exercisable options which means that 77,734 shares were owned outright on the date of the report. Although option grants represent upside to Mr. Henderson, they have no downside risk (other than potentially expiring worthless). In terms of “skin in the game”, he has 77,734 shares which are worth around $3.3 million currently. If we took the number presented in the table at face value without looking at the footnote, we would incorrectly consider his “skin in the game” to be nearly $20 million, obviously a huge difference.

The use of stock options is common and this type of situation will exist in the presentation for most companies. There is a good case to be made that the distinction between options and outright ownership should be visible in the table rather than only in the footnotes but unless that change is mandated by the SEC, investors simply have to be sure to examine the footnotes carefully.

Election of Directors

The next section deals with the election of directors. Readers should focus on the frequency of elections for directors and the length of a director’s term. In the case of Car-Mart, directors are elected to serve for one year until standing for re-election at the following annual meeting. This is a good practice. Many companies have staggered boards where directors are elected for longer terms, typically three years, and not all directors face re-election at the same time. This can impede potential changes in control and effectively protect incumbent directors and management from the concerns of owners. Although having staggered terms is not an automatic disqualification, companies that have both staggered terms for directors and very low insider ownership should be examined very closely when it comes to other aspects of corporate governance.

Generally, readers should attempt to determine whether directors are likely to be interested in the operations of the company, have necessary business background, and have incentives aligned with shareholders through a reasonable amount of ownership, as specified in the ownership information described above. Many larger companies have elaborate presentations in this section where all kinds of information that is tangential to the key factors are discussed such as the ethnic and gender make-up of the board. Investors can differ in terms of their opinion regarding such factors and there is obviously some social benefit in a diverse board, but the primary factors should involve whether a director’s biography and ownership show that he or she can actually contribute meaningfully to oversight of management.

Board Structure, Organization, and Compensation

The proxy contains a discussion regarding the board’s structure and organization including a description of the manner in which the board goes about conducting its business. We learn that the board held nine meetings in its last fiscal year and that each incumbent director attended at least 75 percent of the aggregate number of meetings held by the full board and committees on which the director serves. This isn’t really that insightful but at least validates that there are no totally disengaged directors seeking re-election.

Further description of the leadership structure, including the company’s separation of the CEO, Chairman, and Lead Director roles is provided. Car-Mart separates the CEO and Lead Director roles, and subsequent to the proxy, named a Chairman. The separation of the CEO and Chairman roles is a critical factor. Unless a CEO is either a founder of the company or a very significant stockholder, the Chairman role should almost always be held by someone else. The Chairman’s biography also must demonstrate that the individual has both the necessary business experience and the gravitas to influence the CEO’s conduct.

The various committees of the board are discussed in some detail, including the members who serve on each committee and the frequency of meetings. In the case of Car-Mart, there are committees charged with audit, compensation, compliance, and board nominations. Generally, there is limited to no insight to be gained from committee membership and it is questionable whether functions such as the audit committee are really equipped to oversee a complicated company’s financial statements over the course of a few meetings. Nevertheless, it is good to verify that committee members are plausibly qualified for the roles in which they serve.

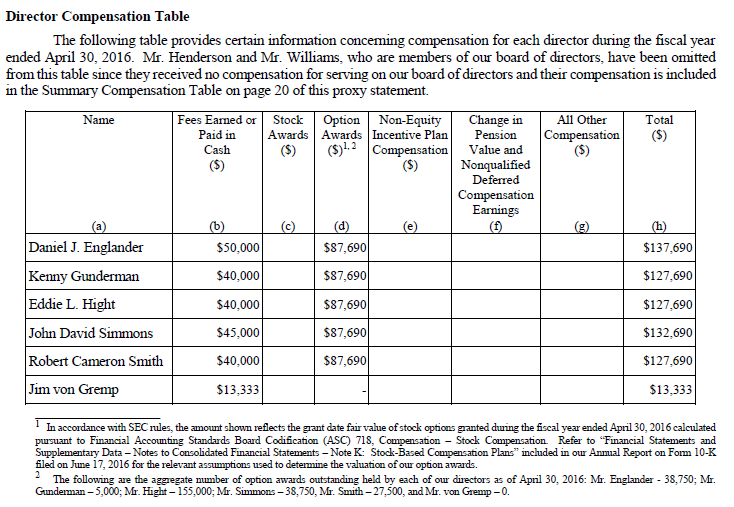

The proxy goes from dull to interesting again with the discussion of director compensation. Only outside directors, that is, those who are not on the management team, are compensated for serving on the board. Typically, companies provide board members with a cash retainer that can vary based on their committee assignments along with some form of equity compensation. The director compensation for Car-Mart appears below:

The cash retainer varies from $40,000 to $50,000 per year and is pro-rated for partial year service. In addition, each director who served the full term received an award valued at $87,690. The footnotes provide information regarding the total number of options held by each director.

Evaluating director compensation is not a simple task. The goal should be to fairly compensate directors but we would also prefer to see directors whose real “compensation” comes from capably executing their duties as directors because they are also major shareholders. However, it is quite rare to see directors with large shareholdings that are not provided by companies in the form of options or restricted stock.

Ultimately, directors need to be individuals with strong personalities and a financial stake in the success of the business. Standing up to a CEO is not for the faint of heart in most companies and there is usually no shortage of egos in a boardroom. The compensation at Car-Mart appears to be generous but not set at an egregious level. A more thorough understanding of how the compensation might influence individual directors would involve examination of how an individual director might feel about losing their compensation. For example, is a director dependent on the director fees to fund a majority of his or her personal expenses? However, that type of analysis is beyond the scope of an initial review of a proxy statement.

Executive Compensation

We now get to the heart of the proxy when discussion turns to executive compensation and the rationale behind it. Pretty much every company will include language indicating that they hope to align incentives of management with shareholders but obviously the details need to be read with some sense of informed skepticism. Here are the stated goals of Car-Mart’s executive compensation program:

Only the “named executive officers” of the company are included in this review. In the case of Car-Mart, the officers are CEO William H. Henderson and CFO Jeffrey A. Williams. It should be noted that there could be executives who are paid more than the named officers at certain companies (although not likely at Car-Mart). For example, at Berkshire Hathaway, executive pay for subsidiary management is known to be far higher than the compensation of the named officers.

Car-Mart has employment agreements with Mr. Henderson and Mr. Williams that govern their base salary and incentive compensation, as well as benefits they will receive due to any potential change in control of the company that results in loss of employment. Many companies use compensation consultants to develop elaborate pay schemes along with lengthy explanations that appear in the proxy, but Car-Mart has a more concise presentation.

The board attempted to set base salary at a level that would attract qualified management along with incentives based on a simple performance metric: GAAP fully diluted earnings per share. Short term cash incentive compensation is based on the degree to which management achieves “projected” diluted GAAP earnings per share. Target payments range from 15 to 29 percent of base salary depending on the extent to which projected GAAP earnings are met or exceeded. Long term incentives are comprised of both stock options and restricted stock and are awarded on a periodic basis rather than annually. The latest option grant was made at the 2015 annual meeting and will vest, depending on performance, at the end of fiscal 2020. A portion of the options are time vested while the remainder are performance based.

The table shown below provides a summary of the compensation of Mr. Henderson and Mr. Williams for the past three fiscal years:

To the company’s credit, neither executive has earned short-term bonus payments over the past three fiscal years because the projected GAAP earnings per share metric was not satisfied. Many companies will still grant bonus payments to executives even when performance falls short, citing “retention” or other factors as a justification, so it is good to see a company that actually does what it says it is going to do. We also can see that salary increases have been relatively restrained. The fair value of the stock option grant made at the 2015 annual meeting appears in the table but no cash will be received by either executive until the options vest, if they vest at all, at the end of fiscal 2020.

Although management earns a healthy base salary, overall compensation does not appear egregious compared to many other similarly sized companies and long term compensation seems reasonably well aligned with shareholder interest. Here are the terms under which the performance-based portion of the options will vest:

For the performance-based option, if the Company’s cumulative consolidated net income growth, calculated on a compound basis, for the five fiscal years ending April 30, 2020 is equal to 10% or more, the option will vest in full (20,000 shares) on April 30, 2020. If the Company’s cumulative consolidated net income growth, calculated on a compound basis, for the five fiscal years ending April 30, 2020 is equal to 5% or more but less than 10%, one half of the option (10,000 shares) will vest on April 30, 2020. If the Company’s cumulative consolidated net income growth, calculated on a compound basis, for the five fiscal years ending April 30, 2020 is less than 5%, the option will be forfeited.

Of the 30,000 options granted to each executive, 20,000 are performance vested based on the criteria above while 10,000 are time vested, meaning that they will vest on April 30, 2020 if the executives remain with the company until that time. The proxy contains a table of outstanding equity awards that shows the overall number of options outstanding for each executive:

Here we can see that in addition to the recent option grant, both executives have significant grants that are already fully vested and exercisable. Incidentally, the total number of exercisable options in this table should tie to the footnotes provided in the beneficial ownership table discussed earlier. For example, we can see the 389,000 vested options that Mr. Henderson owns in this table which ties to the options reported in the beneficial ownership table. Also, we can see that the vested options are significantly “in the money” with a strike price well below the recent share price of $42. This is important because options that are significantly out of the money can either lack incentive value or cause executives to take desperate steps to increase the stock price before the options expire.

Conclusion

In this article, we have attempted to highlight the areas of a proxy statement that intelligent investors should carefully study as part of their due diligence process. An annual review of the proxy for existing shareholders is critical as well. In the case of Car-Mart, the proxy is quite simple and obviously has not been afflicted by the work of public relations firms. Additionally, all things considered, compensation for both directors and executive officers seems to be reasonable and incentive systems seem to be aligned with shareholder interests.

There isn’t any way to fully gauge the quality of board oversight from the outside looking in. The best we can do as minority shareholders without sitting on the board ourselves is to critically examine the proxy statement and look out for potential pitfalls. We ideally also need to examine past proxies to see if the criteria has changed, which has not been done in this exercise. While the annual report and 10-K rightfully take priority when an investor is getting to know a business, the proxy should never be ignored when a company becomes a more serious investment candidate. Knowing the people running the business and the incentives they operate under is a big part of the investment process.

Disclosure: No position in America’s Car-Mart.